That is the third in a three-part collection analyzing a recent method to digital remittances in Indonesia.

By Angela Ang, Elwyn Panggabean, and Ker Thao

During the last six months, we launched a pilot program with DANA, considered one of Indonesia’s largest e-wallet suppliers, to supply a digital remittance answer for home employees to ship a refund residence in a secure and safe manner. The pilot answer was initially designed to focus on DANA’s current customers who may very well be potential employers of home employees and leveraged them as the primary touchpoint in introducing DANA as a viable remittance channel. By manner, employers would assist educate their employees about the advantages and values of utilizing DANA, offering a less expensive, sooner, and safer digital avenue for employees to ship cash residence.

Taking an iterative method within the pilot implementation

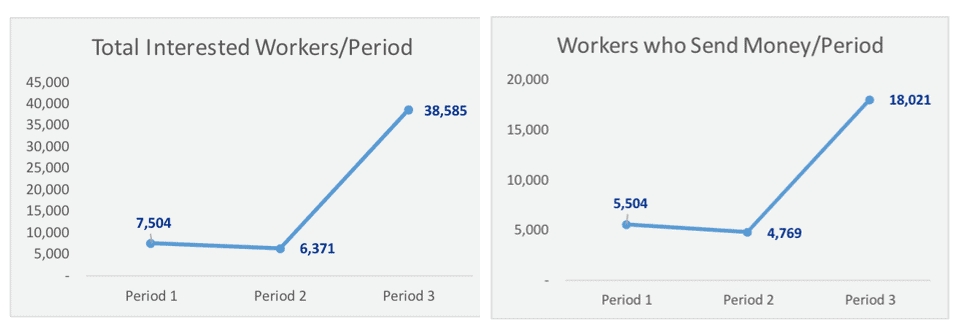

Initially, the pilot venture was deliberate to be launched throughout a three-month, three-part part: the primary and second with a give attention to focusing on employers as a touchpoint to succeed in home employees, serving to them sign-up their home employees for DANA accounts, and educating them about DANA and methods to use DANA to switch cash residence; whereas the third part spanned over the past two months, instantly focused the home employees with a give attention to constructing buyer’s confidence and expertise in utilizing DANA. Whereas the primary and second phases confirmed constructive ends in serving to home employees with entry and use of DANA as a remittance service, the third part confirmed a big improve in engagement and use.

Key learnings from the pilot

Program Consciousness

Most of the contributors of the home employee remittance program realized about this system by means of quite a lot of totally different channels and media equivalent to by means of word-of-mouth referrals, the preferred and trusted technique between employees, from different customers who have been taking part in this system (buddy, neighbor, relative, or employer) and thru DANA’s Instagram web page and tales. The analysis highlighted further avenues to succeed in a bigger home employee viewers, with clients suggesting extra ads and messages in locations that they frequented: companion retailers (equivalent to comfort shops); social media (YouTube and TikTok, which they use for leisure); and leveraging influencers to assist get the message throughout.

Program Signal-up and Onboarding

It was evident throughout the first two phases of this system that employers weren’t the simplest manner to assist home employees sign-up for an account. This was additional validated within the pilot analysis. We found that employees who needed to take part in this system have been keen, ready, and able to signing themselves up for their very own account, with the caveat that almost all of those that have been ready to take action are usually extra tech-savvy and digitally literate. They have been resourceful and capable of entry movies and tutorials that which have been offered throughout the program to assist them full the required steps. The remainder of the home employees realized with the assist of members of the family or their employer.

Whereas employers didn’t turn out to be an important sign-up touchpoint, they have been efficient in offering training and serving to their employees to make use of DANA. Nonetheless, the employers have been confronted with challenges of their very own. A few of the main challenges have been because of employees not having smartphones or not being as tech/digitally-savvy, which discouraged employers from taking part and assist their employees take part as properly. One other problem was that employers didn’t have the time and/or information to show their employees. Many employers had no objections in assuming the educating function, however most well-liked somebody who was a lot nearer to the employees (like household, associates, or friends) to show them with some saying that the academic piece ought to come instantly from DANA.

Transacting with DANA and different Use-cases

General, the answer program proved to achieve success. It helped educate home employees methods to use DANA to make remittance transfers again residence and with the development of customers who began to grasp the advantages and values of utilizing DANA, they turned extra occupied with exploring different use-cases. We noticed as a direct consequence, clients who participated in this system began utilizing DANA for invoice funds (electrical energy tokens and water payments), top-ups, and on-line procuring. Moreover, they even began to make use of DANA Objectives—a short-term financial savings objective characteristic in DANA.

Drivers and Detracting Components for Utilization

As part of the analysis, we recognized particular components that helped drive using DANA for remittance providers and past, in addition to detracting elements that forestalls clients from utilizing DANA.

| Drivers | Detractors |

| Focused messaging and communications helped clients see and really feel that this system was geared toward them

Reminder messages and in-app notifications helped to nudge clients on the proper time to remind them to make use of DANA to ship cash residence Ease of use and transacting made clients wish to discover different use instances Program incentives (raffles and rewards) additionally helped to drive use |

Clients who didn’t have assist or a instructor to assist information them prevented them from studying and utilizing Clients who didn’t have a smartphone or shared their smartphone with others resulted in them not having the ability to take part Clients who didn’t perceive the Phrases and Situations of this system (the required steps wanted to be accomplished as a way to qualify for this system and to qualify for adjustments to win incentives)

|

Incentives for Utilization Past Raffles and Rewards

The pilot analysis confirmed that the simplest answer elements have been a mix of key advertising/messaging, reminders, and incentives to assist drive utilization. The focused advertising and messaging have been efficient to relay the values and advantages of utilizing DANA for home employees and struck a chord with a program that was designed particularly for them. The communications about DANA’s values and advantages have been clearly understood by clients. Reminders performed a vital function within the answer as properly. It helped to nudge clients who could have forgotten about utilizing DANA and helped remind clients that DANA may very well be used for a lot of different transactions past remittance transfers.

Via the pilot analysis, we additionally found that whereas many purchasers have been initially drawn to this system because of the likelihood to win money prizes and rewards. Nonetheless, upon additional utilization, many began to see the precise advantages and values of utilizing DANA. It was seen as a quick, simple, and free method to transact. As well as, it was additionally considered to be a safe and secure method to ship cash residence; whereas on the similar time simple to study. These have been the true incentives for utilizing DANA as a remittance channel. It’s encouraging to see as this system helped construct person confidence and digital monetary capabilities by means of a learn-by-doing method which gave them the digital instruments to transact and handle their very own cash.

Subsequent Steps: Scaling for Affect for all Home Staff

The venture gives evidences on the effectives of utilizing remittances to assist carry migrant employees, on this case, home employees, into formal monetary providers, in addition to showcasing the vital function of digital wallets, like DANA, to drive digital remittance providers in Indonesia. The enterprise alternative on (home) remittances is big and could be a sturdy use-case to focus on the low-income section, significantly migrant employees.

With the success of this pilot program with DANA, Ladies’s World Banking is trying to scale this answer to the remainder of the home employee group in Indonesia. We plan on creating an answer that particularly targets them to supply a secure, safe, and simple method to ship cash residence. As well as, we wish to measure the impression of the answer on the lives of ladies clients and plan to conduct an outcomes analysis. The upcoming analysis will measure the impacts of the answer within the brief and long-term durations in direction of ladies’s (financial) empowerment.

Our ongoing efforts are to maintain buyer engaged and proceed to study to make use of digital monetary providers for his or her each day monetary wants by constructing their digital monetary capabilities and confidence in order that they can also turn out to be advanced and multi-case customers. It’s our hope, at Ladies’s World Banking, that options equivalent to this can assist assist low-income ladies develop to turn out to be extra assured and unbiased customers who can improve their monetary well being, monetary resilience, and monetary independence to make their very own monetary selections within the long-term.