“No one Is aware of How Curiosity Charges Have an effect on Inflation” is a brand new oped within the Wall Avenue Journal August 25. (Full model can be posted right here Sept 25). It is a distillation of two current essays, Expectations and the Neutrality of Curiosity Charges and Inflation Previous, Current, and Future and a few current talks.

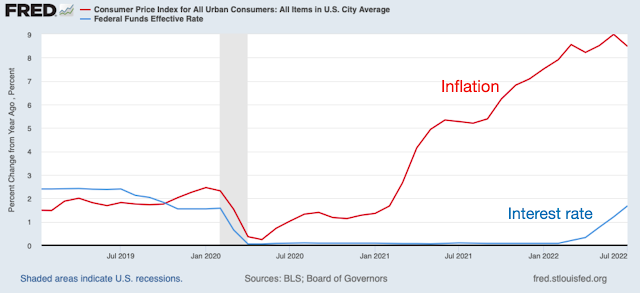

The Fed has solely very slowly raised rates of interest in response to inflation:

Does the Fed’s sluggish response imply that inflation will spiral away, till the Fed raises rates of interest above inflation? The normal concept says sure. On this concept, inflation is unstable when the Fed follows an rate of interest goal. Unstable:

On this view, the Fed should promptly increase rates of interest above inflation to comprise inflation, because the seal should transfer its nostril multiple for one to get again underneath the ball. Till we get rates of interest of 9% and extra inflation will spiral upward.

The view comes basically from adaptive expectations. Inflation = anticipated inflation – (impact of excessive actual rates of interest, i.e. rate of interest – anticipated inflation). If anticipated inflation is final yr’s inflation, you possibly can see inflation spirals up till the actual rate of interest is optimistic.

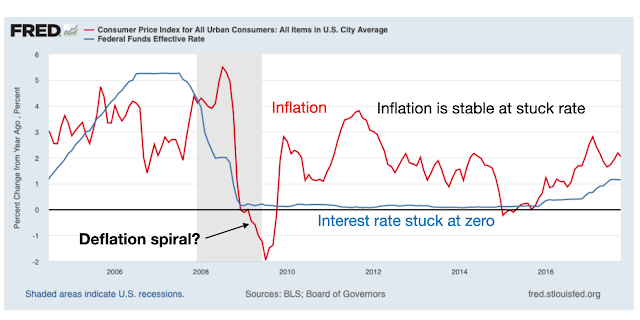

However an alternate view says that inflation is basically secure. Steady:

On this view, a shock to inflation will finally fade away even when the Fed does nothing. The Fed will help by elevating rates of interest, however it doesn’t need to exceed inflation. (That’s, as long as there isn’t any new shock, like one other fiscal blowout.) This view comes from rational expectations. That time period has a nasty connotation. It solely signifies that individuals assume broadly concerning the future, and aren’t any worse than, say, Fed economists, at forecasting inflation. Story: If you happen to drive wanting within the rear view mirror (anticipated highway = previous highway), you veer off the highway, unstable. If you happen to look ahead, even badly, (anticipated highway = future highway), the automobile will finally get again on the highway.

Econometric assessments aren’t that helpful — inflation and rates of interest transfer collectively in the long term in each views, and jiggle round one another. Episodes are salient. The unstable view factors to the Seventies:

The Fed reacted too slowly to shocks, the story goes, letting inflation spiral up till it lastly acquired its nostril underneath the ball in 1980, driving inflation again down once more. However the secure view factors to the 2010s:

It is precisely the other state of affairs. Deflation broke out. The Fed couldn’t transfer rates of interest beneath zero. The traditional evaluation screamed “right here comes the deflation spiral.” It did not occur. Wolf. If the deflation spiral didn’t get away, why will an inflation spiral get away now?

Not elsewhere: As I take a look at these, I begin to have extra doubts concerning the traditional story of the Seventies. The Fed did transfer rates of interest one for one. Inflation didn’t merely spiral uncontrolled. For instance, be aware in 1975, inflation did come proper again down once more, despite the fact that rates of interest by no means acquired above inflation. The straightforward spiral story doesn’t clarify why 1975 was briefly profitable. Every of the waves of inflation additionally was sparked by new shocks.

Who is true? I do not pound my fist on the desk, however stability, no less than in the long term, is wanting an increasing number of more likely to me. That claims inflation will finally go away, after the value stage has risen sufficient to inflate away the current debt blowout, even when the Fed by no means raises charges above inflation. In any case, it appears to be like like we’ve one other actually important episode all arrange, so as to add to the Seventies and 2010s. If inflation spirals, stability is in bother. If inflation fades away and rates of interest by no means exceed inflation, the traditional view is absolutely in bother. The substances are stirred, the check tube is on the desk…

However, that is a conditional imply. A brand new shock might ship inflation spiraling up once more, simply as might have occurred within the Seventies. New virus, China invades Taiwan, monetary disaster, sovereign debt disaster, one other fiscal blowout — if the US forgives school debt, why not forgive residence loans? Bank cards? — all might ship inflation up once more, and damage this lovely experiment.