Sam loves her outdoorsy life in Salt Lake Metropolis, Utah and is an avid rock climber, hiker, path runner, final frisbee participant and skier. On the skilled facet, she manages content material creation for a corporation that manufactures work-at-height gear for careers in vertical areas. She enjoys her job and the soundness it supplies, however craves a extra impartial way of life. She desires to discover the potential of turning into a contract video producer so as to be her personal boss and management her hours. She’d like our recommendation on the best way to make this dream a actuality!

What’s a Reader Case Research?

Case Research deal with monetary and life dilemmas that readers of Frugalwoods ship in requesting recommendation. Then, we (that’d be me and YOU, pricey reader) learn by way of their state of affairs and supply recommendation, encouragement, perception and suggestions within the feedback part.

For an instance, take a look at the final case examine. Case Research are up to date by individuals (on the finish of the put up) a number of months after the Case is featured. Go to this web page for hyperlinks to all up to date Case Research.

The Purpose Of Reader Case Research

Reader Case Research spotlight a various vary of monetary conditions, ages, ethnicities, places, objectives, careers, incomes, household compositions and extra!

The Case Research collection started in 2016 and, up to now, there’ve been 82 Case Research. I’ve featured of us with annual incomes starting from $17k to $200k+ and web worths starting from -$300k to $2.9M+.

I’ve featured single, married, partnered, divorced, child-filled and child-free households. I’ve featured homosexual, straight, queer, bisexual and polyamorous individuals. I’ve featured ladies, non-binary of us and males. I’ve featured transgender and cisgender individuals. I’ve had cat individuals and canine individuals. I’ve featured of us from the US, Australia, Canada, England, South Africa, Spain, Finland, Germany and France. I’ve featured individuals with PhDs and folks with highschool diplomas. I’ve featured individuals of their early 20’s and folks of their late 60’s. I’ve featured of us who dwell on farms and people who dwell in New York Metropolis.

The purpose is variety and solely YOU might help me obtain that by emailing me your story! When you haven’t seen your circumstances mirrored in a Case Research, I encourage you to use to be a Case Research participant by emailing your transient story to me at mrs@frugalwoods.com.

Reader Case Research Pointers

I most likely don’t have to say the next since you of us are the kindest, most well mannered commenters on the web, however please be aware that Frugalwoods is a judgement-free zone the place we endeavor to assist each other, not condemn.

There’s no room for rudeness right here. The purpose is to create a supportive surroundings the place all of us acknowledge we’re human, we’re flawed, however we select to be right here collectively, workshopping our cash and our lives with constructive, proactive strategies and concepts.

A disclaimer that I’m not a skilled monetary skilled and I encourage individuals to not make severe monetary choices based mostly solely on what one particular person on the web advises.

I encourage everybody to do their very own analysis to find out one of the best plan of action for his or her funds. I’m not a monetary advisor and I’m not your monetary advisor.

With that I’ll let Sam, right this moment’s Case Research topic, take it from right here!

Sam’s Story

Hi there! I’m Sam and I’m past grateful for my life. I’m 30-years-old, single and solely have scholar mortgage debt. I’ve an workplace job that’s versatile and pays sufficient for me to do the issues I like and, residing in Salt Lake Metropolis, there are many outside actions I like! My favourite is mountaineering and I dedicate a majority of my time, ideas and cash towards the foolish sport.

Throughout the summer season I path run, play final frisbee, backpack and climb. Within the winters I ski or journey south for heat. I spend most evenings with buddies or alone baking, cooking and Netflixing. I work at an organization that manufactures work-at-height gear for careers in vertical areas (tree care, tower, window washing, rope entry) in addition to gear for ice and mountaineering. I oversee content material creation for the skilled facet, which implies I journey typically for picture and video shoots, averaging about one journey per 30 days.

What feels most urgent proper now? What brings you to submit a Case Research?

What feels most urgent proper now’s the immediacy and brevity of life… and the terrible reliance on cash. My job provides pretty beneficiant paid time without work (18 days), nevertheless it’s absurd to me that you just’re allotted this tiny period of time to dwell. With that being mentioned, I’ve been contemplating the transition to a contract profession as a producer. Producers are the spine of any picture and video shoot. They’re the people who create the schedule, coordinate the logistics, guarantee everyone seems to be fed, safe needed insurance coverage, and many others. A single guardian on steroids, basically. What attracts me to this work is the liberty of working after I need, assembly new individuals, touring and being an entrepreneur.

I’ve the liberty, time and dedication for this transition. Nonetheless, I’m nervous concerning the monetary side of it. Fortunately I don’t have to fret about dependents, pets or a mortgage. However, I do have college debt and am nervous about saving for retirement, paying for insurance coverage and college loans; all of the whereas saving to purchase a home. Though I like being single, it does make launching into a contract life all of the extra intimidating!

What’s one of the best a part of your present way of life/routine?

The most effective a part of my present way of life is that I don’t have to fret about revenue. Since I’m salaried, I get the identical quantity distributed into my accounts every month regardless of how a lot or how little I work. Plus, I don’t have to fret about paying an obscene quantity for insurance coverage. I additionally love the journey and social side of my routine.

What’s the worst a part of your present way of life/routine?

The worst a part of my present way of life just isn’t having autonomy over my life and having somebody (my employer) telling me the place to go and what to do. Additionally, it typically seems like my job is meaningless. I lately didn’t get a promotion I used to be shocked to not get. I wish to be in a management place and be my very own boss. The world wants extra ladies in management! Additionally, I’d take pleasure in a life with a companion who helps my profession ambitions and who desires to lift wholesome, glad kiddos.

And! I don’t have sufficient time to do all of the issues I wish to do – I’ve large concepts and wish to achieve this many issues. Usually, my day is scheduled from 6am – 8pm and I really feel like there’s nonetheless a lot to do. Don’t all of us although? I’m hoping {that a} extra versatile schedule will open up time to do issues like begin a decentralized backyard program and volunteer on the state jail.

The place Sam Needs to be in Ten Years:

Funds:

- In 10 years I wish to have half 1,000,000 in my 401k and 6 months of bills saved.

- I’d additionally prefer to have a various portfolio of investments.

Life-style:

- I wish to have a household ~ companion and children ~ and a home.

- I’d additionally like to have the ability to journey internationally and be glad about my life.

- I wish to spend time with family and friends who reside in Washington State.

Profession:

- I wish to have an effect on the world, one way or the other. Not fully positive what that appears like, however I do know I wish to work with individuals by way of visible media and storytelling, which is why I’m leaning towards producing.

- I additionally wish to construct a status as a tough employee who’s trustworthy and decided.

Sam’s Funds

Revenue

| Merchandise | Quantity | Notes |

| Sam’s web revenue | $3,100 | 8% goes into 401k (2% into earlier than tax; 6% into Roth) |

| Dogsitting Common Revenue | $185 | |

| Month-to-month subtotal: | $3,285 | |

| Annual complete: | $39,420 |

Money owed

| Merchandise | Excellent mortgage stability | Curiosity Fee | Mortgage Interval/Payoff Phrases/Your month-to-month required cost |

| College Mortgage AB | $18,997 | 6.80% | All presently on maintain till October 2022 |

| College Mortgage AE | $7,956 | 3.40% | |

| College Mortgage AA | $1,623 | 4.50% | |

| Complete: | $28,576 |

Property

| Merchandise | Quantity | Notes | Curiosity/sort of securities held/Inventory ticker | Identify of financial institution/brokerage | Expense Ratio |

| Funding Account | $27,081 | Dad gave me $20,000 for varsity loans, however I put it in an funding account and deposit $800/month | Betterment | 0.11% | |

| 401k | $16,073 | 8% of revenue / work matches 4% | RFTTX | Empower Retirement | 0.28% |

| Liquid Financial savings | $10,002 | Liquid HYS account | Marcus Goldman Sachs | ||

| Financial savings | $2,752 | on a regular basis financial savings | Columbia | ||

| 401k | $2,458 | Random 401k account that I don’t do something with and have to switch | Charles Schwab | ||

| 2nd Checking | $2,163 | second checking account for hire, fuel, and many others | America First Credit score Union | ||

| Random financial savings account | $1,914 | I don’t have a card for this account; initially was for my truck funds, however I put in $800 a month now only for additional financial savings | Utah Group Credit score Union | ||

| HSA | $1,690 | well being financial savings account | America First Credit score Union | ||

| Checking | $1,522 | on a regular basis checking & largely to pay for bank card | Columbia | ||

| Complete: | $65,654 |

Autos

| Car make, mannequin, 12 months | Valued at | Mileage | Paid off? |

| Toyota Tacoma, 2016 | $30,000 | 80,000 | Sure |

Bills

| Merchandise | Quantity | Notes |

| Lease | $550 | Very grateful! |

| Groceries | $250 | I get CSA’s each summer season & eat largely entire meals & LOTS of meat |

| Private Care (Waxing & Therapeutic massage & Chiro) & random well being Objects | $234 | I look ahead to these massages each month; could be exhausting to surrender. I see a chiropractor for my scoliosis and waxing is effectively… possibly TMI |

| Consuming out | $210 | |

| Fuel/Rideshare | $195 | #trucklife |

| Sports activities/Outside Gear | $166 | Didn’t get a ski go this 12 months, which is able to (hopefully) decrease this quantity. However, this contains gear and coaching applications |

| Garments & Sneakers & Equipment | $138 | Eeek! Didn’t understand it was this excessive |

| Dwelling items & Hobbies (candles, movie, artwork hobbies, cleansing provides, and many others) | $128 | I simply lumped collectively, however I since my place is so small, and dwell alone, I don’t spend a lot on cleansing provides |

| Presents (Holidays & Birthdays) | $100 | Reward giving is my love language! |

| Journeys & Trip | $100 | It will enhance this summer season with three int’l journeys deliberate… |

| Concert events/Leisure | $100 | Love going to exhibits! This additionally contains books, on-line programs and flicks |

| Automotive & Lease Insurance coverage | $93 | State Farm |

| Web | $65 | Comcast |

| Telephone Invoice | $56 | Limitless knowledge on Verizon household plan |

| Climbing health club membership | $52 | May cancel this since I additionally get a free health club membership by way of work at a unique health club |

| Automotive tabs & oil modifications | $35 | |

| Google/iTunes charges for additional storage | $12 | Possibly not needed? |

| Nutritional vitamins | $10 | |

| Haircuts | $10 | |

| Month-to-month subtotal: | $2,504 | |

| Annual complete: | $30,048 |

Credit score Card Technique

| Card Identify | Rewards Sort? | Financial institution/card firm |

| Journey Rewards American Categorical | Earn 3 factors per greenback spent on eligible web airfare purchases. Earn 2 factors per greenback spent on eligible web lodge and restaurant purchases. Earn 1 level per greenback on all different eligible web purchases.No international transaction charge $95 annual charge |

Columbia Financial institution |

Sam’s Questions for You:

- Any insights into freelance work?

- Monetary suggestions for beginning a contract profession?

- Is it too late, financially, to make this profession change?

- Any insights into medical health insurance for a single particular person?

- Recommendation for somebody with a renaissance soul? How do I decide only one profession?

Liz Frugalwoods’ Suggestions

I’m thrilled to have Sam as our Case Research right this moment and wish to congratulate her for all of her sensible monetary decisions! She’s performed an awesome job on a not-super-high revenue and I wish to commend her for her values-based, prioritized spending. Sam’s at an attention-grabbing juncture and I’m excited to discover her choices for subsequent steps. So let’s dive in!

Sam’s Query #1: Any insights into freelance work?

On the outset, I wish to set up that freelancing isn’t going to be much less work. It’s going to be extra work–at the least in the beginning. Nonetheless, it would provide you with extra flexibility to decide on WHEN you’re employed. I like working for myself and like my freelancing way of life, however over time, it’s been A LOT extra work than a standard 9-5. That’s as a result of along with doing the precise work (in Sam’s case, video manufacturing), you additionally must run your individual small enterprise:

- It’s a must to pay quarterly taxes

- It’s a must to arrange your individual legal responsibility insurance coverage

- It’s a must to arrange (and contribute to) your individual retirement plan (I exploit a Solo 401k)

- It’s a must to analysis and sign-up to your personal medical health insurance (my household and I are on a plan by way of the ACA).

- That is my fast reply to Sam’s query #2 on medical health insurance: you sign-up by way of your state’s ACA portal. Insurance coverage varies by state, so that you’ll simply must see what Utah provides.

- It’s a must to handle your whole personal tech: web site, social media accounts, e-mail supplier, video calls, and many others

- You’re your individual back and front workplace: it’s a must to bill shoppers, reconcile invoices, hold a database, and many others

- You might be your individual advertising and marketing agency: it’s a must to construct a reputation for your self and solicit shoppers.

This isn’t to scare Sam off; slightly, it’s a actuality test. I’ve been working for myself since 2014 and a whole lot of these items has gotten simpler over time, however I nonetheless at all times really feel behind on the “again workplace” stuff. Sure, I might rent somebody, however then I’d have to search out them, interview them, rent them, practice them, arrange payroll, handle them, do efficiency opinions, and many others… It hasn’t been price that problem to me (at the least, not but).

Additionally, I labored WAY tougher increase my enterprise than I ever did at a 9-5 workplace job as a result of my enterprise is my third baby and I like what I do and I would like it to succeed! I joke that my preliminary hourly fee was most likely $0.05. It has elevated over time, however my level is that it’s taken time to construct it up to now.

One Concept: Construct Your Freelance Enterprise Alongside Your 9-5

That is what I did and, I’ve to say, it’s probably the most financially accountable method. I used to stand up at 6am every single day and work for two hours on Frugalwoods earlier than going to my workplace job. Within the evenings, I’d go to yoga, come dwelling and eat dinner after which work for an additional 2-3 hours on Frugalwoods. Each single day. That was the one approach I might construct it into an actual enterprise whereas working full-time.

This was earlier than I had children and my husband helped me each step of the best way. The benefit to doing this–for me–is that I continued to obtain my secure workplace job revenue (and advantages) whereas increase my ardour undertaking. Since we didn’t have children but, I used to be in a position to commit all this additional time to Frugalwoods and I’m so glad I did. I’ll always remember the euphoria I felt on my first “full-time” day engaged on Frugalwoods after I left my workplace job. I used to be euphoric as a result of:

- I used to be already incomes an revenue from it

- I had clear, exact objectives and subsequent steps to execute

- I knew precisely why I used to be engaged on it

- I used to be grateful to have a lot time to commit to it

Consequently, as a result of I turned so accustomed to cramming Frugalwoods work into the odd hours of the day, I’m in a position to not work full-time on it to at the present time. My priorities have shifted to spending extra time with my children and out on the homestead. However, I’m in a position to get so much performed in my part-time schedule as a result of I’m so used to working quick and livid after I’m “on the clock.”

Sam’s expertise will clearly be totally different from mine and he or she’s in a completely totally different business, however, I strongly encourage her to begin increase her freelancing work whereas working at her secure 9-5. This’ll give her ample monetary buffer and can inform her selection of whether or not or not that is really what she desires to do.

Since flexibility and management over her schedule looks like her high purpose, I might envision Sam doing one thing like 9 months of exhausting work per 12 months after which taking 3 months off to go mountaineering! Once more, it’s not going to be much less work, however you possibly can select when and the place you do the work.

Sam’s Query #2: Is it too late, financially, to make this profession change?

The reply is that it actually relies upon. If Sam desires to give up her job tomorrow and dwell off her financial savings whereas increase her freelance enterprise, I’d say she’s going to place herself in a extra financially precarious place. Then again, if Sam desires to construct up her freelance enterprise whereas persevering with to work her common job, she’ll solely be spending her time to take action.

Let’s run by way of all of Sam’s numbers:

1) Money: $18,352

This can be a phenomenal emergency fund! Sam spends simply $2,504 per 30 days, so this quantity would cowl seven months price of her spending–improbable! An emergency fund is easily-accessible money (held in a checking or financial savings account) that covers anyplace from three to 6 months price of your spending. It’s your safeguard from debt and a #1 monetary precedence.

My suggestion: consolidate this to at least one account.

- Sam has this cash unfold throughout 5 totally different checking/financial savings accounts, which looks like so much to maintain monitor of.

- If it had been me, I’d consolidate to at least one high-yield financial savings account, such because the American Categorical Private Financial savings account, which–as of this writing–earns 1.50% in curiosity (affiliate hyperlink).

- Sam would earn $275 on her cash in a 12 months, simply by having it on this high-interest account.

The Freelancing Problem:

If Sam had been to give up her job to deal with increase her freelancing profession, she might spend down this $18k on residing bills, which as famous, would final her about 7 months. I don’t advocate that method as a result of it places Sam in a harmful place of getting no buffer from debt and unsure revenue.

2) Retirement: $18,531

I agree with Sam that she ought to go forward and roll over her outdated 401k. It’s nice that she’s been contributing to her retirement and improbable that her employer provides a match! The key purple flag I see is the expense ratio on this account: 0.28% is approach too excessive. Sam ought to contact her employer’s advantages coordinator to discover what different funds is perhaps obtainable at decrease expense ratios (I’ll speak extra about this beneath).

The Freelancing Problem:

As soon as freelancing, she’ll not have an employer match on this identical sense, though she will match her personal contributions to a Solo 401k. She acknowledged that certainly one of her objectives is to have $500k in her 401k in ten years, so let’s see how she will get there.

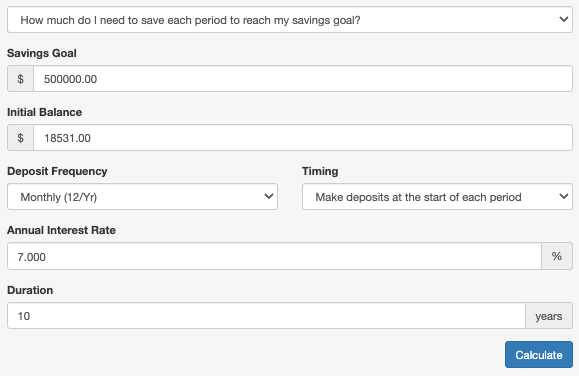

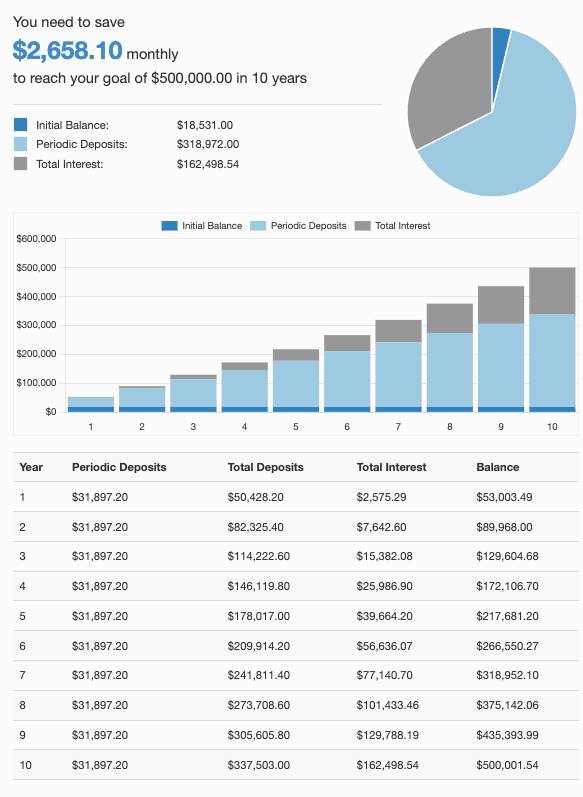

I used this on-line calculator to find out how a lot Sam might want to save each month so as to attain her purpose of $500k in ten years:

What this exhibits is that beginning with Sam’s present retirement financial savings of $18,531, and her purpose of rising that to $500k in ten years, she’d want to avoid wasting $2,658.10 per 30 days. The caveat is that this calculator assumes a flat 7% annual return, which is the historic inventory market common. However, the inventory market doesn’t return that quantity each single 12 months and definitely isn’t assured to take action yearly for the following ten years. That caveat apart, this does give Sam a basic concept of how a lot she’ll want to avoid wasting each month so as to hit that purpose.

3) Taxable Investments: $27,081

Taxable investments are investments within the inventory market that aren’t retirement accounts. Having a taxable funding account is great, nevertheless it’s a better stage purpose. Earlier than opening an account like this, you usually wish to do all the following first:

- Repay all money owed (excluding a low, fixed-rate mortgage)

- Save an emergency fund (of three to six months’ price of your bills)

- Have totally funded retirement accounts (and the flexibility to proceed contributing to them)

- Not have a significant capital expense in your close to future (reminiscent of shopping for a home or automobile)

Whereas I commend Sam for being forward-thinking in opening this account, my concern is that she nonetheless has $28,576 in scholar mortgage debt. Basically, you don’t wish to tie your cash up in a taxable funding account when you might as an alternative be utilizing it to repay debt. That is significantly true in Sam’s case as a result of her largest mortgage has a 6.8% rate of interest and–as we famous above–the inventory market’s common annual return is just 7%. Which means she’s shedding cash on that rate of interest anytime the market doesn’t ship a return above 6.8%.

What to do?

All that being mentioned, the US is presently in a interval of federal scholar mortgage limbo. Funds on federal scholar loans had been paused through the pandemic and proceed to be in deferment till August 31, 2022. Sam famous that hers are deferred till October 2022, however the US Division of Training web site on scholar support states that each one mortgage re-payments will re-start on August 31, 2022. Sam ought to test her paperwork to make sure she has the proper re-start date in thoughts.

This era of scholar mortgage deferment has been an exquisite present to anybody with a federal mortgage as a result of it enabled them to cease making funds however not incur penalties. Moreover, there may be hypothesis that President Biden may additional prolong scholar mortgage deferment or doubtlessly even cancel some portion of scholar loans. In gentle of that, I believe it makes complete sense for anybody with federal scholar loans to not make funds whereas in deferment and to attend and see what the administration decides.

Situation #1: If scholar mortgage deferment (or cancelation) continues:

- Sam ought to proceed not making funds.

Situation #2: If scholar mortgage funds re-start:

- Sam must be on high of when these funds resume to keep away from incurring penalties.

- On this situation, the large query is whether or not or not Sam ought to liquidate her taxable funding account so as to repay her scholar loans.

Liquidating A Taxable Funding Account (AKA pulling cash out of the inventory market)

I sometimes don’t advise doing this as a result of:

- The entire level of getting a taxable funding account is to maintain it open for a lot of many years so as to profit from the inventory market’s longterm progress.

- It’s a must to pay capital beneficial properties taxes on the income (not the overall quantity)–in different phrases, any cash your shares have earned over time.

- When you liquidate throughout a market downturn, you’re locking in your losses and guaranteeing that you just lose cash. See this Case Research for an in depth rationalization of this unlucky situation.

Sam, nonetheless, presents an attention-grabbing case as a result of:

- Her funding account virtually equals her scholar mortgage debt and the rate of interest on her debt is pretty excessive.

- She’s younger and may open one other taxable funding account as soon as her loans are paid off.

- Maybe most significantly, her wage is low. See beneath for why this issues:

Since Sam information her taxes singly and makes beneath $41,675, her long-term capital beneficial properties tax fee ought to be 0%, assuming she’s owned the shares in query for greater than a 12 months (that’s the brink for “long-term capital beneficial properties”). Quick-term capital beneficial properties taxes are greater than long-term, which is but another excuse to maintain taxable funding accounts open for the long-term.

Capital beneficial properties are decided by any income you’ve constituted of your shares in addition to your taxable revenue. Nonetheless, you solely pay greater tax charges on quantities above every tax bracket threshold. Given Sam’s revenue and the scale of her taxable funding account and, assuming she’s held the shares for multiple 12 months, it appears like her tax fee can be nominal or non-existent. This reality makes liquidation-to-pay-off-student-loans extra engaging. Take a look at this Motley Idiot article, which outlines the method and from which I drew a lot of this info. Since Sam’s account is with Betterment, right here’s their overview on the best way to withdraw funds from an funding account.

Opening A Future Taxable Funding Account

If Sam decides to liquidate her Betterment account so as to repay her scholar loans, I counsel she contemplate a unique brokerage sooner or later. Betterment is sweet as a result of it provides help with investing, nevertheless it’s not so good as a result of it fees fairly excessive charges for his or her providers. The expense ratio on Sam’s Betterment account is 0.11%. For comparability, I’ve an expense ratio of 0.015% on my FSKAX account (Constancy’s complete market index fund). These numbers may sound comparable, and that’s what corporations like Betterment are hoping you’ll assume.

To calculate what Sam is shedding in charges, I used this calculator from BankRate.com:

If Sam had been to stay invested on this fund for the following 20 years, and the inventory market delivered its annual common 7% return, her investments would stand at $102,513 and he or she could have misplaced a complete of $2,282 to Betterment, damaged down as follows:

$992 in alternative prices (in different phrases, what the cash she paid in charges might’ve earned her if as an alternative invested out there)

+ $1,290 in charges (in different phrases, funds to Betterment)

$2,282 misplaced

Now, this isn’t a ridiculously massive sum of money, nevertheless it’s cash Sam doesn’t must pay. Let’s run the calculation once more, however this time with Constancy’s 0.015% expense ratio. On this situation, we discover that Sam would lose solely $237 in charges and $181 in alternative prices, for a complete of $418 misplaced.

In different phrases, if Sam had been to change to a low-fee brokerage, she’d stand to avoid wasting $1,864 in charges.

For reference, the next three brokerages supply DIY low-fee funding choices:

- Constancy’s Complete Market Index Fund (FSKAX) has an expense ratio of 0.015%

- Charles Schwab’s Complete Market Index Fund (SWTSX) has an expense ratio of 0.03%

- Vanguard’s Complete Market Index Fund (VTSAX) has an expense ratio of 0.04%

Questioning the best way to discover a fund’s expense ratio? Take a look at the tutorial in this Case Research.

Sam’s Bills

Sam’s bills are completely affordable for her present wage stage. She makes $3,285 a month (after 401k contributions) and spends $2,504. The problem can be if she desires to achieve her 401k purpose of $500k in ten years and if her freelance wage is decrease than her present revenue. However no worries, all of that is solvable!

As at all times, we have now two levers to drag right here:

If Sam had been to begin constructing her freelance enterprise whereas working her full-time job, she’d doubtlessly enhance her revenue and have the ability to keep her present spending stage, repay her debt, and enhance her retirement contributions. Then again, if Sam quits her job to construct up her freelance enterprise full-time, she may attain profitability quicker, however would wish to make use of her emergency fund for her bills and will contemplate decreasing her bills throughout this time interval.

Sam can have a look at decreasing discretionary spending, as outlined beneath:

| Merchandise | Quantity | Notes |

| Private Care (Waxing & Therapeutic massage & Chiro) & random well being Objects |

$234 | I look ahead to these massages each month; could be exhausting to surrender. I see a chiropractor for my scoliosis and waxing is effectively…possibly TMI |

| Consuming out | $210 | |

| Sports activities/Outside Gear | $166 | Didn’t get a ski go this 12 months, which is able to (hopefully) decrease this quantity. However, this contains gear and coaching applications |

| Garments & Sneakers & Equipment | $138 | Eeek! Didn’t understand it was this excessive |

| Dwelling items & Hobbies (candles, movie, artwork hobbies, cleansing provides, and many others) | $128 | I simply lumped collectively, however I since my place is so small, and Iive alone, I don’t spend a lot on cleansing provides |

| Presents (Holidays & Birthdays) | $100 | Reward giving is my love language! |

| Journeys & Trip | $100 | It will enhance this summer season with three int’l journeys deliberate… |

| Concert events/Leisure | $100 | Love going to exhibits! This additionally contains books, on-line programs and flicks |

| Climbing health club membership | $52 | May cancel this since I additionally get a free health club membership by way of work at a unique health club |

| Haircuts | $10 | |

| TOTAL discretionary spending per 30 days: | $1,238 |

There’s no urgent want for Sam to remove all of those bills. However, if she desires to pursue freelancing full-time, she might have to chop these out whereas she builds up her enterprise in order to not deplete her whole emergency fund. If she had been to quickly pause all of those bills–and swap to an MVNO for her cellular phone service–she’d rocket her month-to-month spending right down to a really low $1,225:

| Merchandise | Quantity | Notes |

| Lease | $550 | Very grateful! |

| Groceries | $250 | I get CSA’s each summer season & eat largely entire meals & LOTS of meat |

| Fuel/Rideshare | $195 | #trucklife |

| Automotive & Lease Insurance coverage | $93 | State Farm |

| Web | $65 | Comcast |

| Telephone Invoice | $15 | Limitless knowledge on Verizon household plan |

| Automotive tabs & oil modifications | $35 | |

| Google/iTunes charges for additional storage | $12 | Possibly not needed? |

| Nutritional vitamins | $10 | |

| TOTAL required month-to-month spending: | $1,225 |

At this super-low fee, her fabulous emergency fund of $18,352 would final her 14 months, which ought to be loads of time to make her freelancing enterprise worthwhile! In fact the trade-off is that she wouldn’t be contributing to her retirement throughout this time interval. Sam has two choices right here on the best way to proceed and she will decide which she prefers–or maybe she’ll select a mix of each.

Low Lease Is Nice Whereas It Lasts!

I additionally wish to spotlight that her hire seems to be approach beneath market worth. $550 per 30 days is improbable, however I can’t think about it’s market fee. Sam ought to plan for the eventuality of this rising–presumably by quite a bit. To get a way of what market fee is in her space, she will scan Craigslist, and many others for equally sized and situated flats. This’ll give her a way of what she will anticipate to pay sooner or later.

One other tremendous straightforward approach to save cash is to change her cellular phone supplier to a low-cost MVNO.

Listed below are a two MVNOs to contemplate:

For extra, I’ve a full chart of suppliers and their costs right here: Learn how to Save Cash on Your Cell Telephone Invoice with an MVNO: I Pay $12 a Month

Sam’s Query #3: Recommendation for somebody with a renaissance soul? How do I decide only one profession?

I do not know. If anybody is aware of the reply to this, please let me know :)! I’m on my second (third?) profession, however that doesn’t trouble me. I’m glad to alter my thoughts as I age and as my household circumstances evolve. My priorities change with annually and I’m comfy with this stage of fluidity in my life.

Just a few issues which have labored for me:

-

Scratch the itch for a unique profession by way of volunteer work.

- Sam talked about she has an curiosity in constructing out this side of her life and I encourage her to take action! I derive a whole lot of success from my service on nonprofit boards and it lets me flex my nonprofit fundraising muscle tissues (that was my pre-Fruglwoods profession and I take pleasure in maintaining a toe in it).

- Hold your thoughts and physique engaged by way of hobbies and buddies.

- Sam is already doing this completely together with her climbing and different outside pursuits.

- I don’t really feel the necessity to flip each passion right into a revenue-generating factor, which is why I’m so delighted with my pursuits of snowboarding, paddle boarding, climbing, yoga and horrible farming. I’m clear in my thoughts that these are hobbies and that I can simply take pleasure in studying for the sake of studying.

- Be very clear about the place your revenue comes from.

- I do some work that I don’t 100% love as a result of it earns me cash. I attempt to not do a TON of this work, however I do have income objectives in thoughts and I’m very clear-eyed about how I make cash versus what I do as a result of I adore it, not as a result of it’ll ever make me any cash.

- This additionally encourages freelancers to set clear objectives and charges. Too many freelancers give away an excessive amount of at no cost as a result of they’re enthusiastic about their work. I’ve made this error 100,000 occasions over time and am attempting to be higher about precisely valuing my time and my price.

Basically it’s about constructing a well-rounded life, which Sam is already doing! I believe giving your self permission to designate which issues will earn you cash and which issues gained’t is an effective way to allocate your power and perceive the way you wish to use your two most valuable sources: money and time.

Abstract:

1. If scholar loans are usually not cancelled or deferred:

- Examine on the date for scholar mortgage re-payment re-start and make sure you’re prepared to begin making funds at the moment.

- Think about liquidating the Betterment account so as to repay the scholar loans in a single fell swoop:

- When you go this route, pay the loans off in full.

- Sooner or later, contemplate opening one other taxable funding account with a decrease expense ratio.

2. Contact your HR division to discover what different funds can be found to your employer-sponsored 401k since 0.28% is a really excessive expense ratio.

3. Resolve if you wish to begin constructing your freelancing work whereas sustaining the safety and revenue of your present job. Create a schedule and marketing strategy for making it worthwhile and establish a “give up date” for leaving your job.

4. If you wish to give up your job now so as to construct a freelancing enterprise, be ready for leaner occasions:

- Get rid of all discretionary spending and create a a schedule and marketing strategy for reaching profitability.

- Have a plan for re-entering the standard workforce if the freelancing enterprise isn’t worthwhile by that time.

5. Remember that you just’re paying beneath market fee for hire and that it’s more likely to enhance sooner or later. Perform some research to find out what market fee is so you may have a way of what you may have to pay sooner or later.

Okay Frugalwoods nation, what recommendation do you may have for Sam? We’ll each reply to feedback, so please be happy to ask questions!

Would you want your individual case examine to seem right here on Frugalwoods? Electronic mail me (mrs@frugalwoods.com) your transient story and we’ll speak.

By no means Miss A Story

Signal as much as get new Frugalwoods tales in your e-mail inbox.