Disclaimer: This isn’t funding recommendation. PLEASE DO YOUR OWN RESEARCH !!!!

Background:

After Hannover Re and Munich Re a couple of days in the past, I made a decision to incorporate additionally Swiss Re and Scor in my evaluation. Sadly, for each of those gamers, the CAGRs for revenue and many others. are meaningless as they have been making losses in 2022. Nevertheless, particularly for SCOR I discovered a couple of numbers very attention-grabbing

Rating nonetheless has a comparatively conservative fairness ratio, much like Hannover Re, and can also be relying much less in monetary earnings and has a good long run ROE of 8%. Swiss Re in distinction is certainly a “class of its personal” with actually dangerous comps in all classes.

What I actually discovered attention-grabbing nevertheless is the truth that SCOR appears to commerce at an unlimited low cost to its friends, each when it comes to Worth to Ebook worth in addition to in anticipated 2023 P/E. That’s why I made a decision to have a deeper look into SCOR.

SCOR as an organization

SCOR is a French Reinsurance firm that’s supposed to be the quantity 5 world reinsurer primarily based on complete premium. Simply earlier than the monetary disaster in 2007, Scor merged with Swiss primarily based Converium (itself a spin-off from Zurich Insurance coverage). Of their investor deck, they do have a superb chart of how they’re positioned globally:

On the time of writing, Scor has a marked cap of ~4,2 bn EUR with aroun 178 mn shares excellent.

Elementary Tailwind (1): Reinsurance cycle

2022 was from a claims perspective not a terrific yr for reisurance. Nevertheless, 2023 seems a lot better. One specialty of reinsurance is that the business principally adjusts pricing solely every year at yr finish. Already in November, it was comparatively clear that costs will improve.

Only a few days in the past, the FT lastly reported that Reinsurance costs elevated considerably, in some areas, premiums elevated by as much as 200%.

https://www.ft.com/content material/f5f9d450-c539-47a7-bc5c-44a8db57e74e

The struggle in Ukraine and excessive climate occasions have pushed up the price of reinsurance by as a lot as 200 per cent in essential January renewals, in response to a brand new report, threatening to boost premiums and cut back what insurers are keen to cowl.

Clearly not all enterprise traces will revenue that a lot, however total evidently reinsurers have been capable of get “first rate costs” which ought to tranfer in “higher than common margins” (earlier than NatCat).

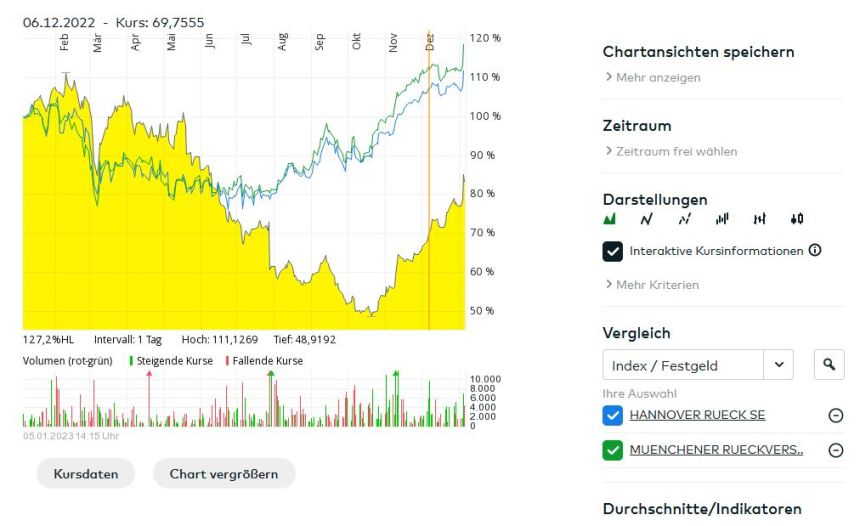

A part of that is clearly mirrored within the share costs of Reinsurers which have recovered considerably since final summer season:

Why has SCOR’s inventory carried out so dangerous within the second half of 2022 ?

It’s at all times troublesome to interpret why a inventory does soemthing. In SCOR’s case, I believe 2 elements may have scared traders in 2022 particularly in Q3: A comparatively giant publicity to French storms and a ~500 mn “reserve strenghtening” in Q3. That is the slide type the IR presentation:

Elementary Tailwind (2): Rates of interest

One other tailwind are rates of interest. With elevated rates of interest, the yield on newly invested cash clearly goes up. Nevertheless there’s one caveat: Lengthy working fastened earnings securities are “beneath water”, so with a purpose to forestall losses, Insures have to attend till the outdated paper matures.

Scor has a good investor presentation from November. With regard to their funding earnings, I discovered this slide actually useful:

Scor’s portolio length is absolutely brief. The three,3 years evaluate with ~6,5 yr for Munich Re (together with Ergo, 5 years excluding Ergo) and 5 years for Hannover Re.

This has two foremost results:

- The rate of interest sensitivity of the IFRS Fairness was decrease than for its friends

- The upper yield envrionement will end in a faster and bigger improve in funding earnings in comparison with their friends, each due to the shorter length in addition to the decrease beginning yield-

A again of the envelope calculation seems as follows:

Scor has round 20 bn in ifxed incoem belongings that yield at present round 2% or 400 mn in funding earnings. Subsequent yr, they’ll be capable to reinvest 30% of the 20 bn at 5% as a substitute of two%. This has the next impact:

=0,3*20bn*(5%-2%) ~180 mn EUR extra internet funding earnings in 2023 in comparison with 2022.

Assuming that rates of interest stay the place there are, this impact will proceed for the subsequent two years as nicely, till the entire portfolio yields 5% (assuming that yield keep the place they’re).

Valuation / Mannequin

I got here up with a simplified mannequin base case which seems as follows:

The bottom case assumption are as follows:

- Each maturing asset (~30% of the prevailing belongings) and any new investments (5% development of the float p.a.) can invested at 5% (present reinvestment fee) in 2023 and roughly 4,5% in 2024 and 4% in 2025.

- The sturdy Reinsurance cycle will enable for a 98% Mixed ratio in 2023, going again as much as 100% till 2025

Nobody may modify this assumptions in any manner (decrease/greater reinvestment yields, Increased development of float, greater/decrease CR and many others.), however I believe these asumptions are cheap base case assumptions.

Primarily based on these assumptions, I’d expext EPS of three,92 for 2023 and primarily based on a P/E of 9 this is able to imply a goal value of 35 EUR per share. This may imply a 50% upside plus an anticipated 1,80 EUR dvidend. Ticker tells me that promote aspect analysts predict 3,77/4,16/4,93 as EPS for 2023 to 2025, so fairly shut and equally lifelike.

SCOR is clealry not precisely a long run compounder, nevertheless it seems like a potnetially very attention-grabbing “worth commerce” with a good upside.

Dangers:

I see three main dangers on this case:

1. Excessive Nat Cat losses (once more) in 2023

There’s completely no assure that 2023 can be higher for NatCat than 2022, it chilly be even worse. Nevertheless the siginficant hieghr premium degree and SCOR’s lowered publicity clearly decrease the chance of a very dangerous yr

2. Rate of interest growth

The most important dirver of upper eanrings is clearly the reinvestment yield. SCOR will reinvest most of its portfolio over the subsequent 3 years. So a sudden and everlasting drop in rates of interest will decrease the anticipated improve within the funding earnings. Based on my expertise, the present yield is at all times one of the best proxy for future yields. Utilizing the yield curves (i.e. the implied frwards) would result in a decrease anticipated reinvestment yield.

3. Additional reserve strenghtening required

Shareholder clearly bought spooked by the reserve strengthening in Q3 and there’s no assure that this would be the final one. Their opponents didn’t want to do that in Q3. It seems like that SCOR’s reserves appeared to have been extra “optimistic” than the opponents with one driver being inflation.

IFRS 9 / IFRS 17 modifications in 2023

I don’t wish to bore out anybody with accounting particulars, however in 2023 two main accounting modifications will kick in for Insurance coverage and Reinsurance companies that report beneath IFRS:

IFRS 9 targets the accounting of investments. The primary matter right here is that particularly for fairness investments, one has to selected between both totally working them by way of P&L or to solely present the dividend earnings within the P&L. This is a matter for insurers with vital publicity to fairness (as an illustration Munich Re) however not for SCOR as they haven’t any fairness inevstments. Many market individuals assume that the funding earnings of many insuers will grow to be way more risky. As well as, Insurers won’t be able to steer total P&L by way of realizing unrealized good points.

IFRS 17 targets the insurance coverage aspect. SCOR has some charts on that of their investor presentation. General, particularly for P&C, internet premium can be decrease however mixed ratios will look higher. Additionally they point out that IFRS Fairness can be greater on account of reserve discounting, one thing that has been attainable beneath US GAAP already. As price-to-book continues to be an essential metric for valuing insurers, this might be an total positivee growth for Insurers with IFRS accounts

General, there’s some uncertainty round these modifications and I anticipate that some shareholders may be shocked by the growing volatility of GAAP earnings for some Insurers and Reinsurers. once more, for SCOR I believe that is much less o a problem on account of their very conservative imvestment portfolio.

Administration/Shareholders and many others.

With reagrd to Managment and startegic shareholders, there’s not lots to report right here. Most notable are a complete 3,5% of share possession of workers and a 3,6% place from Tweedy Brown, an old-fashioned worth investing agency.

Nevertheless, as this can be a extra brief time period relative worth commerce, these elements don’t play such an essential position as for long run investments.

Professional’s/Con’s

As at all times, thes is now a superb time to have a look at some professional’s and con’s relating to this funding case:

+ Tailwind 1: Robust Reinsurance cycle, excessive premium will increase

+ Tailwind 2: Brief length of portfolio to learn from greater rates of interest

+ Low danger funding technique

+ Very engaging relative valuation

+ relative higher by way of IFRS 9 / IFRS 17 (greater fairness, higher CR)

+/- Common administration, avarage ROE, Margins and many others.

+/- Reinsurance claims are unpredictable and might be risky (NatCat)

– beneath common P&C profitability, losses in 2022

– danger of futher reserve strengthening

– total uncertainty about IFRS 9 / IFRS 17

– decrease reinvestment charges

Sport plan:

As talked about above, for me SCOR will not be a long run funding however fairly a “worth commerce”, i.e. a comparatively undervalued safety that has a superb likelihood to catch as much as its friends over the subsequent 12-18 months. My value goal can be round 35 EUR plus dividend.

Some “mushy catalysts” might be the the consequence presentation in early February the place they may, amongst different subjects, present the IFRS 17 impression on fairness and provides a hopefully optimistic forecast for 2023.

Operationally, usually solely after Q3 (US Hurricane season) reinsurers can say if it wil be a superb yr or not, however, one ought to see the ffect of upper rates of interest quarter by quarter.

In the event that they announce one other giant “reserve strengthening”, then I’ll severely rethink the postion.,

Abstract:

General, I do assume that SCOR SE repdrsents an attention-grabbing “relatice worth commerce” alternative. At an estimated P/E of 6 for 2023, the inventory seems too low-cost in comparison with its foremost opponents who commerce at 10-12x P/E. The underlying enterprise is supported by two sturdy fundamntal talwinds: A powerful Reinsurance cycle and growing rates of interest, wher SCOR by way of its brief portfolio length advantages much more than the opponents.

Subsequently I’ve allotted ~4% of the portfolio into SCOR at a value of 23,60 EUR. I financed this thorugh a sale of the GTT place in addition to some revenue taking at Meier & Tobler.

My base case anticipated return is +50% (together with dividend) over a interval of 12-18 months.

Disclaimer: This isn’t funding recommendation. PLEASE DO YOUR OWN RESEARCH !!!!