The reductions on vehicles and vehicles that US dealerships historically provide over vacation weekends have vanished as tight provide has turbocharged pricing sufficient to assist gasoline inflation.

Eric Frehsee, president of family-owned Tamaroff Jeffrey Automotive Group in suburban Detroit, remembers how as a youngster, Labor Day on the dealership meant balloons, barbecue and reductions designed to clear the lot earlier than the subsequent 12 months’s fashions started arriving in October.

However the enterprise of promoting vehicles has modified a lot for the reason that pandemic’s begin that Frehsee, now 37, is closing the dealership for the weekend. If a buyer desires to purchase, the finance supervisor is watching his iPad.

“We’d at all times have a three-day blitz, with extra incentives and rebates and particular financing,” he stated. However now, as producers battle to supply sufficient autos to feed client demand, “incentives have sort of gone away, so there’s no want for that blitz”.

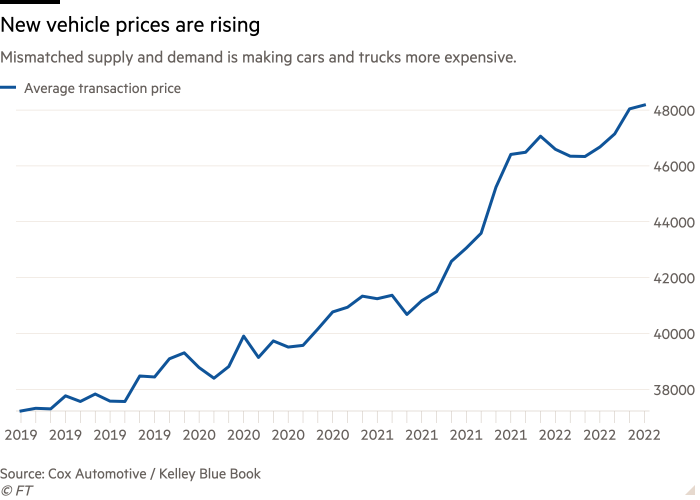

The value of a brand new car has climbed steadily over the previous two and a half years. The typical transaction value reached a record-setting $48,182 in July, a rise of 24 per cent since March 2020, in keeping with information from Kelley Blue E book, a model owned by Cox Automotive.

New and used car costs have helped to drive inflation upward over the previous 12 months. The patron value index in July rose 8.5 per cent over the earlier 12 months. The value for brand spanking new autos rose 10.4 per cent in July, whereas used vehicles and vehicles climbed 6.6 per cent. Collectively the 2 classes contributed 0.7 proportion factors to the general improve.

Worth progress has been fuelled by what EY-Parthenon chief economist Gregory Daco known as a “important mismatch” between car provide and demand.

Client demand for brand spanking new vehicles and vehicles rebounded extra rapidly than carmakers anticipated after Covid-19 pressured crops to droop manufacturing for months. The provision of recent autos tightened additional final 12 months when carmakers worldwide confronted a scarcity of semiconductors, a key part in programs starting from energy steering to anti-lock brakes.

Inventories at dealerships across the US sit at near-record lows. In July, sellers reported they’d between 30 and 40 days of stock available, in keeping with Kelley Blue E book. Stock has elevated 27 per cent from a 12 months earlier, when days’ provide dipped into the 20s.

At Frehsee’s enterprise, stock has dipped from a 120-day provide three years in the past, to 10. His heaps used to have about 1,000 autos parked on them. Now it’s fewer than 100, and vehicles and vehicles are parked horizontally to make the heaps seem fuller. Half the 200 autos he has arriving this month are already offered.

Whereas the present degree of about 1.1mn new autos on the market is simply too lean for the trade, it’s unlikely to ever rebound to pre-pandemic ranges, when it was greater than 3 times larger, stated govt analyst Michelle Krebs at Cox Automotive.

“Automakers and sellers have discovered that demand outstripping provide means greater revenue margins and fewer discounting,” she stated.

Incentives in August decreased 51 per cent in comparison with a 12 months in the past, to a median of $877 per car, Deutsche Financial institution analyst Emmanuel Rosner wrote in a be aware.

Tamaroff Jeffrey is promoting most vehicles and vehicles today on the producer’s recommended retail value, Frehsee stated. The dealership has had report earnings. However he worries that gross sales may decline if altering financial situations make the autos much less inexpensive. For now, lots of his prospects are trading-in leased autos with substantial fairness, and people trade-in values work to maintain their new car funds within the vary they’re used to paying.

“Rising gasoline costs, rising rates of interest and the lower of incentives are resulting in a lot larger automotive funds, and with the financial system being so unstable proper now there are undoubtedly issues about individuals . . . having the ability to take in all these will increase,” he stated.

The median interval a US client owns a car is six years. JD Energy analyst Tyson Jominy stated which means there are nonetheless People who haven’t shopped for a automotive or truck since earlier than the pandemic “and are fully unaware of the situations at a dealership: All you principally see are asphalt or used vehicles.”

However even when a recession looms on the horizon, he stated, low stock ranges, excessive pricing and restricted reductions imply the trade shall be nicely ready. The massive, eye-catching props that automotive sellers have historically used to seize customers consideration won’t be vital.

“Don’t count on any nice offers, don’t count on the inflatable gorilla to be on the market,” Jominy stated. “It’s not the identical gross sales setting this Labor Day.”