Your kitchen has been the identical shade for so long as you’ve lived in your house and you recognize it’s time to make a change. You don’t want the total rework; you simply want some paint (or so that you assume). You go to the paint retailer. That’s not so laborious. You choose a shade. If you must agree with another person on the colour, it could be a bit tougher. You faucet your debit card on a bit machine. They shake the can for you. They even throw stir sticks and a can opener on high of your can. These individuals are so good.

Earlier than you head out the door, they ask offhandedly, “Do you could have brushes at dwelling?” Hmm, you assume. Possibly? “Do you want rollers or a rolling pan? How about drop cloths, portray tape, edge guides, or some wall prep supplies? Do you could have spackle or putty? Right here’s a mixing paddle in your cordless drill.” All of a sudden, hiring an expert looks like an amazing concept.

Truly, stepping again for a second, you contemplate the folks on the paint retailer, not as upsell champions, however as specialists who actually DO know all the issues that you just would possibly want in your mission. It’s as much as you to determine what is actually crucial, however a bit of their recommendation could prevent time and extra journeys to their retailer.

In the identical approach, inserting insurance coverage merchandise isn’t about serving to folks buy what they don’t want. It’s about educating them on what they may want and offering them with what they may want in order that it’s prepared for them after they do want it.

Insurance coverage is a matter of timing. Matching want with merchandise.

Product placement is now a matter of channels and predicting when and the place prospects want a product. Can insurers nail the expertise by additionally nailing the location and the timing? Success requires product and channel synergy, and when it really works, it’s superb! It’s all concerning the “proper place, proper time.”

It’s time for insurers to contemplate some largely unexplored product and channel synergies! That’s what Majesco and PIMA discovered as part of their jointly-authored report, Increasing Channels for Insurance coverage: A Spectrum from Conventional to Affinity and Embedded. In case your group is in search of new avenues for progress, that is the place all of it begins. As you research channel choices, assess which channels are presently in use, which channels and merchandise are interesting to a brand new technology and more and more digitally savvy prospects and enterprise homeowners, and which market alternatives are under-utilized.

For at present’s dialog, we’re centered on P&C Merchandise presently advertising via channels by PIMA members. (For a take a look at L&AH, learn Revisiting L&AH Merchandise and Placement for At the moment’s Clients.) For the needs of our dialog and evaluation, right here’s a brief evaluation of the channel spectrum we’re contemplating.

The Channel Spectrum

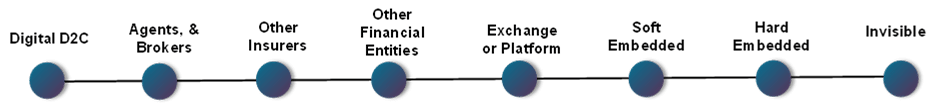

Distribution choices fall throughout a spectrum of channels, together with direct to the shopper, agent/dealer, different insurers, market trade or platform, and embedded as depicted in Determine 1. Embedded insurance coverage is among the many latest choices and expands the normal affinity mannequin leveraging know-how and an ecosystem of partnerships. Quite a few attention-grabbing examples of partnerships between insurers and different industries are popping up on this finish of the spectrum, together with GM, Ford, Tesla, SoFi, Petco, Airbnb, Uber, Intuit, and extra.

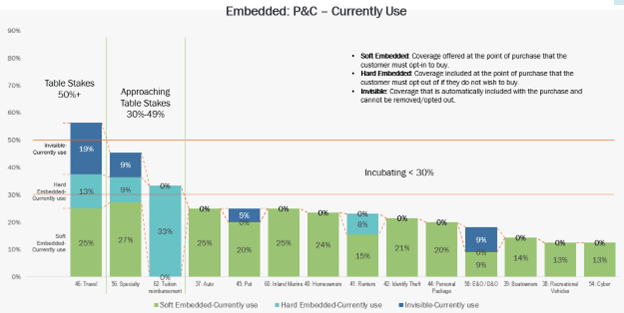

We outlined ranges of embedding as:

- Mushy Embedded: Protection supplied on the level of buy that the shopper should opt-in to purchase.

- Onerous Embedded: Protection included on the level of buy that the shopper opts out of if they don’t want to purchase.

- Invisible Embedded: Protection that’s routinely included with the acquisition and can’t be eliminated/opted out.

Determine 1: Distribution channel methods for insurers

Overview of P&C Merchandise supplied

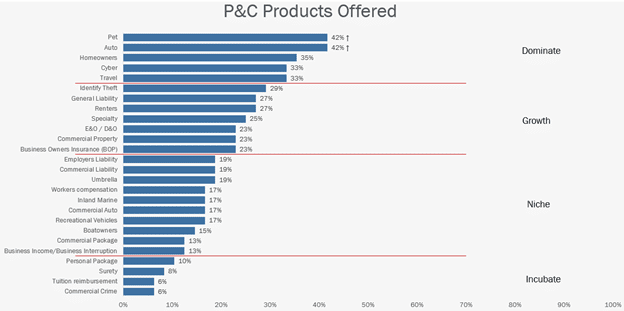

Earlier than we checked out channels in depth, we wished to know which merchandise have been being supplied by our survey group. P&C merchandise have been supplied by fewer respondents, so we aligned classes to signify use throughout the P&C phase (see Determine 2). The 4 classes we used to explain product adoption zones have been:

- Dominate

- Progress

- Area of interest

- Incubate

Dominate describes well-liked choices. Progress can be product areas of elevated curiosity. Area of interest and Incubate describe under-utilized merchandise which will signify “blue ocean” alternatives.

The 2 hottest merchandise, effectively throughout the Dominate phase, are Auto and Pet. They every have a 42% penetration.

Not surprisingly, lots of the P&C merchandise within the Dominate phase are particular person merchandise, whereas the Progress and Area of interest segments are dominated by industrial or specialised private merchandise comparable to umbrella, boatowners, and leisure autos.

Determine 2: P&C merchandise supplied by PIMA members surveyed

Overview of Channel use

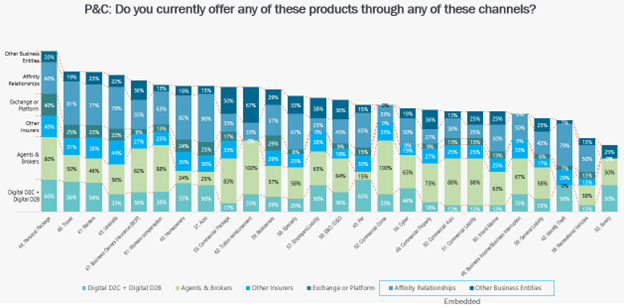

P&C and L&AH channel utilization comply with related patterns and ranging ranges of channel selection, with P&C at decrease ranges, however with a tighter vary of variations. For P&C, less complicated merchandise are supplied via extra channels, whereas extra advanced ones are supplied via a smaller number of channels.

Unsurprisingly throughout all merchandise, Affinity Relationships or Brokers & Brokers are essentially the most used channels, with the latter having a 16 to 9 edge within the highest use (see Determine 3). Digital ranges between second, third, and fourth with every product, by no means reaching the highest spot.

In contrast to the L&AH phase, which has operated in a multi-channel world for many years, the P&C phase stays closely dominated by the Agent & Dealer channel. The Digital channel’s progress has been dominated by giant, direct insurers. Marketplaces and exchanges have emerged as rising choices during the last 5 to seven years with choices like Daring Penquin, Bolttech, and others.

Brokers & Brokers and Affinity Relationships dominate a few of the extra specialised merchandise like cyber, specialty, industrial package deal, industrial auto, EO/DO, and others, reflecting the necessity to perceive and place these merchandise appropriately on the proper time.

In one other similarity to the L&AH channels, Private Package deal led all different merchandise within the number of channels used, although this product is within the Incubate zone, and solely supplied by 10% of corporations.

Determine 3: Channels used to distribute P&C merchandise

Whereas P&C has been on the forefront of digital transformation, outpacing L&AH during the last decade, they aren’t outpacing by way of channel breadth and use. This places P&C effectively behind L&AH in utilizing embedded choices…not a great factor given the excessive curiosity! Twelve of the 26 (46%) P&C merchandise had no reported embedded utilization.

Solely one of many remaining 14 merchandise, Journey, made it to the Desk Stakes phase of fifty%+ utilization (see Determine 4). Embedded journey insurance coverage has been round for a while, which is why it has gravitated to Invisible Embedded, and represents the most important utilization of invisible embedding for any product. Specialty and Tuition Reimbursement are within the Approaching Desk Stakes phase. Apparently, Tuition Reimbursement is just supplied by respondents via laborious embedding.

Determine 4: Embedded choices used with P&C merchandise

With just one product at Desk Stakes, this highlights a serious hole and alternative for P&C merchandise to achieve extra prospects via embedded insurance coverage.

Market Alternatives

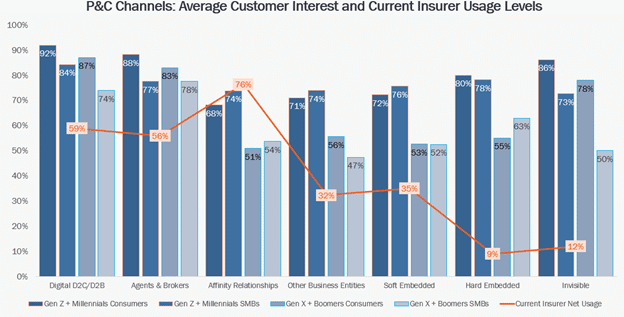

Apparently, the outcomes spotlight plentiful market alternatives for these keen to seize them. We start by Determine 5. The purple line represents present insurer utilization inside P&C channel varieties, comparable to Affinity Relationships, Digital, or Mushy Embedded channel choices, and Invisible Embedded channel choices. The Blue bars are precise buyer curiosity in these channels. The better the distinction, the better the chance for brand new use of these channels.

There are a wide selection of alternatives in P&C when evaluating channel utilization relative to shopper and SMB buyer curiosity. There may be already a powerful alignment between Gen Z & Millennials in Affinity Relationships. Particularly, essentially the most vital alternatives embrace Digital (33%+); Brokers & Brokers (32%); Different Enterprise Entities (42%); Mushy Embedded (41%); Onerous Embedded (71%); and Invisible Embedded (74%).

Closing the gaps within the Digital and Agent & Dealer channels might be achievable, shorter-term wins. The sizable gaps within the embedded choices sign vital market alternatives to achieve extra prospects, enhance income and develop market share for these keen to spend money on and experiment with partnerships and ecosystems.

With new InsurTech startups and revolutionary incumbents actively leveraging these channels, those that don’t are more and more liable to being left behind and unable to determine partnerships as a result of they may already be secured.

Determine 5: Buyer channel preferences for P&C merchandise in comparison with firm channel utilization

Journey insurance coverage: a sensible living proof

Since journey insurance coverage affords us a case of channel success, let’s think about for a second, that every one P&C insurance coverage varieties are “aiming for” the expertise of embedded journey insurance coverage. What can we study folks and insurance coverage from the methods journey insurance coverage is required and marketed?

Let’s contemplate Airbnb — I’m a giant fan of them and use them for our private journey. However this yr when reserving I observed one thing totally different … journey insurance coverage that I might purchase.

Earlier this yr Airbnb rolled out visitor journey insurance coverage within the US, UK, and eight EU international locations – totally different than their Aircover for friends program which is free. They labored on this initiative for two years which is a paid journey insurance coverage product that folks can purchase whereas finishing their Airbnb reserving. The providing is backed by main insurers like Generali and Aon to call a couple of. [i]

Journey corporations and their insurance coverage companions purpose for the purpose of want — whereas prospects are reserving journey.

So, insurers can start by searching for channels near “life and enterprise preparation” duties. The place do you go earlier than you rework a room? What do you want earlier than your wedding ceremony? Whether or not you’re shopping for birthday balloons or an workplace printer, you’re getting ready for some stage of life or enterprise. How can insurers broaden their attain to fulfill prospects at that time of life and enterprise?

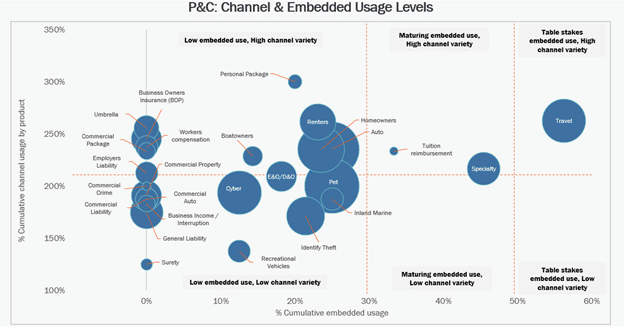

What choices do insurers have to shut the hole? Now we have recognized three market alternatives based mostly on channel and embedded utilization dimensions represented in Determine 6. The size inside this graphic signify product providing recognition (the scale of every circle), channel selection (the vertical axis), and use of embedded choices (the horizontal axis).

1. Transfer off Zero

Based mostly on survey respondents, Industrial Property, Industrial Crime, Industrial Auto, Industrial Legal responsibility, Enterprise Revenue/Interruption, Basic Legal responsibility, and Surety don’t have any situations of embedded choices (see Determine 6). They’ve low channel selection. 5 extra merchandise don’t have any embedded utilization however have excessive channel selection: Umbrella, BOP, Employees Comp, Industrial Package deal, and Employers Legal responsibility. Firms might develop and acquire share by leveraging extra of the channel spectrum, and particularly, the embedded choices throughout the spectrum.

2. Attain New Markets with Fashionable Merchandise by Leveraging the Channel Spectrum

Cyber, Pet, Id Theft, and E&O/D&O, within the decrease center of Determine 6, are supplied by a bigger variety of corporations however have very low ranges of channel selection and embedded use. Likewise, simply above them are Renters, Householders, and Auto that are additionally well-liked merchandise however with low embedded use and better channel selection. These well-liked merchandise are constrained by their few channels and restricted embedded use, limiting progress alternatives. Many of those merchandise are already being supplied by way of embedded choices by corporations via partnerships with different entities like Microsoft, Petco, Paypal, and others.

3. Preserve the Crowded Areas in View

Journey insurance coverage has all the time been a recreation of partnerships and placement, although it was historically supplied by journey brokers. We’d contemplate it a crowded house that’s nonetheless viable now that extra of the channel spectrum is obtainable. Insurers can nonetheless broaden product placement into way of life channels just like the office, affinity teams, uncharted platforms comparable to on-line gaming, and different metaverse places. There’s no finish to product/channel synergy once we contemplate the total spectrum.

Even Journey insurance coverage has room to develop. Solely 33% of corporations are providing this product and there are many alternatives to embed Journey past the normal channels. Publish-COVID journey is on the rise with no indicators of slowing down.

Determine 6: Market alternatives for P&C merchandise based mostly on product recognition, channel selection, and embedded utilization

Ultimate Thought: Use Predictive Analytics to Predict Efficient Channels

In the event you’ve visited the dentist on three consecutive Mondays for some dental work, Siri or Alexa is prone to communicate up this morning. “Are you headed to the dentist? I-75 has mild visitors. Do you need to hear the climate?” Expertise is enabling a broader understanding of our habits.

Take into consideration if insurers used this know-how. “You’ve visited three totally different RV sellers. Would you want us to run some numbers on a brand new motorhome coverage?” The faster that insurers determine the best way to anticipate wants and create product/channel synergy, the extra possible they’re to realize industry-leading aggressive progress.

Insurers have been within the prediction enterprise effectively earlier than an iPhone might learn your e-mail. Predictive knowledge has been used for many years in channels as outdated as mail-order. Insurers simply want to recollect who they’re — risk-mitigators, utilizing all the things at their disposal to collect these in danger into a bunch they’ll shield. At the moment’s knowledge and analytics will help insurers compete by inserting them in the appropriate place, on the proper time, hundreds or thousands and thousands of instances every day. Insurance coverage is about timing. Are your merchandise prepared to fulfill your prospects’ wants proper after they want you?

For a more in-depth take a look at the channel spectrum and the probabilities to be present in embedded merchandise, make sure you learn Majesco and PIMA’s joint report, Increasing Channels for Insurance coverage: A Spectrum from Conventional to Affinity and Embedded.

[i] Airbnb Journey Insurance coverage for Visitors: Price, particulars, limitations, variations with Aircover | Rental Scale-Up (rentalscaleup.com)