A couple of Stanford colleagues received collectively to speak about inflation, and that gave me an incentive to summarize current writings as compactly as attainable. Right here goes, and because of everybody for an awesome dialogue.

The massive query

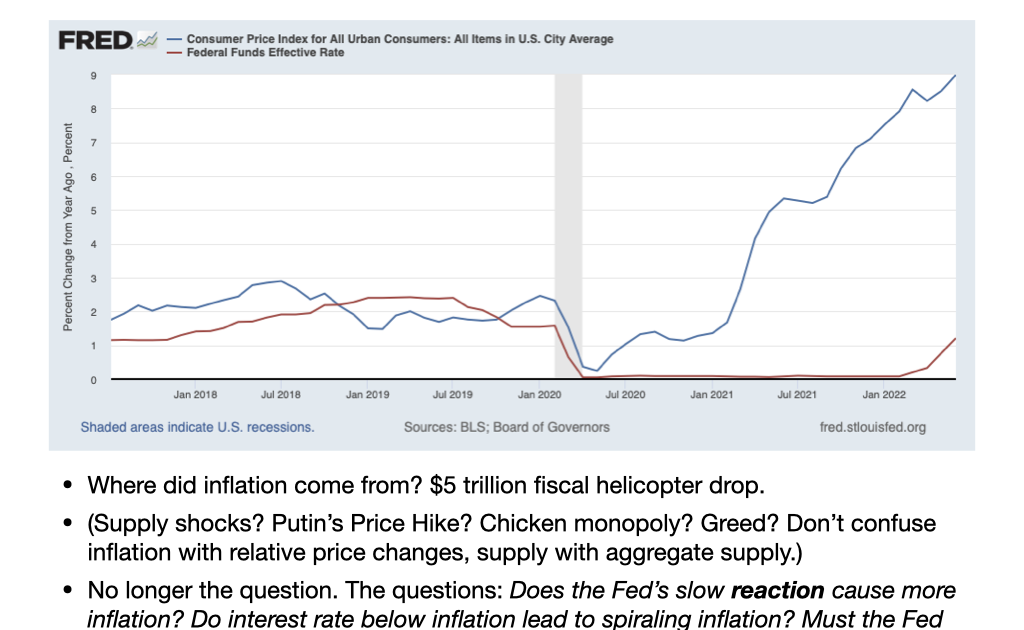

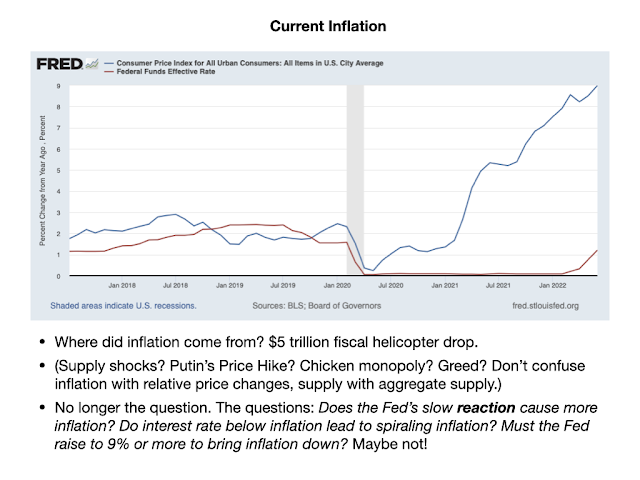

Right here we’re, 9% inflation. Sure, I feel it got here from the large fiscal helicopter drop. Others produce other theories.

Do not confuse inflation with relative costs. An oil value shock could make oil costlier than different issues. However it doesn’t decide whether or not oil goes up 10% and wages go up 5%, or oil goes down 5% and wages go down 10%. The central phenomenon is a decline within the worth of cash, that costs and wages all go up collectively. The clearest indication that’s the phenomenon is that wages are going up. After all folks and politicians care most about costs relative to wages. However do not let that confuse us concerning the financial subject.

|

| Slide courtesy Arvind Krishnamurthy |

The necessary query proper now’s, will the Fed’s gradual response result in spiraling inflation? Standard financial knowledge says that it takes rates of interest above inflation to deliver inflation down. So long as rates of interest are beneath inflation, inflation will spiral up. That wants 10% or extra rates of interest, now. However the Fed thinks that rates of interest are already “impartial,” which means {that a} 2.25-2.5% rate of interest and 9% inflation doesn’t push inflation up any extra. How can they imagine this?

Markets additionally imagine that inflation will largely go away by itself, with no interval of rates of interest considerably above inflation:

Proper now (proper aspect of graph), markets assume that inflation 5 years from now (decrease blue line) shall be 2.5%, and common inflation within the subsequent 5 years shall be about 3.4%. And these numbers have come down lately! After all these markets just like the Fed fully missed the emergence of inflation: each numbers have been 2.5% in January 2021 on the day that inflation broke out. However that is their present forecast.

And right here is the market forecast of rates of interest. Markets assume charges will rise briefly to three.5%, however then go rapidly again all the way down to 2.5%. Inflation goes away by itself. How can that be?

A lot for the true world, how does it work in principle?

This slide boils down 50 years of macroeconomics. i is rate of interest, pi is inflation, x is output, the remainder are parameters. There are two primary components. First in “IS”, increased actual rates of interest — nominal rate of interest i much less anticipated inflation — lowers output x. (The right equation has the grayed out time period, however that does not prove to matter for these factors.) Second, in “Phillips,” inflation is increased if folks anticipate extra inflation sooner or later — in that case, increase costs now — and if the financial system is booming.

Now, put these components collectively, and we’ve got the dynamic relationship between rates of interest and inflation proven within the third equation.

However what is predicted inflation? Beginning with Milton Friedman in 1968, and continuing by way of the Keynesian custom since then, standard knowledge says anticipated inflation is pushed by no matter occurred final yr, “adaptive” expectations. Substitute that in, and you’ve got the dynamics simply above the left hand graph.

Inflation = (quantity greater than one) x final yr’s inflation minus (quantity) instances rate of interest.

(Quantity greater than one) implies that inflation is unstable. If the Fed leaves rates of interest alone, any small inflation will get greater and greater over time. That is the standard knowledge that till the Fed raises charges above current inflation, inflation will preserve getting worse and worse.

What if persons are smarter than that? What if their expectations for subsequent yr are “rational,” together with all data, or not less than “constant,” a mannequin ought to write that the folks in the mannequin have the identical expectations as these of the mannequin, we economists aren’t a lot smarter than everybody else. Now we’ve got the precise hand group, and inflation dynamics are.

Subsequent yr’s anticipated inflation = (quantity lower than one) x this yr’s inflation plus (quantity) instances rate of interest

Now inflation is secure. Even when the Fed does nothing inflation will finally — accent on finally, lots could occur alongside the way in which — come again down once more.

Rational (or not less than constant) expectations, the concept that folks take into consideration the long run when making selections as we speak, has been the cornerstone of macroeconomics since about 1972. It’s a part of the “new-Keynesian” custom marked NK. There too, inflation is secure. The NK fashions cannot inform you which of the dashed paths will occur, in order that they predict inflation will bat round between them. However they’re all secure. Fiscal principle of the value stage picks one of many dashed paths. Inflation is now secure and determinate.

Now you see the central financial query. One other solution to put it, it is actually concerning the signal of output within the Phillips curve. Does increased output, and decrease actual rates of interest, trigger inflation to develop, or to decline–to increase as we speak’s inflation above future inflation?

The Fed, and the markets, are taking the steadiness view, which the mannequin produces by rational expectations. It isn’t fully loopy.

The Details

What does historical past inform us about this momentous query? Properly, that relies upon.

The standard stylized historical past of inflation comes from the Seventies, high graph. The Fed did not do as dangerous a job as most individuals say. In every of the 4 waves of inflation, the did, promptly, increase rates of interest not less than one for one, and normally extra so, with inflation. The Fed by no means waited a complete yr to do something. And but it was not sufficient, with inflation steadily ramping up, till in 1980 the Fed lastly put rates of interest decidedly above inflation, and left them there for years, regardless of a bruising recession.

With that customary interpretation of historical past, and the adaptive unstable mannequin in thoughts, the standard view economists are precisely proper to be screaming from the rooftops that the Fed wants to lift rates of interest, now.

However now there may be one other historical past. Within the zero certain period, backside graph, deflation threatened. (I plot core cpi. Precise CPI received to 2% deflation.) The identical unstable/spiral view mentioned, right here we go. The Fed cannot decrease rates of interest anymore, so we’ll have a deflation spiral. It by no means occurred. Inflation was quieter on the zero certain than earlier than when the Fed was shifting rates of interest round!

Europe’s zero certain lasted longer, till now. And Japan’s longer nonetheless, beginning within the early Nineties. You possibly can’t ask for a clearer check that inflation will be secure (and quiet) whereas central banks do nothing with rates of interest. In principle, that wants a variety of preconditions, specifically that no different “shocks” come alongside — we simply noticed a giant one, extra are coming. However the “secure” principle not less than has one episode to counter the usual story of the Seventies.

In brief, ye who say inflation will spiral upward if the Fed doesn’t increase rates of interest to 10% or extra tomorrow, did ye not additionally say that inflation would spiral downward on the zero certain?

It isn’t fully loopy.

A fuller easy mannequin

My final slide reveals a simulation from an actual however nonetheless quite simple mannequin. It has sticky costs, the total IS curve, rational expectations, and long-term debt. Within the high panel, there’s a 1% fiscal shock — the federal government arms out 1% extra debt and folks don’t assume this shall be repaid — and the Fed does nothing. Once more, in my opinion, we simply did this instances 30. The graph reveals a variety of attention-grabbing issues. First, a one-time fiscal shock results in persistent inflation. Over a number of years of inflation increased than rates of interest, inflation eats away on the worth of presidency bonds. It doesn’t result in a one-time value stage soar. We’re dwelling that interval. However the inflation of a one-time fiscal shock finally fades away by itself. (Do not take steadily declining inflation too critically. It is fairly straightforward to spiff up the mannequin to a hump-shaped response that rises easily for some time earlier than turning round.)

Financial coverage is just not helpless. What occurs if the Fed raises charges, as it’s beginning to do, however there isn’t a surprising change in fiscal coverage (i.e. proceed to spend like drunken sailor, as earlier than covid). On this easy mannequin the Fed can decrease inflation within the quick run. Discover output fall. Sure, the Fed’s device is to trigger a little bit of recession (IS), and that pushes down inflation (Phillips). The Fed hopes so as to add simply sufficient of the underside curve on to the highest curve to maintain inflation considerably moderated. However the Fed can not remove inflation. Discover inflation goes up in the long term. The Fed purchased decrease preliminary inflation at the price of prolonging the inflationary interval. Ultimately, on this mannequin, inflation goes to wherever the Fed units rates of interest. I plotted rates of interest that keep excessive without end so you may see the way it works, but when the Fed finally brings these charges down, so does inflation come down.

The perfect finish to inflation would have the Fed perform a little little bit of this, after which Congress wakes up and will get fiscal coverage so as — passes the detrimental of the highest graph.

Backside line, each fiscal and financial coverage matter for inflation. Add the 2 graphs as you please to consider eventualities.

It isn’t so loopy.

Is that this how the world works? I haven’t got pound fist on desk certainty. I’ve spent a lot of my life considering the Fed has to lift rates of interest promptly to keep away from inflation, and so many economists assume that is true, that totally digesting the rational expectations view may be very laborious. But principle, the Fed, markets, and the zero certain expertise communicate loudly.

In any case, if nothing horrible occurs (these simulations assumptions no further shocks), we’ll quickly have one other nice check of macroeconomic theories, including to the zero certain episode. Inflation will both fade away again down in direction of the Fed’s rates of interest, or inflation will proceed to spiral upward till the Fed raises charges dramatically.

Sure, economics actually does not totally know the reply to probably the most primary query, is inflation secure or unstable round an rate of interest goal, and does the Fed want to lift rates of interest greater than noticed inflation to deliver inflation underneath management. You now know as a lot as nearly anybody.

The IS and Phillips curves (particularly the latter) are awfully weak constructing blocks as properly.