Pricey buddies,

Welcome to the top of summer season. Historically, within the markets and on faculty campuses, it’s a quiet time of 12 months. Buying and selling volumes drop, merchants and wise individuals alike flock to seashores, and amenities crews at faculties like Augustana work 12-hour days attempting to handle all the problems that may’t be handled in a university jammed with individuals.

However come this primary weekend of September, a brand new chapter begins … with a brand new president (Andrea Talentino is the ninth president in our 162-year historical past, and solely the sixth president since 1901), a stunningly beneficiant alumni present to fund a brand new scholarship program (Augustana Doable) for high-achieving college students from households with out some huge cash, and 630 new first-year college students. That tally consists of one thing like 120 new college students who’ve traveled 7500 miles from dwelling and who won’t see household once more till after their sophomore 12 months. At a time when home college students are hesitant to think about colleges greater than two hours from mother and pop, that strikes me as an act of religion and bravado that’s profoundly humbling for these of us who’re charged with making all of it appear potential.

Is the solar rising or setting over Outdated Fundamental, my educational dwelling? At this second, with these youngsters, I do know it to be daybreak.

The value of maintaining your fingers jammed in your ears

On Friday, August 26 at 10:00 a.m. EDT, Fed chair Jay Powell mentioned precisely (a) what he’d been saying for months and (b) what traders knew he was going to say. One of many professionals at Wells Fargo confidently predicted:

That day’s reduction rally seemed kind of like this:

If market professionals have been able to blushing …

Traditionally, September and October have been the 12 months’s two most risky months. In some ways, this 12 months’s market is more likely to be formed by an unlikely determine: Vladimir Putin. The Federal Reserve is attempting to make aggressive however data-driven strikes to manage inflation. As the top of a significant vitality exporting nation, ought to Mr. Putin do one thing precipitous, a panicky spike within the value of meals and vitality would comply with.

A smart technique is likely to be to comply with the info reasonably than comply with the speaking heads. Mr. Powell has introduced his expectation that they are going to inflict ache on you with the intention to change your habits; that change in habits might be mirrored in information about year-over-year value adjustments and shopper and industrial exercise. If all of these stay elevated, the Fed will crack down more durable.

In the meanwhile, investor confidence – mirrored within the VIX – stays inexplicably excessive, and spending is brisk. Professionals are assured that the Fed will bump charges by 75 bps in September after which ease up. Professionals are ceaselessly unsuitable, although hardly ever unsure. In the event that they have been unsuitable in both of those two newest guesses, distinctive unhappiness will ensue.

For me, and most of my colleagues right here, our long-term plans have been designed with the fact of main drawdowns and grinding markets in thoughts. Because the market has generously offered each, we’re doing little greater than making marginal changes. We attempt to be taught from the previous, however we will’t outthink the long run, and we aren’t attempting.

To the extent you possibly can, distance your self from the noise. Lock your cell telephones away in a drawer. Harvest tomatoes. Marvel on the Detroit Lions’ choice to chop all of their backup quarterbacks. And suppose long-term: is your asset allocation applicable to your stage in life? Are you snug with the funds that enact the plan? Are there methods of adjusting your life-style to generate fewer calls for and extra delights, nonetheless quiet?

Painful unwinding of FPA Worldwide Worth / Phaeacian Accent Worldwide Worth

Will Schmitt for CityWire (8/25/2022) chronicles the ugly and painful public unwinding of the partnership between FPA and Polar Capital and the liquidation of the 2 FPA funds adopted by Polar.

We had already shared our dialog with Pierre Py, lead supervisor for the FPA/Phaeacian funds, about his anguish over the funds’ demise and his dedication to in the future return to the sphere (“Off to the Dustbin of Historical past,” Might 2022).

Mr. Schmitt’s reporting reveals a sequence of lawsuits between Polar and Phaeacian and Polar and FPA. He reviews,

Polar Capital has accused First Pacific Advisors (FPA) of ‘fraud’ in reference to Polar’s ill-fated acquisition of a workforce of PMs and their funds from FPA.

Polar made the accusation earlier this month as a part of an ongoing authorized battle over the way forward for Phaeacian Companions, a three way partnership between Polar and two former FPA portfolio managers, Pierre Py and Greg Herr.

After this text was printed, FPA issued a press release ‘categorically’ denying Polar’s allegations which it mentioned are ‘utterly unsubstantiated with no factual help.’

It’s unhappy, not least as a result of it sullies the work of two tremendous managers and retains their companies from the traders they’d prefer to serve.

This month within the Observer …

Devesh Shah has been puzzling via the previous and way forward for rising markets investing. Too usually, it feels just like the theme music for EM investing has been “Tomorrow” from the musical Annie.

The solar’ll come out tomorrow

So you bought to hold on ’til tomorrow

Come what could

Tomorrow, tomorrow, I like ya tomorrow

You’re all the time a day away

There have been stretches when EM returns have been spectacular and longer stretches after we’ve largely talked about how they ought to be spectacular … maybe tomorrow? Devesh engaged in conversations with six distinguished EM managers concerning the asset class, its challenges, and its future. He shares his leads to “Rising Markets Investing within the Subsequent Decade: The Sport.”

We complement Devesh’s piece with fast bios of the Choose Six and their funds in “Rising Markets Investing within the Subsequent Decade: The Gamers.”

Lynn Bolin gives extra depth to the case for warning in “Right here be dragons: Information-driven warning for the market forward,” then enhances that with an in-depth evaluation of Constancy New Millennium ETF (FMIL), the latest addition to his portfolio. And sure, he does speak about why an aggressive fund and a cautious strategy can complement each other.

The Shadow brings us updated on business information and foolishness in “Briefly Famous.”

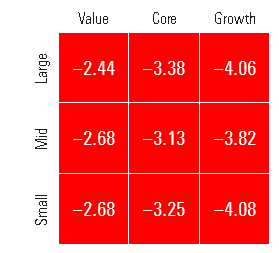

Lastly, I share profiles of two outstanding funds. We first profiled Harbor Worldwide Small Cap Fund (HAISX) in September 2021, across the second anniversary of its new administration workforce, from Cedar Avenue Asset Administration. We advised you then that it was going to be good. Seems it was even higher: since Cedar Avenue joined, HAISX has been the top-performing worldwide small cap fund in existence, typically by a mile. Heck, it’s the highest performer amongst each worldwide small worth and worldwide small core and is a high 5 fund even while you add worldwide small progress. Barron’s is on the path, and also you may wish to be, too.

Disciplined Development Buyers (DGIFX), headquartered in Minneapolis a few mile from my son’s tiny house, is essentially the most distinctive balanced fund in existence and likewise one of the profitable by a complete string of measures. In a peer group dominated by funds that make investments just like the S&P 500 Index, DGI pursues a real multi-cap (actually, micro-caps in a balanced fund … who’d have imagined?) balanced portfolio whose efficiency beats even an all-equity benchmark. The workforce appears gifted, targeted, and passionate. Be taught extra.

Thanks, as ever …

To Radley Olson, for his monetary help and sort notice. There’s a Nineteenth-century adage, “if you’d like something achieved, ask a busy individual to do it” (no, not Franklin, not Lucille Ball, or any of the remaining … the earliest occasion in print is 1856), which appears to rule our lives. As quickly as I stepped apart from 1 / 4 century as chair of a giant educational division, I used to be requested to assist revive our wobbly Honors program. As quickly as Chip moved out of her deanship and into the function of Chief Info Workplace at her faculty, her new chancellor poked her head within the door with an innocuous, “do you will have only a minute?” (sigh) That mentioned, we’ve deliberate a few weekends away in fall – there’s an interesting heirloom apple orchard in southeast Wisconsin and many causes to drive up alongside the Mississippi – and are plotting an escape to the Shetland Islands (her household has roots there) within the 12 months forward. And so, thanks! We’re good.

Blessings to our indispensable regulars, from the great of us at S&F Funding Advisor in pretty Encino to Wilson, Gregory, William, the opposite William, Brian, David, and Doug. And to Ira, Andrew, Paul, Sherwin, and James, thanks, thanks, and thanks.

It might be nice should you’d be part of them, both with a tax-deductible contribution to MFO itself or via a $125 membership to MFO Premium. Given the price and wobble evident in Morningstar’s slimmed-down “Investor” service, severe of us may discover it cash properly invested.

As you’re studying this, I’ll be in Minneapolis serving to Will get settled right into a tiny house close to Loring Park and a brand new life as a graduate pupil. If you wish to get a way of the passing of the years at MFO (and, I dare say, what “swish ageing” seems like), you may examine this summer season’s model of Will and me with the snapshot of us on London’s Millennium Wheel, on the “Help Us” web page.

As you’re studying this, I’ll be in Minneapolis serving to Will get settled right into a tiny house close to Loring Park and a brand new life as a graduate pupil. If you wish to get a way of the passing of the years at MFO (and, I dare say, what “swish ageing” seems like), you may examine this summer season’s model of Will and me with the snapshot of us on London’s Millennium Wheel, on the “Help Us” web page.

It is going to be an journey, as a lot of a great life all the time is.

Take care, and we’ll see you quickly,