On this version of the reader story, 30-year-old Mr Yo (identify withheld on request) explains intimately how he has systematically structured his cash administration and the way he tracks his monetary targets. This can be a follow-up to his earlier audit: How I observe monetary targets with out worrying about returns.

About this collection: I’m grateful to readers for sharing intimate particulars about their monetary lives for the advantage of readers. A few of the earlier editions are linked on the backside of this text. You can too entry the total reader story archive.

Opinions revealed in reader tales needn’t characterize the views of freefincal or its editors. We should recognize a number of options to the cash administration puzzle and empathise with various views. Articles are usually not checked for grammar except essential to convey the best which means to protect the tone and feelings of the writers.

If you need to contribute to the DIY group on this method, ship your audits to freefincal AT Gmail dot com. They are often revealed anonymously in the event you so need.

Please observe: We welcome such articles from younger earners who’ve simply began investing. See, for instance, this piece by a 29-year-old: How I observe monetary targets with out worrying about returns. Now we have additionally began a brand new “mutual fund success tales” collection. That is the primary version: How mutual funds helped me attain monetary independence. Now over to Mr Yo.

Thanks for permitting me to jot down an article in your weblog once more and for serving to me study so many issues. My main motivation to jot down that is to drive myself to doc my thought course of right now and revisit (and hopefully write) yearly (at the least as soon as like this one) to see the evolution.

About me: I’m an engineer who handed out in 2013. I belonged to a decrease middle-class household. My curiosity in excel helped me to discover and revel in spending time studying/watching/attempting issues. Presently, I’m working with Chandan Singh Padiyar as my Charge-Solely-advisor. I obtained married in November 2019 and have a daughter of 18 months now. I’ve a automobile mortgage from an organization automobile lease plan. I’ve 4 dependents and a 20k minimal dedication to charity.

Fundamentals:

- Time period Insurance coverage: 42x of present annual expense purchased in December 2018 + workplace time period insurance coverage of 20x.

- Medical Insurance coverage: workplace supplied 3l ( for me, my spouse, daughter and my mother and father), private insurance coverage of 10l + 40l (for me, spouse and daughter)

- Contingency fund: 7 occasions month-to-month in-hand wage or ten months of month-to-month expense + 3l of medical money cowl

- Private Unintentional Cowl: 24x of present annual expense purchased in April 2022 + workplace unintended insurance coverage of 20x

Targets:

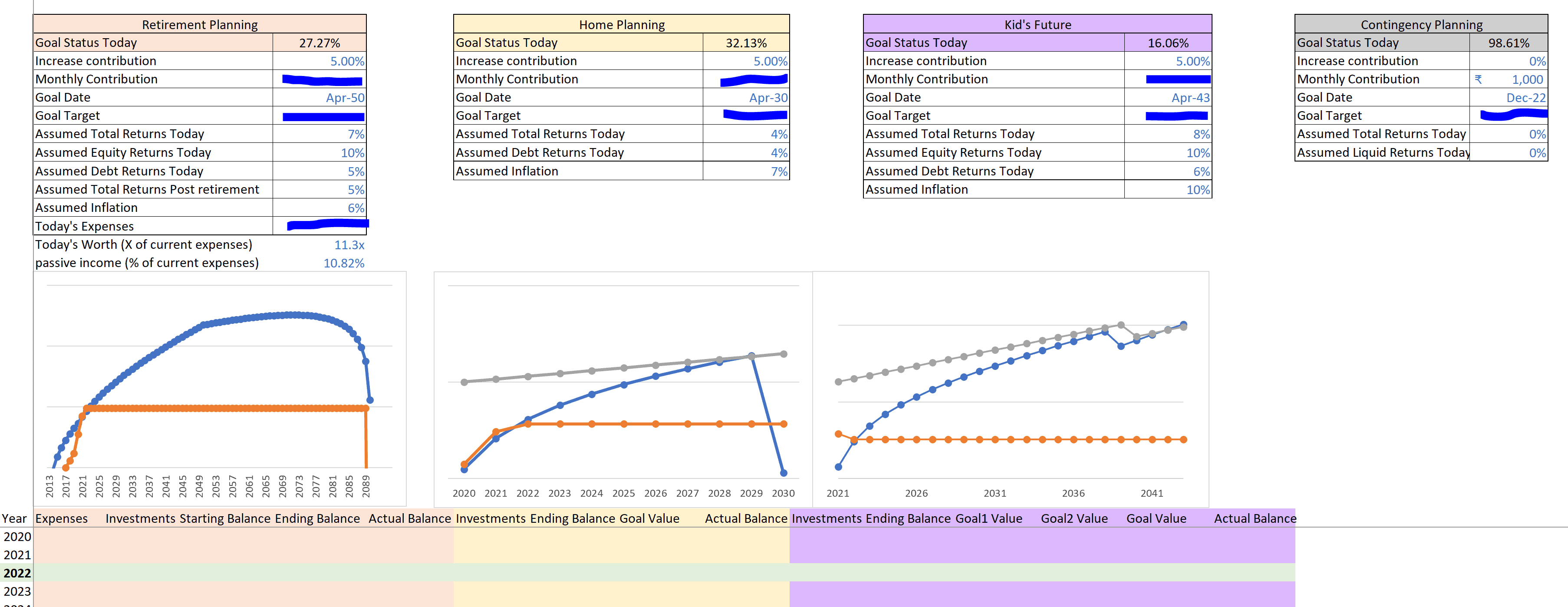

All of the targets are color coded for ease of tracing. They’re listed beneath:

- Orange shades: Retirement

- Yellow shades: Residence

- Purple shades: Child’s future

- Gray shades: Contingency

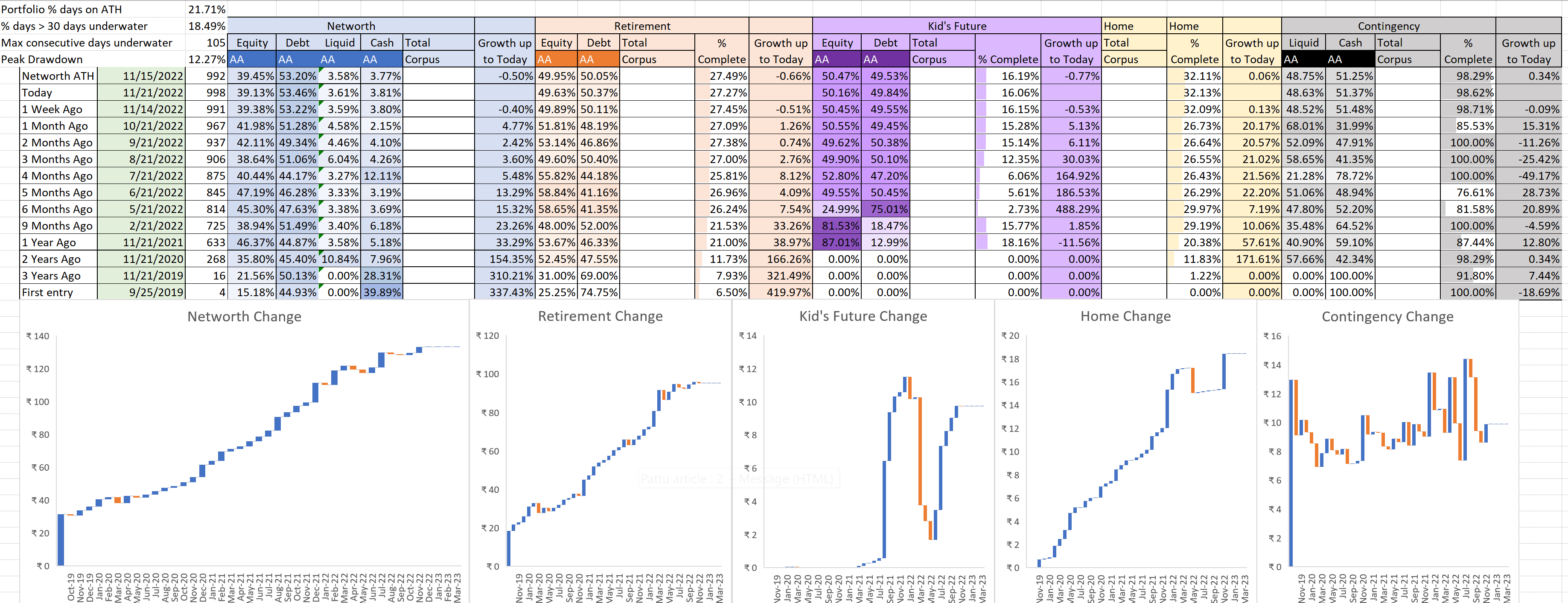

Assumptions, an outline of plans and the standing of all targets are as beneath. All of the graphs proven are plotted with the y-axis in log scale to understand the actual fee of development. The decrease coated half exhibits the annual standing of all targets as of 1st Jan of that yr.

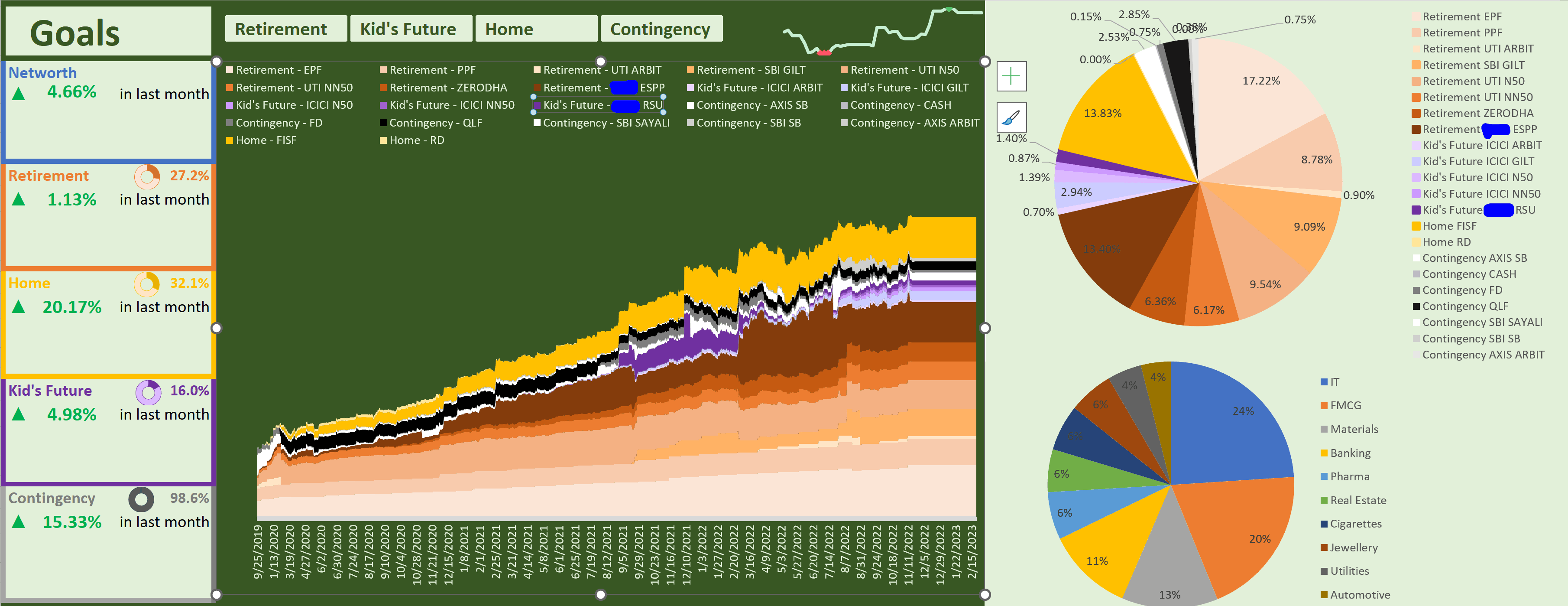

The distribution of the targets throughout totally different accounts and statuses is as proven beneath. The left facet exhibits all of the targets, their present completion standing, motion within the final month and their values (hidden). The central half exhibits the distribution throughout the property in whole networth with selectable filters from the highest centre. Subsequent to it’s networth motion within the final 50 days. The fitting facet exhibits the asset allocation of at this time throughout accounts.

All mutual fund holdings are in direct plan development possibility. Fairness mutual funds are solely of index funds (UTI and ICICI) with a goal 60-40 allocation between high 50 and subsequent 50. In debt house, for very long run targets 10 yr fixed maturity gilt funds (ICICI + SBI) are used. For medium time period cash market fund (franklin) and for brief time period liquid fund (quantum) and arbitrage funds (UTI + ICICI+AXIS) are used.

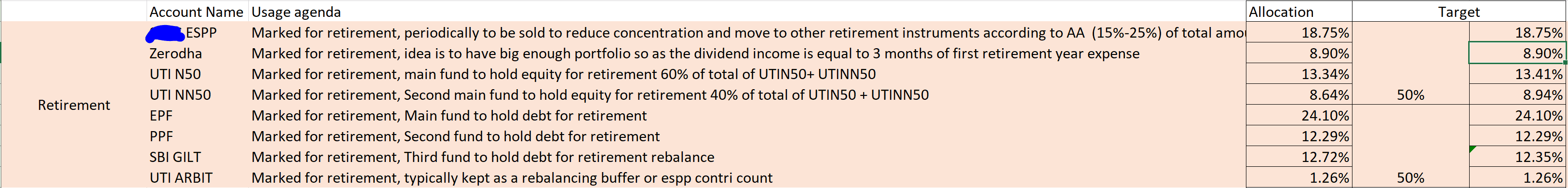

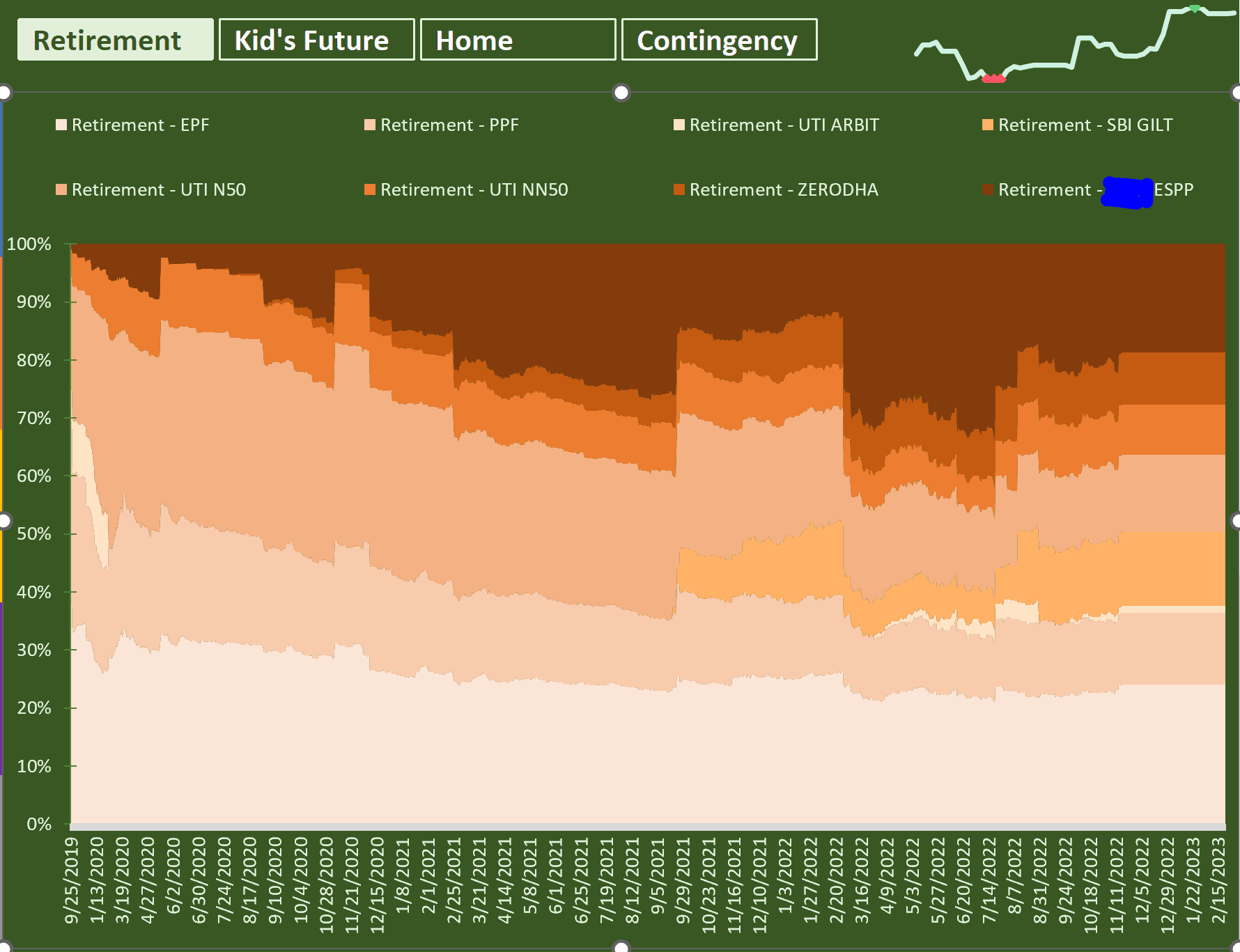

Retirement: Intend to retire not earlier than 55 (that if the corporate retains me). I can grow to be Financially Free presumably a lot sooner, although I’m not concentrating on and attempting for it. Previous few years fast development in firm has helped me transfer quick on this purpose. Present corpus is equal to roughly 11.3x of present annual bills. Evolution of funding philosophy and plan of funding is as proven beneath.

My asset allocation is bit tough resulting from massive allotment in the direction of firm ESPP (worker inventory buy plan) and RSU (restricted inventory items) allocation and huge reductions/quick motion of inventory. I solely make investments month-to-month for this purpose by way of ESPP contribution and EPF (worker provident fund) contribution (each auto deducted from wage pre credit score to account). Relaxation accounts are up to date each 6 months (or when very skewed) to the goal allocation (or close by it) by both promoting of firm shares or contemporary capital infusion. I do some investments in direct fairness as a interest and anticipate 0% returns (not together with any particulars as it’s about 1 yr outdated portfolio). Though it has grown it’s allocation considerably in final 1 yr I intend to cap it to most 10%.

The evolution of asset distribution with time is as follows:

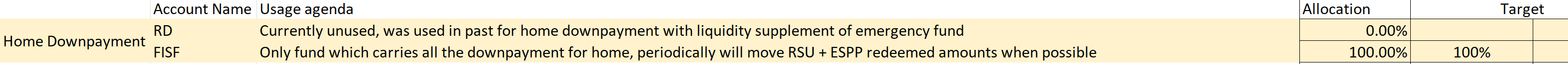

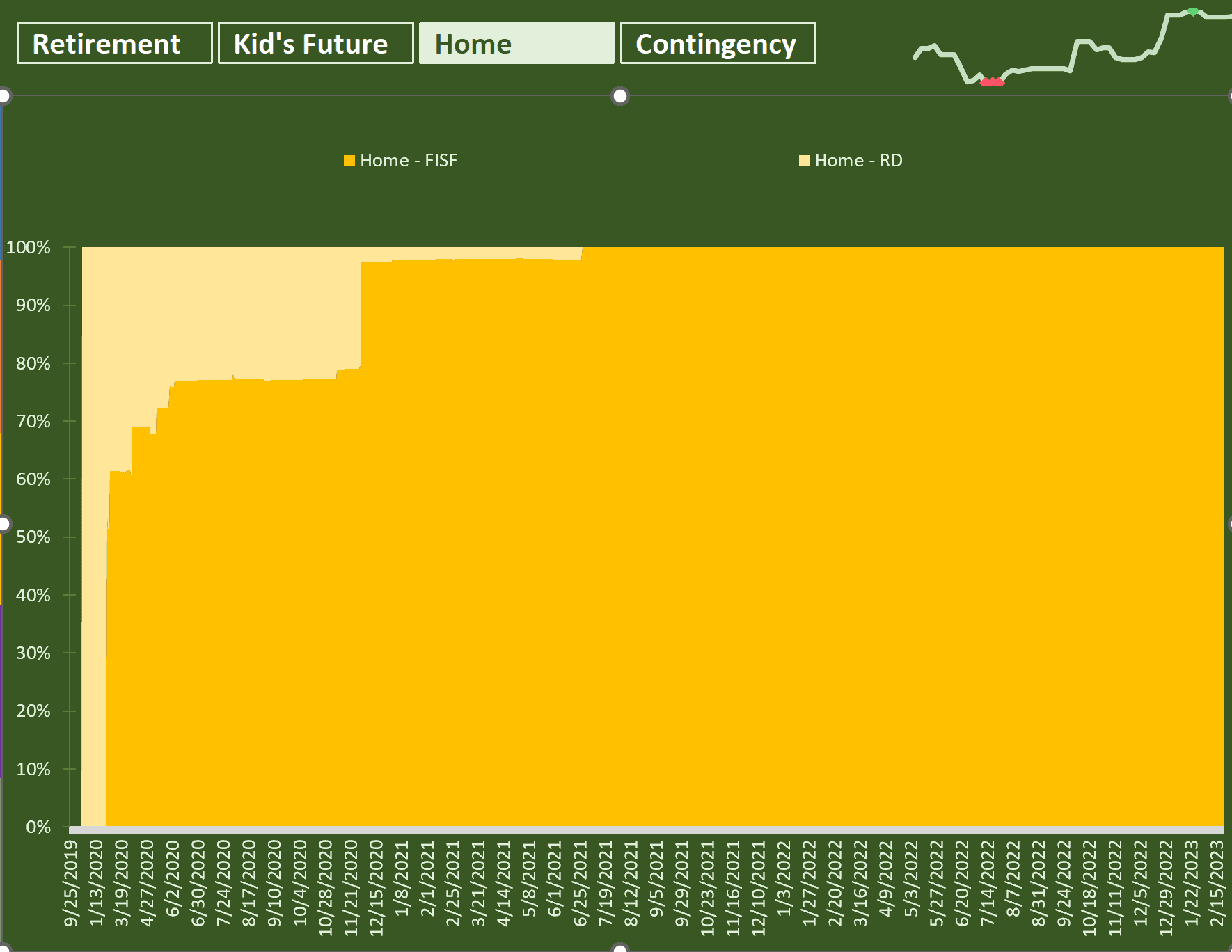

Residence: Intend to have roughly 50% of the house’s buy worth collected earlier than I’d go to purchase. This can be a tentative plan and has been revised couple of occasions. Hopefully I can have all the cash for dwelling prepared after which get dwelling to pre-close it anytime I want to. Final yr I couldn’t make investments aggressively for this purpose and hopefully would be capable to subsequent yr. Bills for my daughter’s everyday dwelling and new automobile elevated and I used to be not ready allot adequate precedence to this purpose then. Philosophy and plan of funding is as proven beneath.

As it’s a quick time period purpose complete quantity is saved in debt fund (100% debt) with periodic inflows from promoting of firm fairness at opportune moments. In early days this purpose was sharing quantity with emergency fund. However now it has been break up as soon as the emergency fund was sufficiently huge.

The evolution of asset distribution with time is as follows.

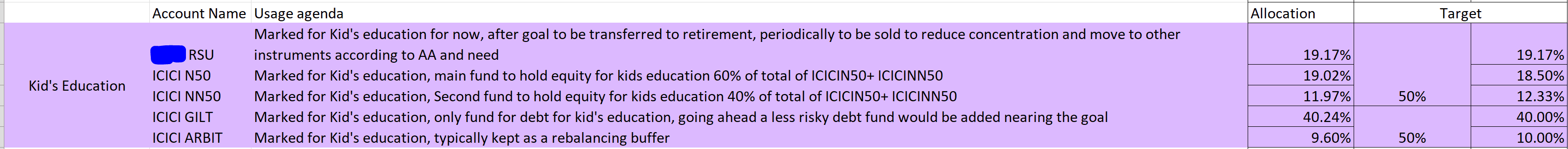

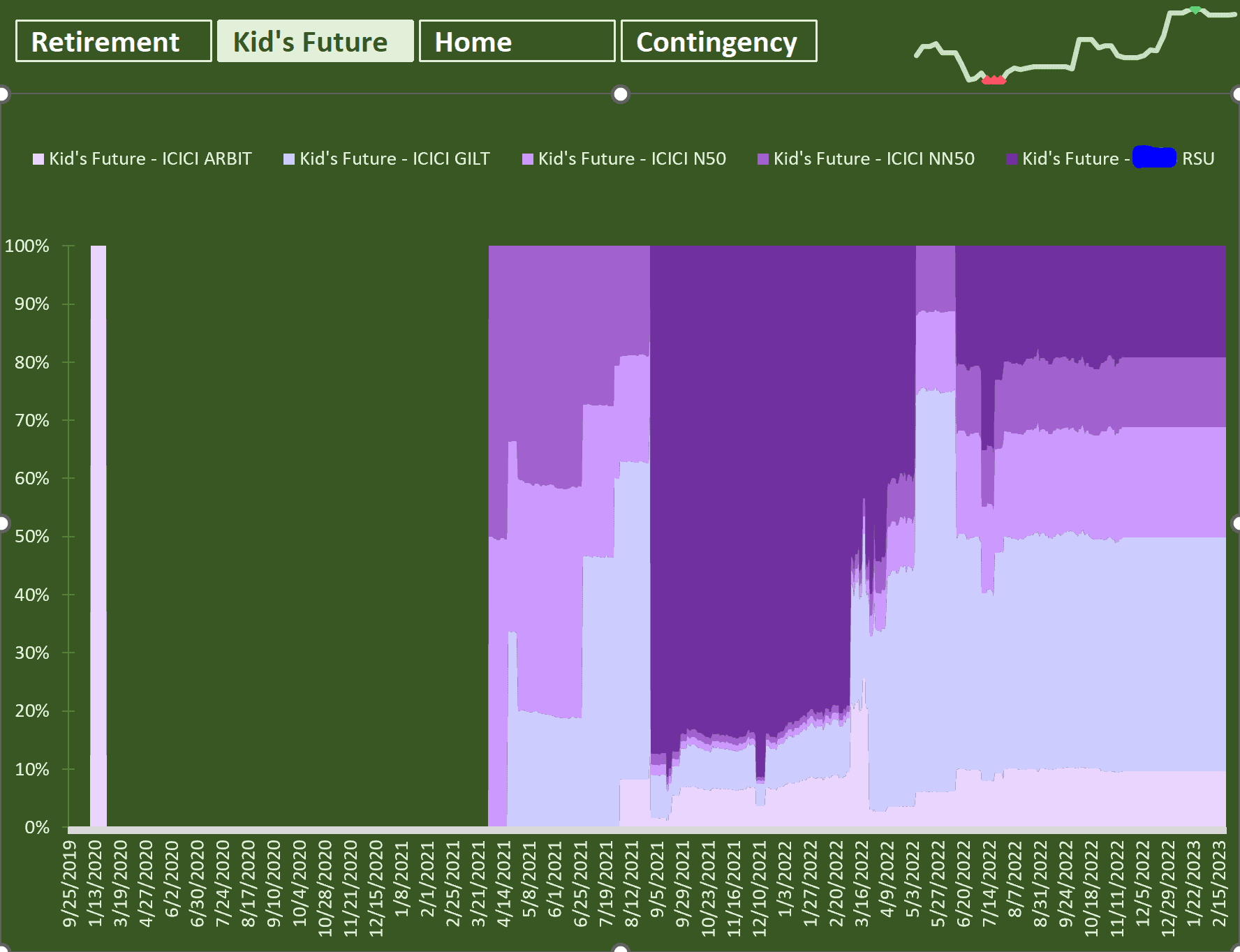

Child’s Future: Intend to have roughly single purpose for all undergraduation bills, marriage expense and if adequate then publish graduate bills. I’ve not but been capable of resolve if I need to plan for all of the schooling or let her study with schooling mortgage. I’ve modified the technique to allocate all firm RSU’s (restricted inventory items) for this purpose and solely hold small quantity of holdings for firm shares for this hold aligned with asset allocation goal. Relaxation are saved tagged for retirement. Philosophy and plan of funding is as proven beneath.

Asset allocation for this purpose was very skewed final time and I’ve now saved it close to the targets at value of retaining solely required quantity of firm shares tagged to this purpose and relaxation to retirement. As I reshuffled the holding of this purpose the quantity I had marked for this purpose final yr was greater than I’ve now.

The evolution of asset distribution with time is as follows.

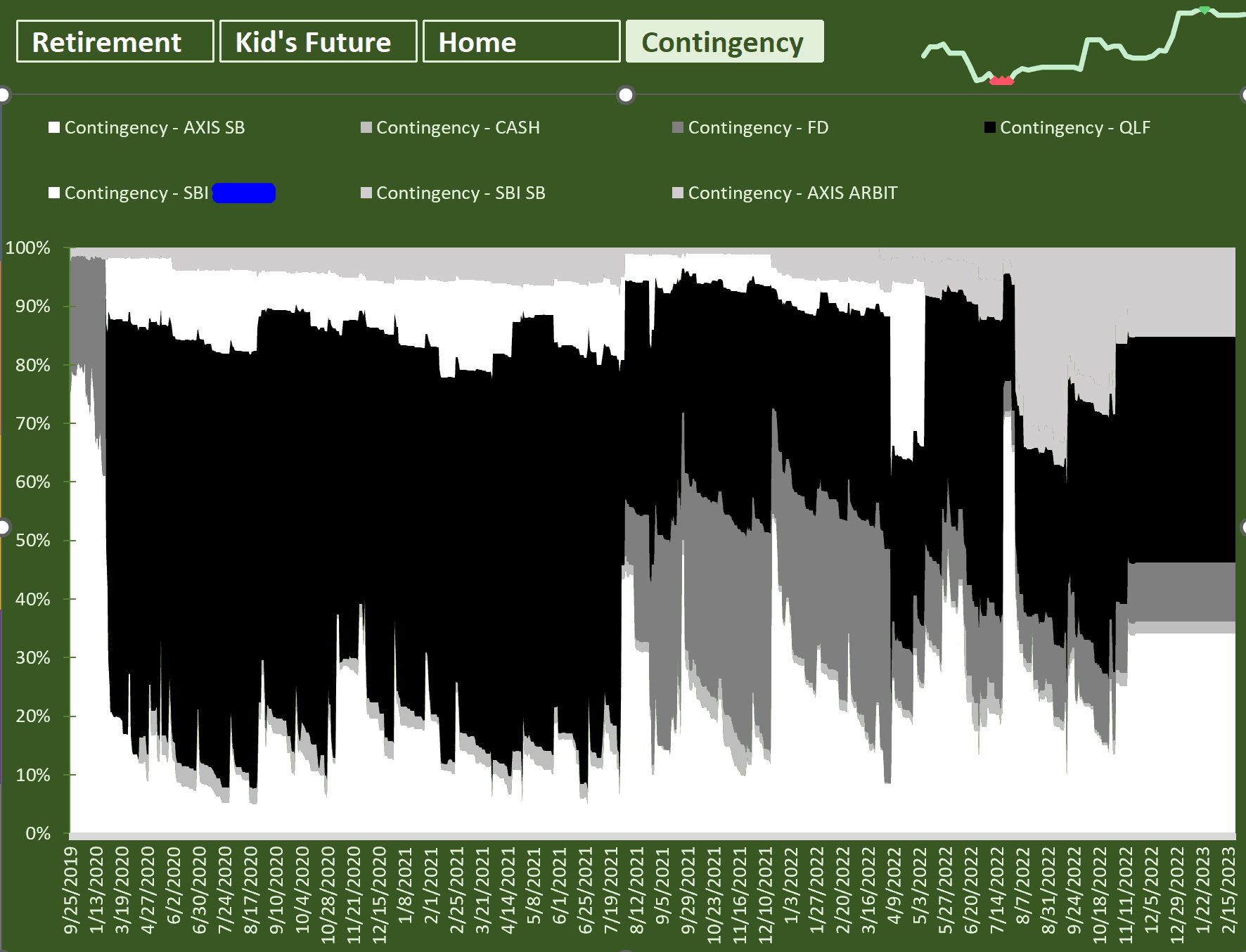

Contingency fund: Described largely about this purpose in fundamentals. Subsequent plan is to have type of sinking fund/very quick time period purpose fund (holidays)/fairness alternative fund/gadget substitute fund allotted inside this class. I used to be recommended a pleasant identify to it as revenue stabilization fund. The concept for this fund comes from the necessity to handle my messy/variable wage construction. Many months resulting from totally different occasions my wage varies from adverse to considerably optimistic to regular salaries. Months with much less wage are tough to handle because the bills roughly stay fixed. Plan of motion going ahead is to promote firm shares at “opportune second” or in “second of want” and reserve it in axis arbitrage fund. The quantity could be one thing like say 6 months wage. As soon as the quantity goes beneath 3 months, I look out for the time to promote firm shares (opportune second). If I can’t promote it even when the fund goes beneath 1 month bills, I promote the shares regardless of worth (second of want). This nonetheless wants some working and planning to be executed. At this level I’ve some quantity in arbitrage fund however is insufficient w.r.t. plan of 6 months.

The evolution of asset distribution with time is as follows.

Thoda Gyaan:

I consider there’s nothing which can provide development higher than wage. I’ve by no means switched my firm in all these 9 years+. I consider actual worth can solely be extracted from group in addition to particular person solely after sufficiently very long time (additionally I’m lazy). I attempt to comply with identical coverage even for my holdings and never intend to alter them a lot. I personally don’t observe neither XIRR or CAGR and even funding quantity. I solely have a look at the motion of the portfolio month on month and even yr on yr. So long as portfolio is rising at regular tempo it doesn’t matter whether it is rising due to extra investments or positive aspects. The way in which I audit my targets at portfolio degree with asset allocation and general progress is by trying on the plan of targets graph y-o-y (first one within the targets part) and the expansion of portfolio graph m-o-m beneath.

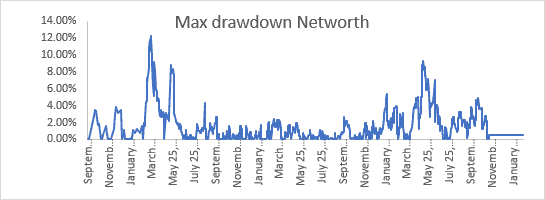

Being conservative particular person I desire to trace portfolio degree volatility or the danger by gauging 3 4 elements on high left i.e. % days on all-time excessive (ATH), % days when portfolio is beneath underwater greater than 30 days, most consecutive days portfolio has been underwater and peak drawdown. Shade shades that are equal to headers means the asset allocation is in line. Lighter shades means much less dangerous and darker shades means extra danger. Y axis within the graphs beneath is calibrated to worth 100 as of final years’ networth and different numbers are proportionately modified. First entry is the beginning worth of the all of the targets earlier than I began monitoring utilizing this tracker (25th September 2019).

Few Occasions of Final yr:

- I moved majority of my firm share holdings from child’s future purpose to retirement which exhibits as an enormous fall within the purpose.

- The networth grew roughly 33% over final yr even with the type of uneven markets.

- Portfolio was underwater for greater than 100 days, which was tough 😊

- I couldn’t promote my inventory holdings in :second of want” in addition to “opportune second” throughout underwater time which meant I bought my dwelling purpose debt fund holding ☹

- General contingency fund motion was large and this yr pressured me to suppose (Thanks Ashal Jauhari Sir) about revenue stabilization fund I discussed above.

- Vital understanding of my portfolio over final yr was not like the perfect approach of investing in accordance with asset allocation, I make investments most issues with out my management over it. This implies solely method to keep on with desired allocation is promote and distribute at an outlined frequency or threshold (and taxes are unavoidable).

- I might do most of the deliberate issues from final yr within the part beneath.

Remaining plans for upcoming yr are:

- Get medical health insurance

- Get unintended insurance coverage

- Rebalance child’s future purpose mid-December

- Rebalance Retirement purpose mid-March (together with annual overview with Chandan)

- Enhance contingency fund -> create revenue stabilization fund inside this purpose

- Enhance fractal inventory allocation technique -> I’m glad with my present method

- Create laborious copy of knowledge (handbook) for my household to entry every thing in

- case of my non-availability

- Have joint checking account

- Add nominations to all accounts

- Have a pattern will

Reader tales revealed earlier

As common readers might know, we publish a private monetary audit every December – that is the 2021 version: Portfolio Audit 2021: How my goal-based investments fared this yr. We requested common readers to share how they overview their investments and observe monetary targets.

These revealed audits have had a compounding impact on readers. If you need to contribute to the DIY group on this method, ship your audits to freefincal AT Gmail. They may very well be revealed anonymously in the event you so need.

Do share this text with your mates utilizing the buttons beneath.

🔥Get pleasure from huge year-end reductions on our programs and robo-advisory device! 🔥

Use our Robo-advisory Excel Instrument for a start-to-finish monetary plan! ⇐ Greater than 1000 buyers and advisors use this!

- Observe us on Google Information.

- Do you’ve gotten a remark concerning the above article? Attain out to us on Twitter: @freefincal or @pattufreefincal

- Be part of our YouTube Neighborhood and discover greater than 1000 movies!

- Have a query? Subscribe to our publication with this way.

- Hit ‘reply’ to any electronic mail from us! We don’t provide customized funding recommendation. We will write an in depth article with out mentioning your identify you probably have a generic query.

Discover the positioning! Search amongst our 2000+ articles for info and perception!

About The Creator

Dr M. Pattabiraman(PhD) is the founder, managing editor and first creator of freefincal. He’s an affiliate professor on the Indian Institute of Expertise, Madras. He has over 9 years of expertise publishing information evaluation, analysis and monetary product improvement. Join with him through Twitter or Linkedin or YouTube. Pattabiraman has co-authored three print books: (1) You might be wealthy too with goal-based investing (CNBC TV18) for DIY buyers. (2) Gamechanger for younger earners. (3) Chinchu Will get a Superpower! for youths. He has additionally written seven different free e-books on varied cash administration matters. He’s a patron and co-founder of “Charge-only India,” an organisation for selling unbiased, commission-free funding recommendation.

Dr M. Pattabiraman(PhD) is the founder, managing editor and first creator of freefincal. He’s an affiliate professor on the Indian Institute of Expertise, Madras. He has over 9 years of expertise publishing information evaluation, analysis and monetary product improvement. Join with him through Twitter or Linkedin or YouTube. Pattabiraman has co-authored three print books: (1) You might be wealthy too with goal-based investing (CNBC TV18) for DIY buyers. (2) Gamechanger for younger earners. (3) Chinchu Will get a Superpower! for youths. He has additionally written seven different free e-books on varied cash administration matters. He’s a patron and co-founder of “Charge-only India,” an organisation for selling unbiased, commission-free funding recommendation.

Our flagship course! Study to handle your portfolio like a professional to attain your targets no matter market circumstances! ⇐ Greater than 3000 buyers and advisors are a part of our unique group! Get readability on how one can plan on your targets and obtain the required corpus it doesn’t matter what the market situation is!! Watch the primary lecture without spending a dime! One-time fee! No recurring charges! Life-long entry to movies! Scale back concern, uncertainty and doubt whereas investing! Discover ways to plan on your targets earlier than and after retirement with confidence.

Our new course! Enhance your revenue by getting individuals to pay on your expertise! ⇐ Greater than 700 salaried staff, entrepreneurs and monetary advisors are a part of our unique group! Discover ways to get individuals to pay on your expertise! Whether or not you’re a skilled or small enterprise proprietor who desires extra purchasers through on-line visibility or a salaried particular person wanting a facet revenue or passive revenue, we’ll present you how one can obtain this by showcasing your expertise and constructing a group that trusts you and pays you! (watch 1st lecture without spending a dime). One-time fee! No recurring charges! Life-long entry to movies!

Our new e book for youths: “Chinchu will get a superpower!” is now obtainable!

Most investor issues might be traced to an absence of knowledgeable decision-making. We have all made unhealthy selections and cash errors after we began incomes and spent years undoing these errors. Why ought to our youngsters undergo the identical ache? What is that this e book about? As mother and father, what would it not be if we needed to groom one means in our youngsters that’s key not solely to cash administration and investing however to any side of life? My reply: Sound Choice Making. So on this e book, we meet Chinchu, who’s about to show 10. What he desires for his birthday and the way his mother and father plan for it and educate him a number of key concepts of choice making and cash administration is the narrative. What readers say!

Should-read e book even for adults! That is one thing that each dad or mum ought to educate their children proper from their younger age. The significance of cash administration and choice making primarily based on their desires and desires. Very properly written in easy phrases. – Arun.

Purchase the e book: Chinchu will get a superpower on your youngster!

The way to revenue from content material writing: Our new book for these thinking about getting facet revenue through content material writing. It’s obtainable at a 50% low cost for Rs. 500 solely!

Need to test if the market is overvalued or undervalued? Use our market valuation device (it is going to work with any index!), otherwise you purchase the brand new Tactical Purchase/Promote timing device!

We publish month-to-month mutual fund screeners and momentum, low volatility inventory screeners.

About freefincal & its content material coverage Freefincal is a Information Media Group devoted to offering unique evaluation, reviews, opinions and insights on mutual funds, shares, investing, retirement and private finance developments. We achieve this with out battle of curiosity and bias. Observe us on Google Information. Freefincal serves greater than three million readers a yr (5 million web page views) with articles primarily based solely on factual info and detailed evaluation by its authors. All statements made will probably be verified from credible and educated sources earlier than publication. Freefincal doesn’t publish any paid articles, promotions, PR, satire or opinions with out information. All opinions offered will solely be inferences backed by verifiable, reproducible proof/information. Contact info: letters {at} freefincal {dot} com (sponsored posts or paid collaborations won’t be entertained)

Join with us on social media

Our publications

You Can Be Wealthy Too with Objective-Based mostly Investing

Printed by CNBC TV18, this e book is supposed that will help you ask the best questions and search the proper solutions, and because it comes with 9 on-line calculators, you may also create customized options on your life-style! Get it now.

Printed by CNBC TV18, this e book is supposed that will help you ask the best questions and search the proper solutions, and because it comes with 9 on-line calculators, you may also create customized options on your life-style! Get it now.

Gamechanger: Overlook Startups, Be part of Company & Nonetheless Reside the Wealthy Life You Need

This e book is supposed for younger earners to get their fundamentals proper from day one! It is going to additionally enable you to journey to unique locations at a low value! Get it or present it to a younger earner.

This e book is supposed for younger earners to get their fundamentals proper from day one! It is going to additionally enable you to journey to unique locations at a low value! Get it or present it to a younger earner.

Your Final Information to Journey

That is an in-depth dive evaluation into trip planning, discovering low-cost flights, funds lodging, what to do when travelling, and the way travelling slowly is healthier financially and psychologically with hyperlinks to the online pages and hand-holding at each step. Get the pdf for Rs 300 (immediate obtain)

That is an in-depth dive evaluation into trip planning, discovering low-cost flights, funds lodging, what to do when travelling, and the way travelling slowly is healthier financially and psychologically with hyperlinks to the online pages and hand-holding at each step. Get the pdf for Rs 300 (immediate obtain)