What are the revised Newest Revenue Tax Slab Charges for FY 2023-24 after Price range 2023? Throughout the Price range 2023, Finance Minster revised the revenue tax slab charges relevant for people. On this put up, allow us to look into the revised charges.

The distinction between Gross Revenue and Whole Revenue or Taxable Revenue?

Earlier than leaping into what are the Newest Revenue Tax Slab Charges for FY 2022-23 / AY 2023-24 after Price range 2022? Are there any modifications to relevant tax charges for people? Allow us to see the main points., first, perceive the distinction between Gross Revenue and Whole Revenue.

Many people have the confusion of understanding what’s Gross Revenue and what’s Whole Revenue or Taxable Revenue. Additionally, we calculate the revenue tax on Gross Revenue. That is utterly incorrect. The revenue tax can be chargeable on Whole Revenue. Therefore, it is vitally a lot vital to grasp the distinction.

Gross Whole Revenue means complete revenue underneath the heads of Salaries, Revenue from home property, Income and good points of enterprise or career, Capital Good points or revenue from different sources earlier than making any deductions underneath Sections.80C to 80U.

Whole Revenue or Taxable Revenue means Gross Whole Revenue diminished by the quantity of permissible as deductions underneath Sec.80C to 80U.

Subsequently your Whole Revenue or Taxable Revenue will all the time be lower than the Gross Whole Revenue.

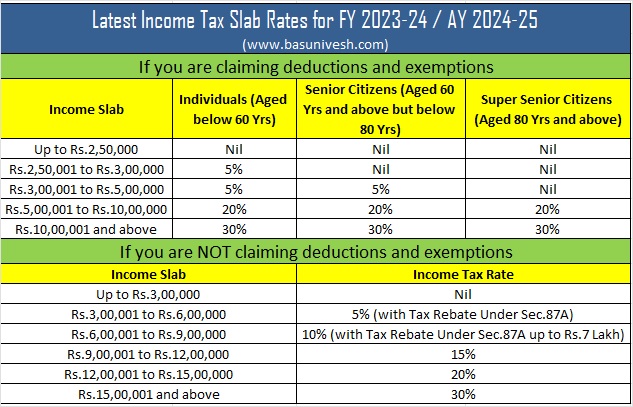

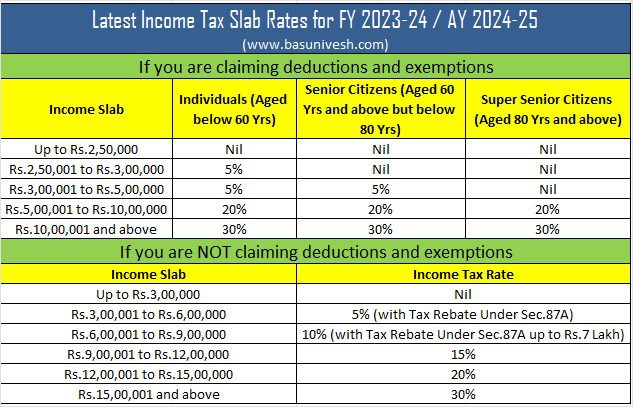

Revised Newest Revenue Tax Slab Charges FY 2023-24

There can be two kinds of tax slabs.

- For individuals who want to declare IT Deductions and Exemptions.

- For individuals who DO NOT want to declare IT Deductions and Exemptions.

Earlier, underneath the brand new tax regime, there have been six revenue tax slab charges was once there. That is now diminished to 5 revenue tax slab charges.

Do do not forget that the modifications in revenue tax slab charges are relevant solely to the brand new tax regimes. There isn’t a change in outdated tax regime.

Additionally, earlier the usual deduction accessible for the salaried class and the pensioners together with household pensioners is on the market just for the outdated tax regime. That is now accessible underneath the brand new tax regime additionally.

Yet one more vital announcement through the funds 2023 is that the brand new tax regime is a default tax regime. In the event you want to undertake the outdated tax regime, then you need to choose it.

Additionally, earlier, the rebate underneath Sec.87A was as much as Rs.5 lakh. That is now enhanced to Rs.7 Lakh. Therefore, in case your revenue is under Rs.7 lakh and choosing a brand new tax regime, then you definitely no have to pay the tax.

Let me now share with you the revised Newest Revenue Tax Slab Charges FY 2023-24.

I hope this info can be useful to you. I’ve written the most recent posts on Price range 2023 additionally. You possibly can confer with the identical at “Price range 2023 – 12 Key highlights impacting private finance” and “Part 87A – How is revenue as much as seven lakhs tax-free?“.