My final article on In search of Alpha urged that worth, worldwide, small caps, and rising markets would outperform over the approaching years. David Snowball wrote “The Investor’s Information to 2023: Three Alternatives to Transfer Towards” final month alongside the identical traces and affords his perception into these asset lessons together with some wonderful funds. I comply with the Bucket Strategy, the place some Buckets have similarities to Dr. Snowball’s “Terrified Investor,” “Exhausted Investor,” or “Enterprising Investor.” A Reader on In search of Alpha requested my opinion about American Century Avantis All Fairness Markets ETF (AVGE) as a one-stop fund for these classes. This text represents my opinion of AVGE.

American Century Avantis All Fairness Markets ETF (AVGE) is an actively managed exchange-traded fund within the World Multi-Cap Core Lipper Class constructed of ten Avantis fairness ETFs. AVGE is exclusive in that for those who use the MFO Multi-Search Display for the World Multi-Cap Core Class with 20 or fewer holdings and over $50 million in property, AVGE is the one fund. American Century now has eighteen Avantis ETFs, many with three years of historical past, so we will take a deeper dive.

With bonds now incomes aggressive yields, I’ve tailored my technique to match withdrawal wants with particular person CDs and bonds. The consequence is that I must shift from multi-asset funds in the direction of fairness funds as a way to enhance allocations to equities. On this article, I discover how AVGE works and performs. Whereas I don’t view AVGE as a one-stop fairness fund, it satisfies my need to be the “Enterprising Investor” positioning some Buckets for “energetic, long-term” development.

This text is split into the next sections:

Part 1, What or Who’s Avantis?

Part 2, Avantis All Fairness Markets ETF (AVGE)

Part 3, Comparability to World Multi-Cap Funds

What or Who’s Avantis?

Professor Snowball coated the launch of Avantis and one of many Avantis funds in Launch Alert: Avantis Worldwide Small Cap Worth (AVDV) in 2019. In line with American Century in “Unthink ETFs, Rethink Prospects,” the corporate was fashioned in 1958 by James E. Stowers Jr. and manages greater than $200B in property. At present, over 40% of its annual income go to funding the Stowers Institute for Medical Analysis.

Utilizing the MFO Premium fund screener, American Century has 140 funds with $164B in property below administration. They’ve three funds which might be greater than fifty years outdated. The MFO Household Ranking for the previous three years is a good “Higher.” American Century has thirty-five ETFs with $19B in Belongings below administration.

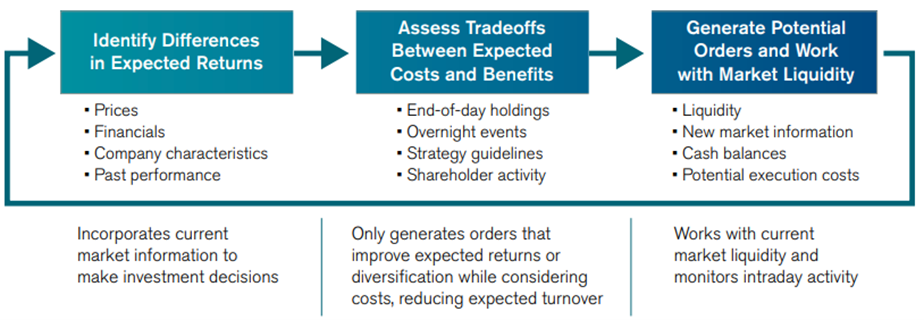

American Century Investments fashioned Avantis in 2018, and it manages eighteen ETFs with $17B in property and 9 mutual funds with $1.5B in property. Eduardo Repetto (PhD) is the Chief Funding Officer at Avantis Buyers. He was previously the Co-Chief Govt Officer and Co-Chief Funding Officer at Dimensional Fund Advisers, a personal funding agency well-known for its energetic administration strategy. The Avantis web site is situated right here. “Our Scientific Strategy To Investing” by Avantis in April 2021 describes their strategy primarily based on valuation and profitability with a watchful eye on diversification, turnover, and prices, summarized as proven in Chart #1.

Chart #1: Avantis Course of

Supply: “Our Scientific Strategy To Investing,” Avantis Buyers, April 2021

Of the ten Avantis Funds which might be three years outdated and older, the classes embody worldwide, small-cap, and rising markets. Of those ten funds, six obtain the MFO classification of “Nice Owl” for high-risk adjusted efficiency, and 7 had an MFO ranking of above common or higher (4 or 5). Eight of the ten funds had an MFO Danger Ranking of 4 (much like the S&P 500), and two had a ranking of 5 for increased threat. Six had a Lipper Preservation ranking of common or higher (3 to five). In different phrases, these funds carry a lot of the chance of their respective Lipper Classes however are higher performers on a risk-adjusted foundation.

Avantis All Fairness Markets ETF (AVGE)

Morningstar charges the AVGE course of as above common and provides All Fairness Markets ETF (AVGE) a “Bronze Analyst Ranking” primarily based largely on the method:

The managers will strategically allocate to the underlying funds throughout geographies and funding kinds to attain the specified allocation. The underlying funds characterize a broadly diversified basket of fairness securities that search to chubby securities which might be anticipated to have increased returns or higher threat traits than a passive and market-cap-weighted index.

The principle drawback of the Avantis All Fairness Markets ETF (AVGE) is its inception date of September 2022. Nonetheless, buyers have proven a perception within the fund by investing over $100M on this brief time interval. The Avantis All Fairness Markets ETF (AVGE) is managed by Dr. Eduardo Repetto (CIO), Mitchell Firestein (Senior Portfolio Supervisor), Daniel Ong (CFA, Senior Portfolio Supervisor), Theodore Randall (Senior Portfolio Supervisor), and Matthew Dubin (Affiliate Portfolio Supervisor), collectively with eighteen years common expertise. AVGE is main a development that I feel will proceed as an actively managed fairness “fund of funds.” AVGE has a big value benefit over World Multi-Cap Funds with an expense ratio of 0.23 in comparison with a median of 86 funds with an expense ratio of about 0.75.

From the Prospectus, a abstract of the Principal Funding Methods is:

Avantis All Fairness Markets ETF is a “fund of funds,” which means that it seeks to attain its goal by investing in different Avantis exchange-traded funds (ETFs) (collectively, the underlying funds). The underlying funds characterize a broadly diversified basket of fairness securities that search to chubby securities which might be anticipated to have increased returns or higher threat traits than a passive, market-cap weighted index…

To determine these securities with increased anticipated returns, the underlying funds typically place enhanced emphasis on securities of corporations with smaller market capitalizations and securities of corporations with increased profitability and worth traits…

Below regular market circumstances, the fund will make investments at the very least 80% of its property in fairness ETFs. The managers will strategically allocate to the underlying funds throughout geographies and funding kinds to attain the specified allocation…

Within the occasion of remarkable market or financial circumstances, the fund might take short-term defensive positions which might be inconsistent with the fund’s principal funding methods…

Desk #1 exhibits the fund’s goal weight and vary for allocation among the many fund’s main asset lessons and exhibits the underlying funds.

Desk #1: Goal Weights and Ranges

| Goal Weight | Goal Vary | |

| U.S. Fairness | 70% | 63% to 77% |

| Avantis U.S. Fairness ETF | ||

| Avantis U.S. Small Cap Fairness ETF | ||

| Avantis U.S. Massive Cap Worth ETF | ||

| Avantis U.S. Small Cap Worth ETF | ||

| Non-U.S. Developed Markets | 17% | 10% to 24% |

| Avantis Worldwide Fairness ETF | ||

| Avantis Worldwide Massive Cap Worth ETF | ||

| Avantis Worldwide Small Cap Worth ETF | ||

| Rising Markets | 10% | 3% to 17% |

| Avantis Rising Markets Fairness ETF | ||

| Avantis Rising Markets Worth ETF | ||

| Sector Fairness | 3% | 1% to six% |

| Avantis Actual Property ETF |

Supply: Prospectus, Avantis Buyers, January 2023)

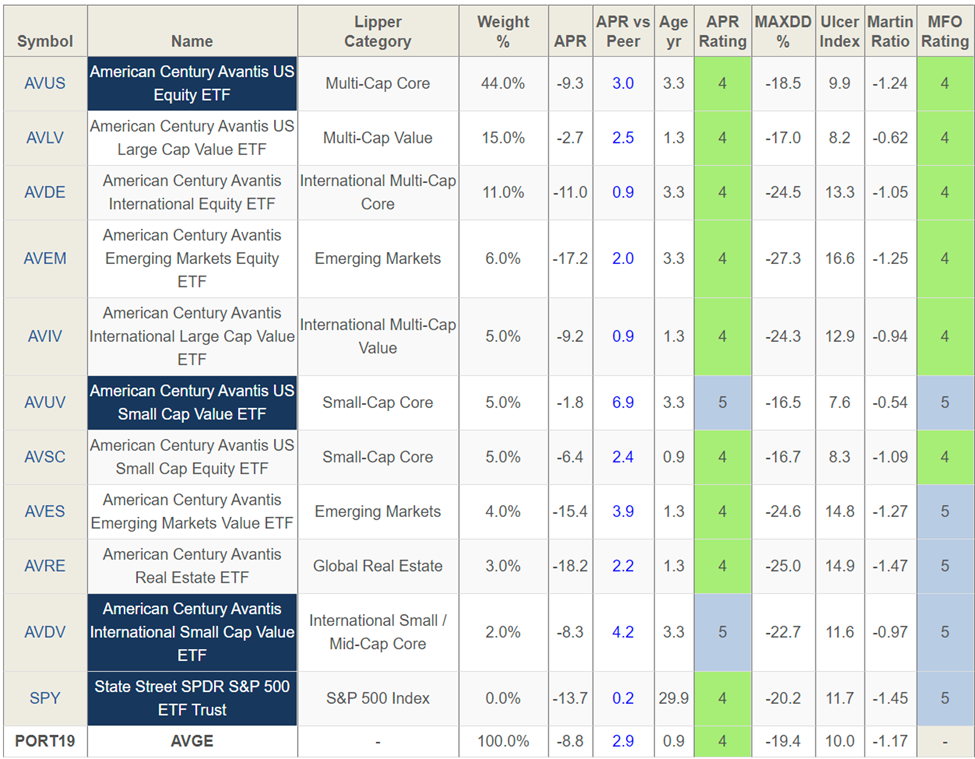

To partially overcome the brief historical past of AVGE, I loaded the AVGE portfolio into the MFO premium portfolio software. The outcomes are proven in Desk #2. The age of the youngest fund is roughly ten months outdated. Throughout this ten-month interval, all Avantis funds carried out above common on a risk-adjusted return foundation. I included SPY with no allocation for comparability functions. The annualized return of AVGE, had the fund existed for the previous ten months with the identical allocation, would have been practically -9% on a month-to-month foundation in comparison with practically -14% for the S&P 500. The drawdown and Ulcer Index are barely decrease than the S&P 500.

Desk #2: MFO Portfolio Device

A second doable disadvantage of AVGE is whether or not the allocation is suitable for buyers. Rob Berger, within the Monetary Freedom Present, describes the usage of Avantis All Fairness Markets ETF (AVGE) as a one-stop fairness fund. Mr. Berger describes each Avantis and AVGE. Mr. Berger’s conclusion is that he likes AVGE. Nonetheless, he wouldn’t use it for all of an investor’s allocation to fairness as a result of it’s so new.

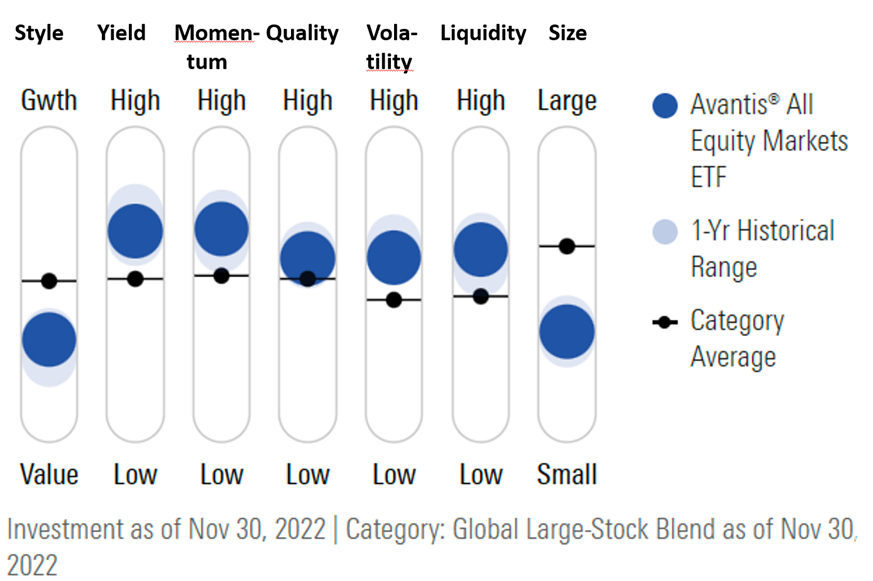

I used Morningstar to view their issue scores AVGE proven in Chart #2.

Chart #2: Morningstar Issue Rankings

For regional allocation, AVGE at the moment has 73% allotted to North America and about 29% allotted to Worldwide International locations. Roughly 8 to 10% is allotted to various Growing Economies, with the bulk allotted to Asia Rising Markets. AVGE has a sector allocation according to the S&P 500 however with a tilt towards Primary Supplies, Monetary Providers, Vitality, and Industrials, and away from Expertise, Client Protection, Healthcare, and Utilities.

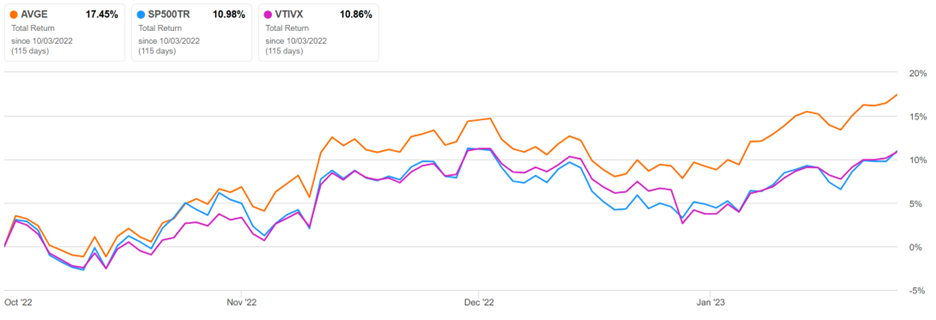

In some regards, a distant cousin to Avantis All Fairness Markets ETF (AVGE) is mutual fund goal retirement funds with a date older than 2045. These funds have a tendency to speculate utilizing a passive, international multi-cap strategy however embody about 15% in bonds and get extra conservative over time. Chart #3 exhibits the Whole Return efficiency of AVGE in comparison with the S&P 500 and the Vanguard Goal Retirement 2024 mutual fund. AVGE (orange line) carried out effectively over the four-month interval.

Chart #3: All Fairness Markets (AVGE) Whole Return vs Vanguard Goal Retirement 2045 (VTIVX)

Comparability to World Multi-Cap Funds

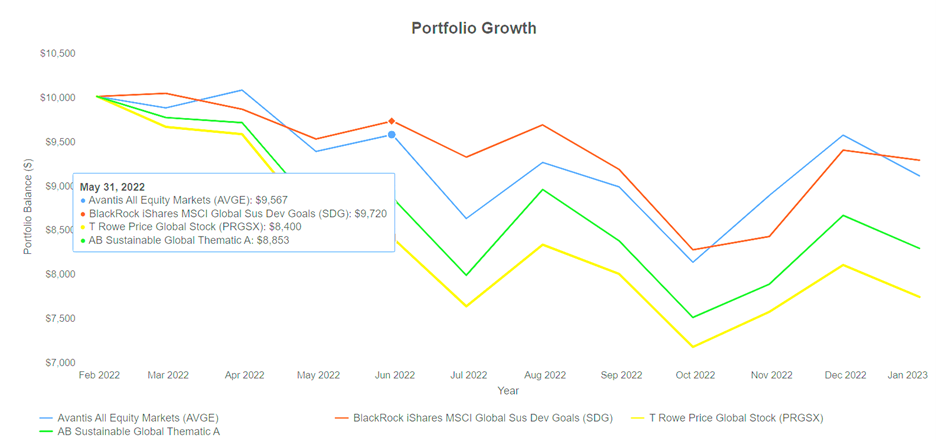

I used Portfolio Visualizer Backtest to match the present allocation in AVGE to different high quality World Multi-Cap funds obtainable to particular person buyers. There are few friends on this Lipper Class which might be obtainable to particular person buyers. This can be a conceptual train as a result of AVGE was not in existence for the total yr. The AVGE portfolio would have finished effectively.

Chart #4: Portfolio Visualizer of Present AVGE Allocation vs. Friends

Closing Ideas

One ought to all the time contemplate threat first when making investments. I quote Ataman Ozyildirim (PhD), Senior Director, Economics, at The Convention Board, a corporation with a protracted and respectable observe report:

“There was widespread weak spot amongst main indicators in December, indicating deteriorating circumstances for labor markets, manufacturing, housing building, and monetary markets within the months forward. In the meantime, the coincident financial index (CEI) has not weakened in the identical trend because the LEI as a result of labor market associated indicators (employment and private revenue) stay sturdy. Nonetheless, industrial manufacturing— additionally a element of the CEI—fell for the third straight month. General financial exercise is more likely to flip detrimental within the coming quarters earlier than choosing up once more within the remaining quarter of 2023.”

Supply: The Convention Board, January 23, 2023

I favor Avantis All Fairness Markets ETF (AVGE) for my Buckets which have intermediate Treasuries to satisfy withdrawal wants and wish fairness for long run development. AVGE invests in classes that I imagine have development potential over the following a number of years and has the pliability to regulate. The brief historical past of AVGE doesn’t concern me due to the energy and efficiency of American Century and the sturdy Avantis administration workforce with prior expertise on this methodology.

I’ll watch the yield curve and different financial and monetary indicators to point out indicators that financial threat is beginning to lower earlier than shopping for a big quantity of AVGE. I don’t see AVGE as a one-stop fund as a result of I like diversification, however I do see it being a significant holding in a few of my Buckets over the course of the following few years.

My undertaking this weekend is to re-organize the storage. It’s a daunting however rewarding activity after our transfer to Colorado.

Finest needs.