On this version of the reader story, 37-year-old Siva shares his monetary journey from scratch in 2014 to a web price of 18 occasions annual bills.

About this sequence: I’m grateful to readers for sharing intimate particulars about their monetary lives for the good thing about readers. A few of the earlier editions are linked on the backside of this text. It’s also possible to entry the total reader story archive.

Opinions revealed in reader tales needn’t symbolize the views of freefincal or its editors. We should respect a number of options to the cash administration puzzle and empathise with various views. Articles are usually not checked for grammar until essential to convey the best which means to protect the tone and feelings of the writers.

If you want to contribute to the DIY neighborhood on this method, ship your audits to freefincal AT Gmail dot com. They are often revealed anonymously in the event you so want.

Please notice: We welcome such articles from younger earners who’ve simply began investing. See, for instance, this piece by a 29-year-old: How I monitor monetary objectives with out worrying about returns. We’ve additionally began a brand new “mutual fund success tales” sequence. That is the primary version: How mutual funds helped me attain monetary independence. Now over to Siva.

I’ve had vital studying and have come throughout fascinating thought processes on Private Monetary planning primarily based on the DIY sequence initiative of FreeFincal. I at all times had it at the back of my thoughts to supply my little bit to this sequence, and hope it provides worth to somebody studying this someplace.

Like many different readers, I’m grateful to Professor Dr Pattabiraman for operating this web site and serving to many retail traders with a treasure trove of knowledge they’ll study of their pursuit of monetary planning and their monetary independence journey.

I chanced upon the web site in late 2020. It has been an enchanting journey going via articles, backtests, and views and revisiting just a few of them repeatedly to hunt inspiration.

Right here is my journey and what I plan to do going ahead. I’m a 37-year-old, and my working profession began in 2007. The primary decade principally had its share of start-stops with me pursuing a post-graduation after the preliminary couple of years for which I needed to empty the kitty I used to be filling with no matter little I might save (together with PF + Depart encashment from these few years of labor).

After my PG, I landed a decent-paying job and was a diligent saver. I used to be not reckless regardless that I lacked nuanced information of investments (didn’t have optimum funding methods in place – had a sweeping financial savings account which was giving FD-like returns, and virtually all of my financial savings went there apart from some investments into PPF and a LIC coverage (I used to be enrolled to it by default by my father again in 2008 for … you guessed it proper – 80 c profit;

Just lately, calculated the XIRR on this 12-year coverage, and it involves round 5%; Unhappy story, however that was a part of the educational expertise). Coming again to my journey, after two years submit PG, bought married and needed to spend no matter I had saved until then to account for bills on the marriage and on safety deposit & furnishing for the rental home, I moved into.

Whilst my profession started in 2007, I hit just a few resets and needed to begin from zero in mid-2014. Once more, saving into my sweeping account continued with some diligent VPF+PPF contributions. There have been firm shares I might buy at a reduction for a few years beginning in 2016 (kicking myself for not beginning that off in 2014, however that is all in hindsight, so I pardon myself).

Nonetheless, it wasn’t till 2018 that I began taking a look at Fairness as an funding possibility. I had examine it earlier than, however the paperwork for organising the KYC to get began was an enormous hurdle. Right now’s traders won’t pay attention to the difficulties, particularly in the event you don’t have correct telephone handle data mapped to proof of id.

So, these beginning at present should thank on-line fintech options & Nandan Nilekani for his workforce’s UID undertaking that permit a number of this to be finished on-line, not having to undergo the layers of friction concerned in any other case.

So, fairness contributions began in a small manner in 2018, however in the direction of the top of 2016, my spouse and I saved an honest quantity on our sweeping SB Accounts and will go in to buy our main residence. I wasn’t a lot conscious of the advantages of renting over shopping for at that time. Even in hindsight now, I don’t suppose it’s been a nasty resolution as a result of we now have loved our journey in our house so far and having moved just a few occasions earlier than, I understand how robust it might be to shift throughout rental locations.

We went in with a down cost of 25%, with the remainder serviced via an overdraft House Mortgage (SBI Maxgain). We felt that might be possibility as we had been diligent savers, and we might benefit from it, particularly given the restricted funding choices we knew of at the moment.

I ought to say that call has labored in our favour as we now have been in a position to accumulate a big amount of cash over these six years into the OD account, a lot in order that, as a substitute of shopping for then, if we had determined to go for a home buy and not using a mortgage at present, our resolution wouldn’t have been a lot completely different financially talking.

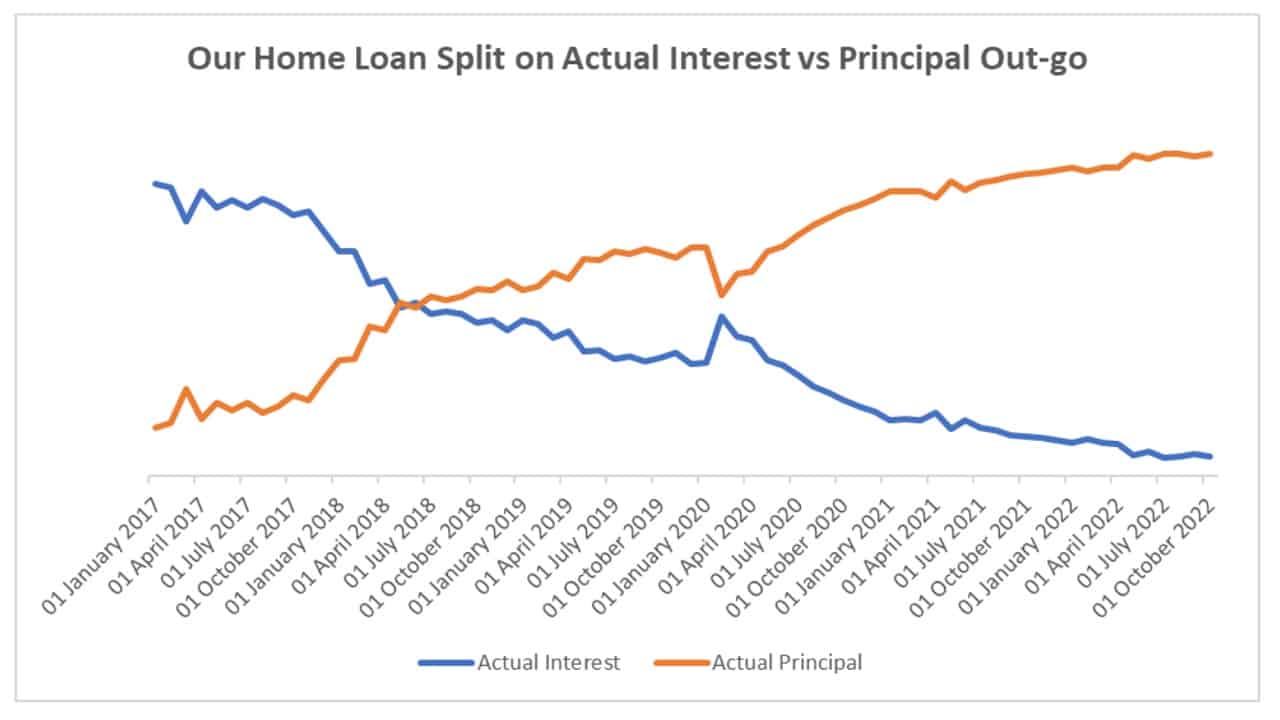

What I imply by that’s the curiosity out-go we now have had to this point solely equates to the lease we might have needed to pay over these six years, leaving us solely with the chance price of curiosity we might have earned for the 5 years on the cash collected (we bought to avoid wasting a bit on taxes the primary few years in order that that distinction wouldn’t be an excessive amount of). Here’s a chart that maps the Curiosity to Principal outgo on our EMIs for this journey.

You possibly can see that our curiosity went beneath the principal in about 15 months since we began with the House mortgage. The spike seen in early 2020 is because of a withdrawal from the account for buying our first Automotive.

We might do this with out going for a mortgage (Once more, I felt happy with this resolution we made once I realized a bit of later that going for a mortgage on liabilities just isn’t a fantastic monetary resolution).

I spotlight this right here as a result of some arguments go towards choosing a Maxgain-type house mortgage. Whereas these causes is likely to be compelling, there’s a case for choosing them.

You need to use it as your quick to medium-term funding possibility. It fares as properly, if not higher post-tax than different debt devices, particularly in a medium to high-interest price atmosphere. The curiosity you get to avoid wasting is a unfastened equal of the curiosity you’d get in the event you had been to spend money on different debt devices) and this will additionally double up as your emergency fund, given its skill to remain liquid.

If I had recognized sufficient, I might even have used among the cash collected in it to buy fairness when the market hit its lows in early 2020, however that line of considering doesn’t make a number of sense as it’s pushed by the good thing about hindsight.

I’m grateful my choices earlier than 2020 weren’t dangerous, given how restricted my monetary literacy was. It was in 2020 that I began following freefincal and a bunch of different sources to grasp private finance (behavioural and in any other case) higher, and I’m fascinated by the subject each passing day.

I’ve been in a position to course-correct our journey, and some key realizations/actions I’ve had within the final 2.5 years have been: Gathering the information on how asset allocation & estimating objectives had been extra essential than issues like what particular product you need to buy.

After going via the Freenfincal articles on quantifying retirement corpus, I bought extra readability on what would represent corpus for us to be financially free and what a sane and risk-controlled journey to that might appear to be when it comes to asset allocation decisions and what investments would make sense to get there.

The precise means of getting my allocations to the purpose is one thing I’m engaged on (I’ve a 60%:40% Fairness Debt purpose to take care of until I get to 44 and slowly taper it off to a 40%:60% within the decade after that). Given my late publicity to fairness and the truth that I used to be doing EPF/VPF/PPF for a number of years, I’m nonetheless on the trail to attending to the 60%:40% with month-to-month allocations tilting lots in the direction of fairness (extra like 80%:20% until I get there).

Solely time will inform if that might work very properly in my favour. Previous knowledge signifies a excessive likelihood of that being the result, however nothing is assured. I consider within the simplicity of a unified portfolio for our objectives. Therefore, the allocations referred to listed below are broadly for all medium to long run objectives (retirement, child’s schooling and many others.).

The necessity to have a conviction on merchandise you select to experience with. My fairness portfolio contains primarily a few energetic funds managed by fund managers pushed by Worth-Investing and Contrarian investing approaches. After studying in regards to the completely different types, I really feel I’m snug with Worth investing particularly given I’ve an extended runway earlier than for the objectives to mature for which I’m investing in them.

Nonetheless, the logic behind passive investing made it irresistible for me to keep away from it. So, round 25% of my fairness portfolio goes right into a Nifty50 Index fund (I do know Pattabiraman sir will not be happy with it given his suggestion on sticking both with Energetic or Passive, and I agree it doesn’t make a number of sense going each methods, however this has been extra of an emotional alternative and an thrilling experiment that I can monitor and measure down the street on which a part of it labored out properly for me).

The necessity for constructing an emergency corpus. Our OD account serves the aim for now. Nonetheless, the plan is to proceed to build up extra and have it in in a single day fund /long run bond kind devices to get that flexibility to stability my asset allocations higher. I’m studying about that to higher perceive debt choices within the Bonds house, however I could need to use the companies of a Price-only RIA to make the best decisions there.

The necessity for time period and medical insurance, I already have one after spending time estimating the wants of the household for all times if I had been to stop present anytime from now.

One pending motion is to go for correct medical insurance outdoors the employer-provided. I’m nonetheless researching a bit and hoping to get that finished inside the subsequent yr or so.

Mother and father are past 70 and with out medical insurance of their very own. So, have enrolled them on employer insurance coverage for some further premium and constructing a conflict chest of types to deal with any surprising emergencies is the plan there. If anybody from the Freefincal neighborhood is aware of different choices I can go along with for them, please be happy to teach me.

All mentioned, my spouse & I at the moment are at some extent the place the mixed web price (not together with main residence right here) of my spouse & I is round 18x our yearly bills. With an honest quantity of runway left and given our wholesome financial savings price, we might need to take it to 40x-45x over the subsequent ten years to make our life decisions totally unbiased of our monetary wants.

A few of you hopefully discovered this fascinating, with just a few factors resonating along with your journeys or with some readability on what to do and what to not do primarily based on my journey to this point. Thanks, Pattu sir, for offering me with the platform to share my journey with fellow FreeFincal followers.

Reader tales revealed earlier

As common readers could know, we publish a private monetary audit every December – that is the 2021 version: Portfolio Audit 2021: How my goal-based investments fared this yr. We requested common readers to share how they overview their investments and monitor monetary objectives.

These revealed audits have had a compounding impact on readers. If you want to contribute to the DIY neighborhood on this method, ship your audits to freefincal AT Gmail. They might be revealed anonymously in the event you so want.

Do share this text with your pals utilizing the buttons beneath.

🔥Take pleasure in huge year-end reductions on our programs and robo-advisory device! 🔥

Use our Robo-advisory Excel Software for a start-to-finish monetary plan! ⇐ Greater than 1000 traders and advisors use this!

- Comply with us on Google Information.

- Do you could have a remark in regards to the above article? Attain out to us on Twitter: @freefincal or @pattufreefincal

- Be a part of our YouTube Neighborhood and discover greater than 1000 movies!

- Have a query? Subscribe to our e-newsletter with this manner.

- Hit ‘reply’ to any electronic mail from us! We don’t provide customized funding recommendation. We will write an in depth article with out mentioning your identify when you’ve got a generic query.

Discover the positioning! Search amongst our 2000+ articles for data and perception!

About The Writer

Dr M. Pattabiraman(PhD) is the founder, managing editor and first creator of freefincal. He’s an affiliate professor on the Indian Institute of Expertise, Madras. He has over 9 years of expertise publishing information evaluation, analysis and monetary product improvement. Join with him through Twitter or Linkedin or YouTube. Pattabiraman has co-authored three print books: (1) You might be wealthy too with goal-based investing (CNBC TV18) for DIY traders. (2) Gamechanger for younger earners. (3) Chinchu Will get a Superpower! for youths. He has additionally written seven different free e-books on varied cash administration subjects. He’s a patron and co-founder of “Price-only India,” an organisation for selling unbiased, commission-free funding recommendation.

Dr M. Pattabiraman(PhD) is the founder, managing editor and first creator of freefincal. He’s an affiliate professor on the Indian Institute of Expertise, Madras. He has over 9 years of expertise publishing information evaluation, analysis and monetary product improvement. Join with him through Twitter or Linkedin or YouTube. Pattabiraman has co-authored three print books: (1) You might be wealthy too with goal-based investing (CNBC TV18) for DIY traders. (2) Gamechanger for younger earners. (3) Chinchu Will get a Superpower! for youths. He has additionally written seven different free e-books on varied cash administration subjects. He’s a patron and co-founder of “Price-only India,” an organisation for selling unbiased, commission-free funding recommendation.

Our flagship course! Study to handle your portfolio like a professional to realize your objectives no matter market circumstances! ⇐ Greater than 3000 traders and advisors are a part of our unique neighborhood! Get readability on learn how to plan on your objectives and obtain the required corpus it doesn’t matter what the market situation is!! Watch the primary lecture free of charge! One-time cost! No recurring charges! Life-long entry to movies! Scale back worry, uncertainty and doubt whereas investing! Discover ways to plan on your objectives earlier than and after retirement with confidence.

Our new course! Improve your revenue by getting folks to pay on your expertise! ⇐ Greater than 700 salaried staff, entrepreneurs and monetary advisors are a part of our unique neighborhood! Discover ways to get folks to pay on your expertise! Whether or not you’re a skilled or small enterprise proprietor who desires extra shoppers through on-line visibility or a salaried individual wanting a facet revenue or passive revenue, we’ll present you learn how to obtain this by showcasing your expertise and constructing a neighborhood that trusts you and pays you! (watch 1st lecture free of charge). One-time cost! No recurring charges! Life-long entry to movies!

Our new guide for youths: “Chinchu will get a superpower!” is now out there!

Most investor issues might be traced to an absence of knowledgeable decision-making. We have all made dangerous choices and cash errors once we began incomes and spent years undoing these errors. Why ought to our youngsters undergo the identical ache? What is that this guide about? As mother and father, what would it not be if we needed to groom one skill in our youngsters that’s key not solely to cash administration and investing however to any facet of life? My reply: Sound Resolution Making. So on this guide, we meet Chinchu, who’s about to show 10. What he desires for his birthday and the way his mother and father plan for it and educate him a number of key concepts of resolution making and cash administration is the narrative. What readers say!

Should-read guide even for adults! That is one thing that each mum or dad ought to educate their children proper from their younger age. The significance of cash administration and resolution making primarily based on their desires and desires. Very properly written in easy phrases. – Arun.

Purchase the guide: Chinchu will get a superpower on your youngster!

The way to revenue from content material writing: Our new e-book for these considering getting facet revenue through content material writing. It’s out there at a 50% low cost for Rs. 500 solely!

Wish to verify if the market is overvalued or undervalued? Use our market valuation device (it’ll work with any index!), otherwise you purchase the brand new Tactical Purchase/Promote timing device!

We publish month-to-month mutual fund screeners and momentum, low volatility inventory screeners.

About freefincal & its content material coverage Freefincal is a Information Media Group devoted to offering unique evaluation, reviews, critiques and insights on mutual funds, shares, investing, retirement and private finance developments. We achieve this with out battle of curiosity and bias. Comply with us on Google Information. Freefincal serves greater than three million readers a yr (5 million web page views) with articles primarily based solely on factual data and detailed evaluation by its authors. All statements made might be verified from credible and educated sources earlier than publication. Freefincal doesn’t publish any paid articles, promotions, PR, satire or opinions with out knowledge. All opinions offered will solely be inferences backed by verifiable, reproducible proof/knowledge. Contact data: letters {at} freefincal {dot} com (sponsored posts or paid collaborations won’t be entertained)

Join with us on social media

Our publications

You Can Be Wealthy Too with Purpose-Based mostly Investing

Printed by CNBC TV18, this guide is supposed that can assist you ask the best questions and search the right solutions, and because it comes with 9 on-line calculators, you may also create customized options on your way of life! Get it now.

Printed by CNBC TV18, this guide is supposed that can assist you ask the best questions and search the right solutions, and because it comes with 9 on-line calculators, you may also create customized options on your way of life! Get it now.

Gamechanger: Overlook Startups, Be a part of Company & Nonetheless Reside the Wealthy Life You Need

This guide is supposed for younger earners to get their fundamentals proper from day one! It can additionally aid you journey to unique locations at a low price! Get it or reward it to a younger earner.

This guide is supposed for younger earners to get their fundamentals proper from day one! It can additionally aid you journey to unique locations at a low price! Get it or reward it to a younger earner.

Your Final Information to Journey

That is an in-depth dive evaluation into trip planning, discovering low cost flights, finances lodging, what to do when travelling, and the way travelling slowly is healthier financially and psychologically with hyperlinks to the net pages and hand-holding at each step. Get the pdf for Rs 300 (immediate obtain)

That is an in-depth dive evaluation into trip planning, discovering low cost flights, finances lodging, what to do when travelling, and the way travelling slowly is healthier financially and psychologically with hyperlinks to the net pages and hand-holding at each step. Get the pdf for Rs 300 (immediate obtain)