The markets have spoken – persons are anxious about inflation hitting its highest in 40 years and with little indicators of abating anytime quickly; whereas shrinking GDP is elevating the chances of a recession within the close to time period. However for earnings traders seeking to generate steady earnings, infrastructure property aligned to generational development themes could probably supply a lift to your portfolio. These not solely have a number of tailwinds, but in addition authorities mandates pushing their development ahead, making them an acceptable asset class for risk-adverse traders. Right here’s just a few methods you may journey on it.

Will the present market volatility proceed?

The street forward for equities might not be as smooth-sailing because it was within the final decade.

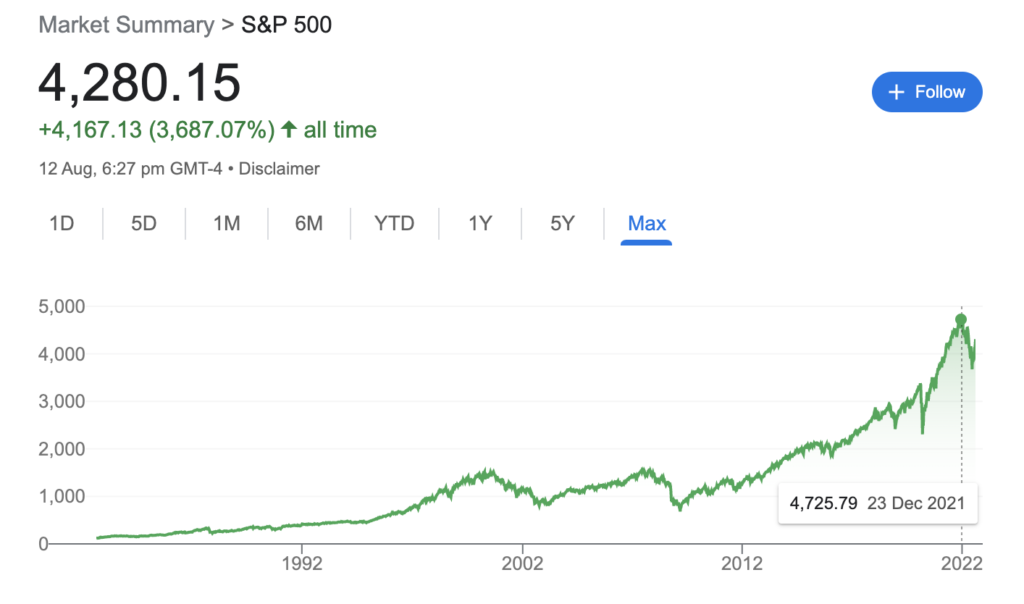

If we zoom out into the longer-term chart of the S&P 500, the final decade up until 2021 was marked by a gradual, virtually relentless improve. Equities carried out beautifully properly throughout this era.

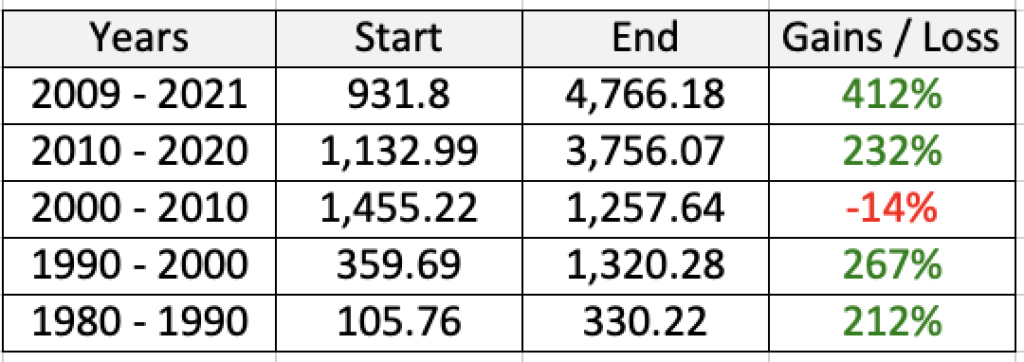

However after I seemed again into earlier many years, I spotted this was not at all times the case:

What stands out to me is how we’ve simply emerged out from a interval of unprecedented features, probably fuelled by the beneficiant liquidity and free financial coverage of that period.

Now, with this liquidity being taken out of the system, we ought to be ready for slower development within the decade forward. What’s extra, mixed with recession fears, world political tensions, inflation and slowing development, we will count on markets to be uneven for some time longer.

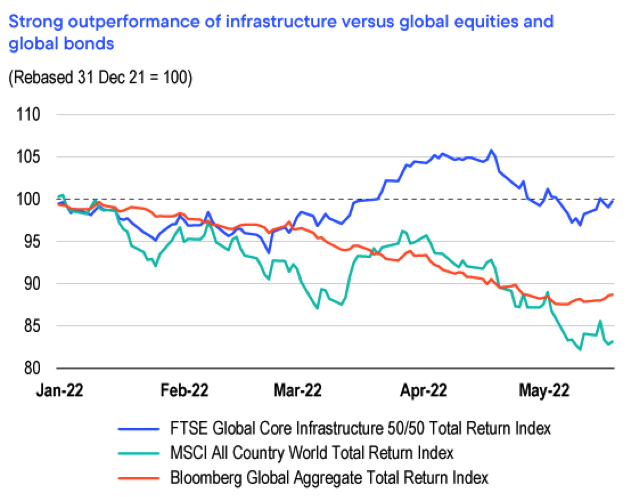

For traders searching for development with out the volatility, infrastructural performs can certainly be a very good hedge in opposition to inflation and future uncertainty. Whereas world equities, bonds and actual property posted double-digit losses within the first 5 months of this 12 months, in distinction, world core infrastructure rose 2.52% throughout this identical interval.

Notably for earnings traders, you’d need to keep away from investing in any property that can face difficulties in producing sufficient earnings to offset inflation.

Infrastructure – a dependable hedge in opposition to market downturns

A glance again into historical past exhibits the identical pattern – in keeping with analysis by Franklin Templeton, out of the 21 market sell-off episodes since 2005, world listed infrastructure shares outperformed world equities 67% of the time.

Therefore, for traders who want to tackle comparatively decrease danger whereas nonetheless searching for development, you’ll be happy to notice that the infrastructure sector is hardly correlated to the efficiency of bonds and equities; in reality, it has outperformed regardless of difficult market situations.

Why the outperformance? Nicely, for a begin, many of those infrastructure present important providers which can be important for contemporary society to proceed functioning. As an illustration,

- Utilities – folks nonetheless use water, electrical energy and fuel day by day

- Communication – with rising demand for cloud and knowledge, together with the shift in direction of 5G, infrastructure suppliers equivalent to mobile towers must develop to maintain up

- Transport – delivery, e-commerce logistics and journey add to elevated transport infrastructure wants

- Vitality – midstream pipelines and contracted renewables are benefiting from the push in direction of higher carbon seize, storage and renewable power

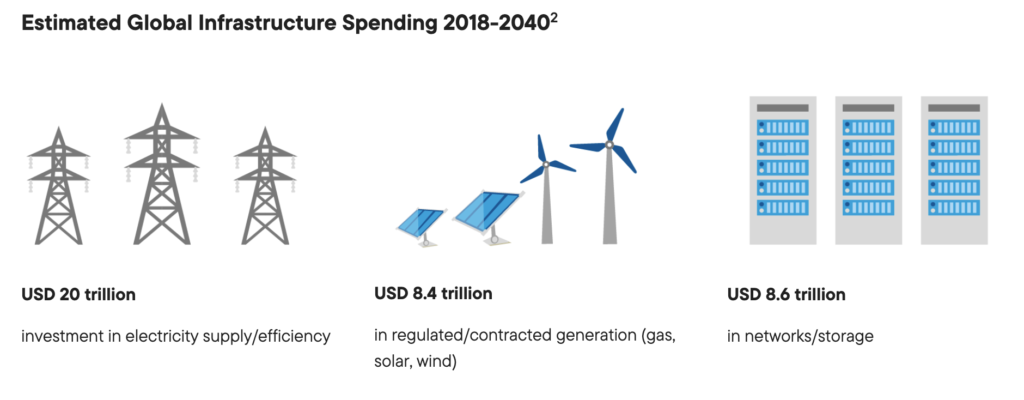

In the US, Congress has already handed Biden’s $1 trillion infrastructure invoice, in any other case often known as the Bipartisan Infrastructure Regulation to rebuild America’s roads, bridges and rails, broaden entry to scrub consuming water. However the want for infrastructure upgrades isn’t restricted to only the US alone, however moderately, world spending is estimated to hit an all-time excessive:

In developed economies, an elevated want for services upgrades, capability enhance, upkeep and the newest shift in direction of decarbonization will necessitate increased infrastructure expenditure.

For rising markets, inhabitants development and urbanisation requires enlargement of infrastructural assist, equivalent to in international locations like Brazil and India, the place the federal government is pushing for nearly double of its present capability to be constructed within the subsequent few years.

Some examples of listed infrastructure equities which can be engaged on assembly these wants embody:

- Nationwide Grid PLC – delivers electrical energy and fuel within the UK and US.

- Iberdrola SA – a worldwide power firm (third electrical energy utility by market cap) and the second largest producer of wind energy.

- Atlas Arteria Ltd – a worldwide developer and operator of personal toll roads in France, Germany and the US.

- Clearway Vitality Inc – one of many largest renewable power homeowners within the US with over 5,000 internet MW of put in wind and photo voltaic technology tasks.

Distinguishing between infrastructural property

Particularly, we will group infrastructure performs into 2 essential forms of property:

Regulated property are usually extra defensive in nature because of the steady and inelastic demand for its providers. However, firms with user-pay property tackle volumes danger – the extra folks use these property, the extra income they generate.

This explains why telecom operators have been constructing extra cell towers in sure international locations in recent times, because the demand for cell knowledge grows.

Decarbonisation and renewables are robust tailwinds

One other plus for this sector can be the continued decarbonisation efforts and the demand for extra inexperienced infrastructure. Firms who can meet and assist such demand, have an extended pathway and might present a steady, rising profile for traders.

The Worldwide Vitality Company (IEA) tasks renewable power will adccount for almost 90% of electrical energy technology by 2050. IEA additionally expects spending on inexperienced electrical energy methods to just about triple by 2030 for the world to be on monitor to attain internet zero carbon emissions by then.

This exhibits that in our net-zero future, 2 traits stand out:

- Carbon-free electrical energy will quickly turn out to be the dominant selection of power provider

- Renewable power applied sciences like photo voltaic, hydro and wind will turn out to be crucial for energy technology.

Going inexperienced was once an possibility, however at present it has turn out to be a transparent mandate (particularly if we want to avert an outright local weather catastrophe).

Revenue traders have to search for dividends which can be impartial from the financial cycle

The worst nightmare for many earnings traders is a state of affairs the place you might have lesser dividends mixed with falling inventory costs.

For many shares, dividends are usually paid out of the corporate’s revenues or income. In troublesome durations, the dividends paid could fall; we noticed this occur in the course of the pandemic the place many firms reduce or halted their dividend payouts.

Should you’re making an attempt to guard your dividend base, infrastructure firms with their dividend payouts linked to the asset bases moderately than the financial cycle are enticing.

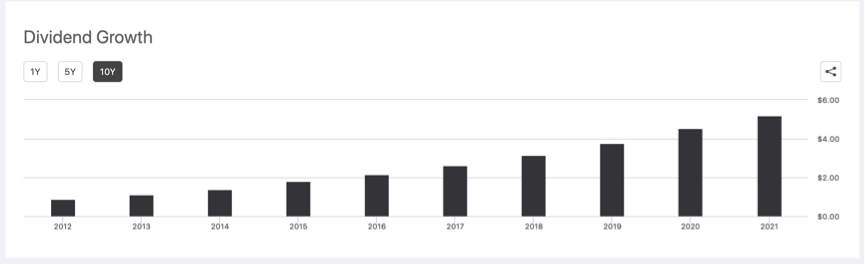

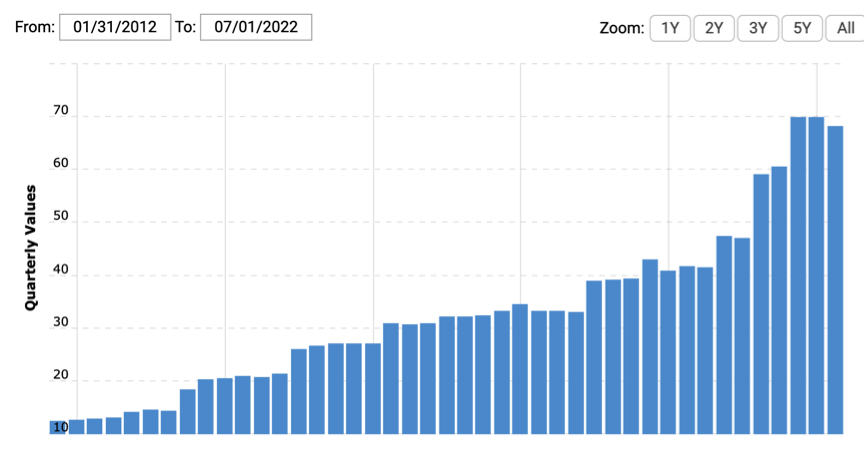

Traditionally, many firms that develop their infrastructure asset base often go on to pay increased dividends. For instance, let’s check out American Tower (a worldwide operator of cell towers)’s dividend historical past and asset development:

Supply: Creator’s screenshots from Macrotrends on 18 August 2022.

TLDR: Infrastructure is a robust hedge in opposition to inflation

Once we make investments, we need to spend money on property that not solely supply a margin of security, but in addition have robust development prospects for the longer term.

Who would possibly profit from the present regulatory mandates for vital decarbonisation efforts, shifting public spending priorities in direction of greener infrastructure, and the continued urbisation of populations?

Buyers who can determine firms well-placed to journey these long-term secular development traits will profit.

Should you haven’t already integrated infrastructure property into your portfolio, now could be the time to start out taking a look at them.

Get concepts from fund managers investing into infrastructure property right here.

P.S. Loved this learn? Take a look at this text to study one other technique – the multi-asset earnings technique – as one other potential strategy you may undertake.

Sponsored Message Like most sectors, some firms are higher positioned than others to profit from the acceleration of investments to decarbonise world infrastructure. Even handed inventory choice would require scrutinising the standard of an infrastructure firm’s property and rigorously assessing the laws or contracts that govern them. Or you may outsource that to the professionals at Franklin Templeton, through our Legg Mason Clearbridge International Infrastructure Revenue Fund. Take a look at the fund right here.

DISCLAIMER I'm not your private monetary advisor and don't know about your particular person monetary circumstances or actions that it's essential to take. You might want to search recommendation from a licensed monetary adviser earlier than making a dedication to spend money on any shares of any named Funds, and contemplate whether or not it's appropriate to fulfill your individual particular person objectives. Within the occasion recommendation isn't sought from a licensed monetary adviser, it's best to contemplate whether or not the Fund is appropriate for you. This commercial or publication has not been reviewed by the Financial Authority of Singapore. This commercial is for info solely and doesn't represent funding recommendation or a suggestion and was ready with out regard to the particular targets, monetary scenario or wants of any specific one that could obtain it. This commercial might not be reproduced, distributed or revealed with out prior written permission from Franklin Templeton. There is no such thing as a assurance that any prediction, projection or forecast on the financial system, inventory market, bond market or the financial traits of the markets can be realized. Franklin Templeton accepts no legal responsibility by any means for any direct or oblique consequential loss arising from using any info, opinion or estimate herein. The worth of investments and the earnings from them can go down in addition to up and chances are you'll not get again the total quantity that you just invested. Previous efficiency isn't essentially indicative nor a assure of future efficiency. The Legg Mason Clearbridge International Infrastructure Revenue Fund is a sub-fund of Legg Mason International Funds plc, an open-ended umbrella funding firm constituted in Eire. This fund has been categorized as Article 8 beneath the Regulation on sustainability associated disclosures within the monetary providers sector (EU) 2019/2088. These are Funds which have an ESG integration strategy and, as well as, have binding environmental and/or social traits of their funding course of. Subscriptions could solely be made on the premise of the latest Prospectus and Product Highlights Sheet which is offered at Templeton Asset Administration Ltd or Legg Mason Asset Administration Singapore Pte. Restricted or authorised distributors of the Fund. Potential traders ought to learn the main points of the Prospectus and Product Highlights Sheet earlier than deciding to subscribe for or buy the Fund. This shall not be construed because the making of any supply or invitation to anybody in any jurisdiction wherein such supply isn't authorised or wherein the particular person making such supply isn't certified to take action or to anybody to whom it's illegal to make such a suggestion. Specifically, the Fund isn't out there to U.S. residents, residents or greencard holders. As well as, a abstract of investor rights is offered from https://s.frk.com/sg-investor-rights. The Fund could spend money on sure forms of derivatives for environment friendly portfolio administration functions and/or funding functions. Copyright© 2022 Franklin Templeton. All rights reserved. Please confer with Necessary Info on the web site. This submit is written in collaboration with Templeton Asset Administration Ltd, Registration Quantity (UEN) 199205211E, and Legg Mason Asset Administration Singapore Pte. Restricted, Registration Quantity (UEN) 200007942R. Legg Mason Asset Administration Singapore Pte. Restricted is an oblique wholly owned subsidiary of Franklin Sources, Inc.