That is the primary in a three-part collection inspecting a contemporary strategy to digital remittances in Indonesia.

By Angela Ang, Elwyn Panggabean, and Ker Thao

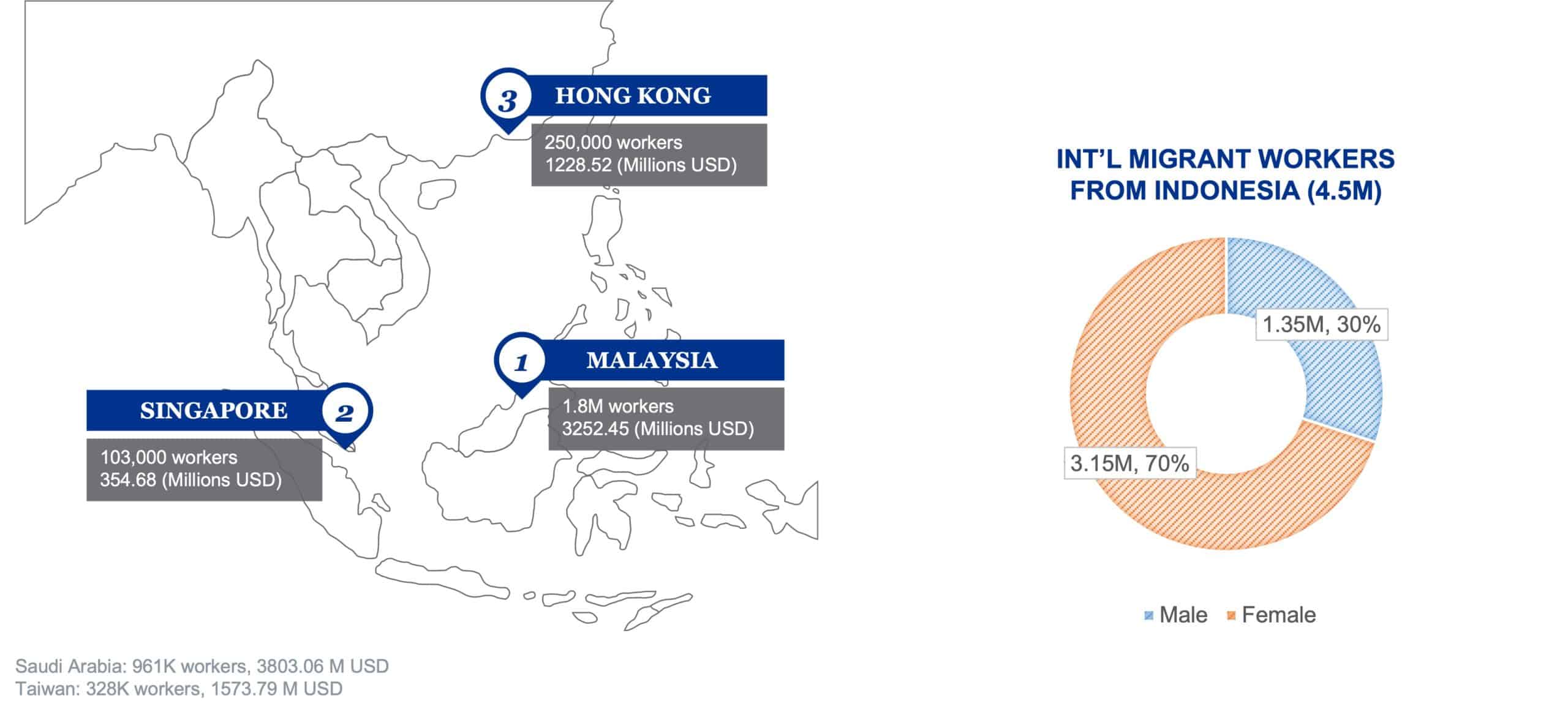

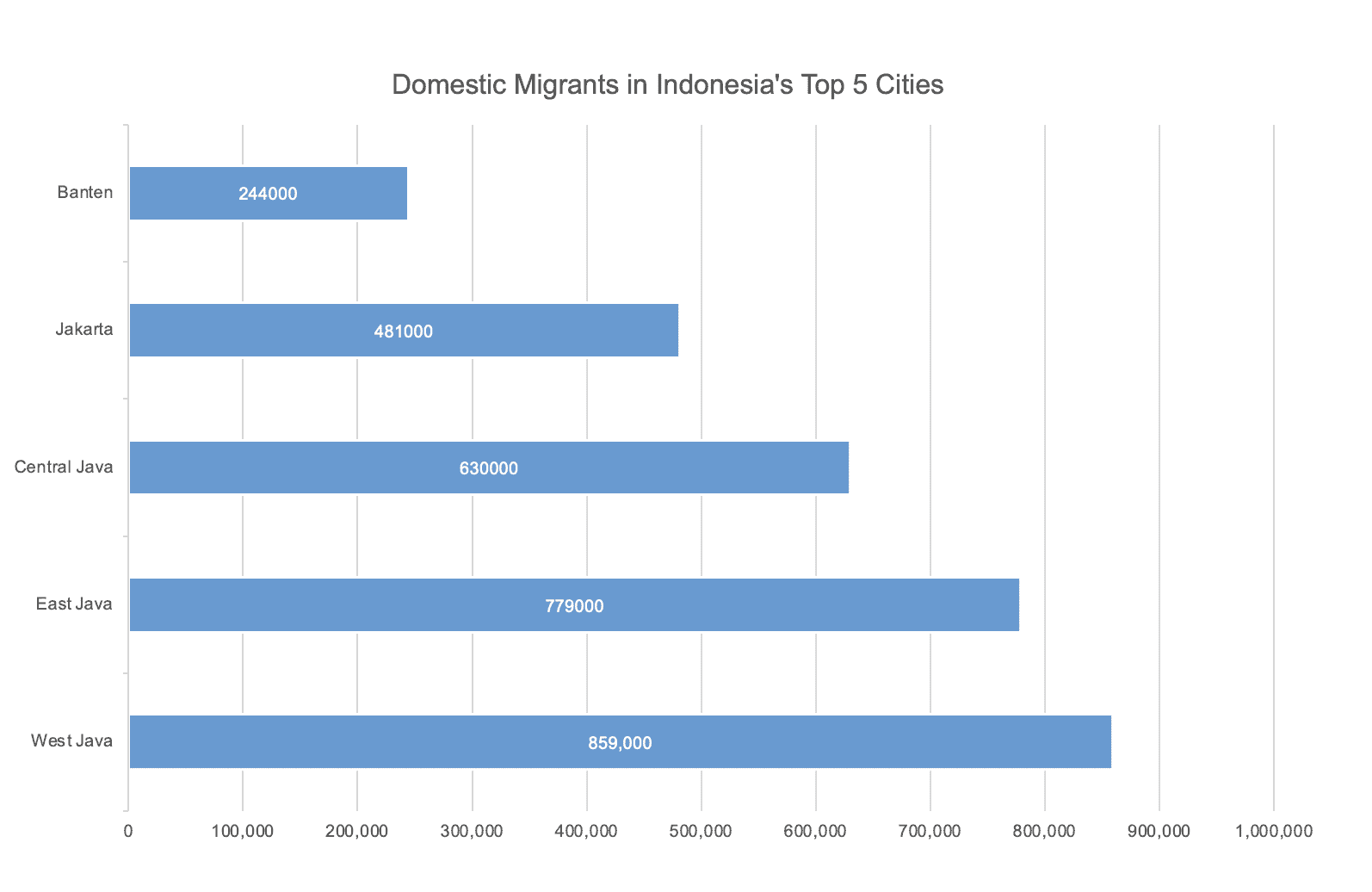

In Asia, Indonesia has the second largest migrant inhabitants, with worldwide migrant staff comprising a big portion of the economic system. There are roughly 4.5 million worldwide migrant staff, of which just about 3 million (70 %) are ladies and the bulk are employed in home providers. Indonesia additionally has an extra 4.2 million home migrant staff (roughly 68% ladies) who’re employed as manufacturing facility staff, babysitters, housemaids, and caretakers. Many of those migrant staff rely closely on casual channels to meet their remittance must ship cash residence to household, however, because of restricted or troublesome to entry inexpensive remittance providers, face excessive service charges and the danger of theft and loss.

In recent times, Indonesia’s monetary sector has been rapidly evolving and continues to develop into extra dynamic, with new non-bank gamers slowly rising as important contributors to monetary inclusion. The Monetary Inclusion Perception Survey 2020 exhibits that, in Indonesia, there was a major 2.5x improve in e-money customers and an general 19.5 p.c improve in consumer consciousness from 2018 to 2020. The fast development of smartphone possession in Indonesia, in comparison with fundamental and have telephones, holds nice promise for e-money to assist advance monetary inclusion for low-income ladies, significantly as cellphones are key to driving digital funds and the elevated use of server-based e-money and cell banking.

Whereas the rise in smartphone possession is encouraging, progress has not been accompanied by equitable alternatives for numerous low-income populations, corresponding to ladies migrant staff. In accordance with GSMA’s Cell Gender Hole Report, the cell phone possession gender hole nonetheless stays the identical for ladies throughout low and middle-income nations. Many migrant staff in Indonesia additionally come from rural and distant elements of the nation, the place smartphone possession and adoption of digital providers is sluggish to materialize.

Ladies’s World Banking sees a chance to have interaction with ladies migrant staff and produce them into the formal monetary sector by growing their consciousness and adoption of digital monetary providers—beginning with a digital remittance service that’s dependable, reliable, and cost-effective. To this finish, we’ve partnered with DANA, one of many largest e-wallet suppliers in Indonesia, to develop options that may supply and drive the usage of inexpensive and secure remittance providers by an e-wallet for ladies migrant staff.

Via leveraging the superior know-how embedded in DANA, each Ladies’s World Banking and DANA hope to create better financial stability and prosperity for ladies, households, and their communities. Moreover, instilling a notion that digital wallets could be simply utilized by anybody—together with worldwide and home migrant staff—to help their household’s livelihood of their hometown, safely and conveniently.

In regards to the migrants: Insights from our subject analysis

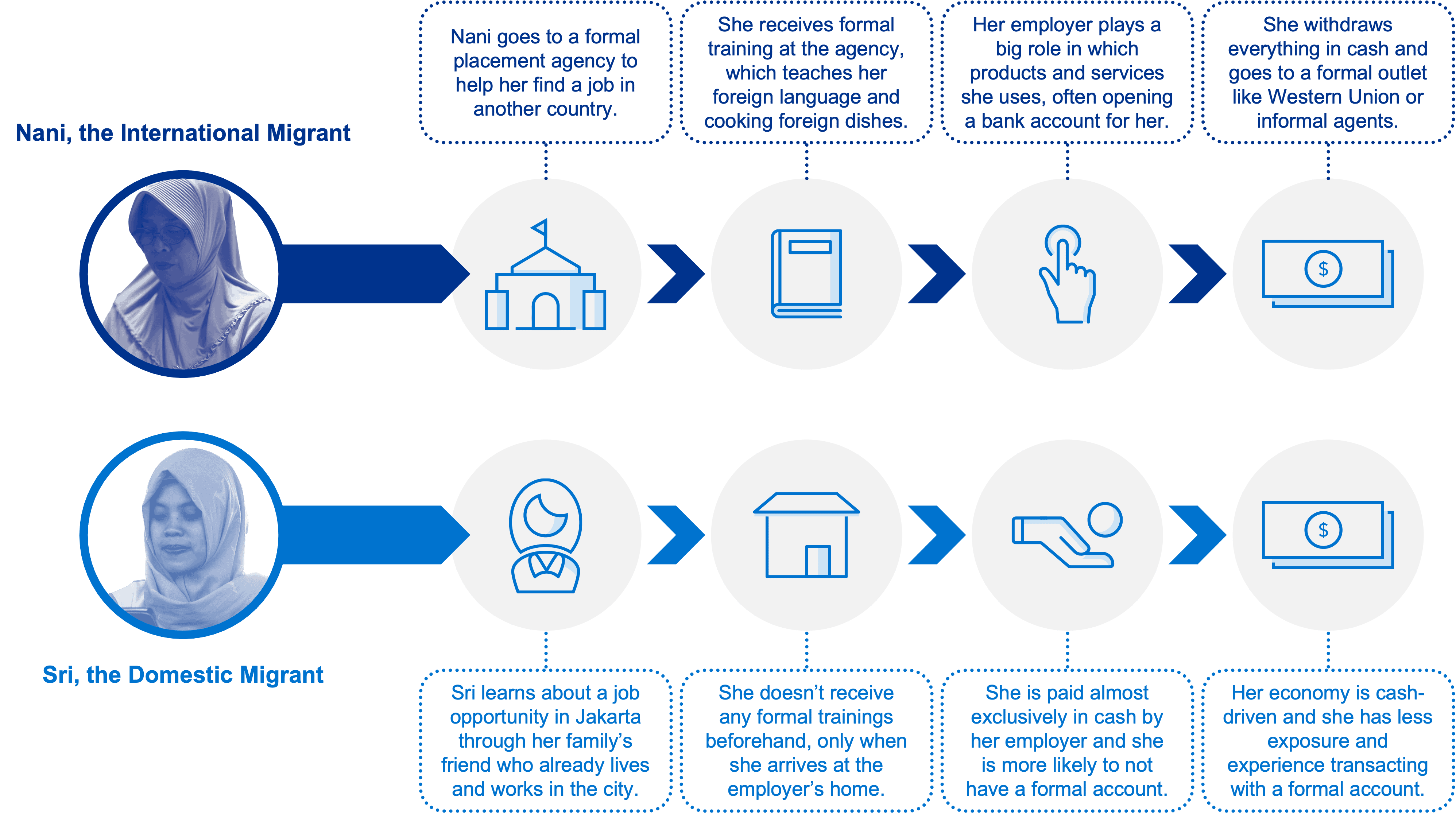

The respective journeys of worldwide and home migrant staff in Indonesia differ considerably from one different, the first differentiator being the formality of their employment processes. Worldwide staff usually tend to undergo formal placement companies, whereas home migrant staff depend on casual sources for his or her employment, usually referrals from different migrant household or associates. Whereas precise retention for migrant staff varies tremendously, the vast majority of staff discover employment within the home service sector (e.g., family helpers, caretakers, babysitters, cooking, and cleansing).

The Worldwide Migrant Employee

As soon as overseas, worldwide migrants rely largely on their employers and a small migrant neighborhood, made up of present colleagues, associates, and members of the family within the vacation spot nation, as trusted sources of knowledge. Because of this, many migrants choose into utilizing services which might be referred to them by these trusted people. Employers additionally play a vital function by influencing which monetary services migrant staff use and infrequently favor to pay their staff by formal financial institution accounts. Because of this, many worldwide migrant staff usually tend to have entry to a proper checking account.

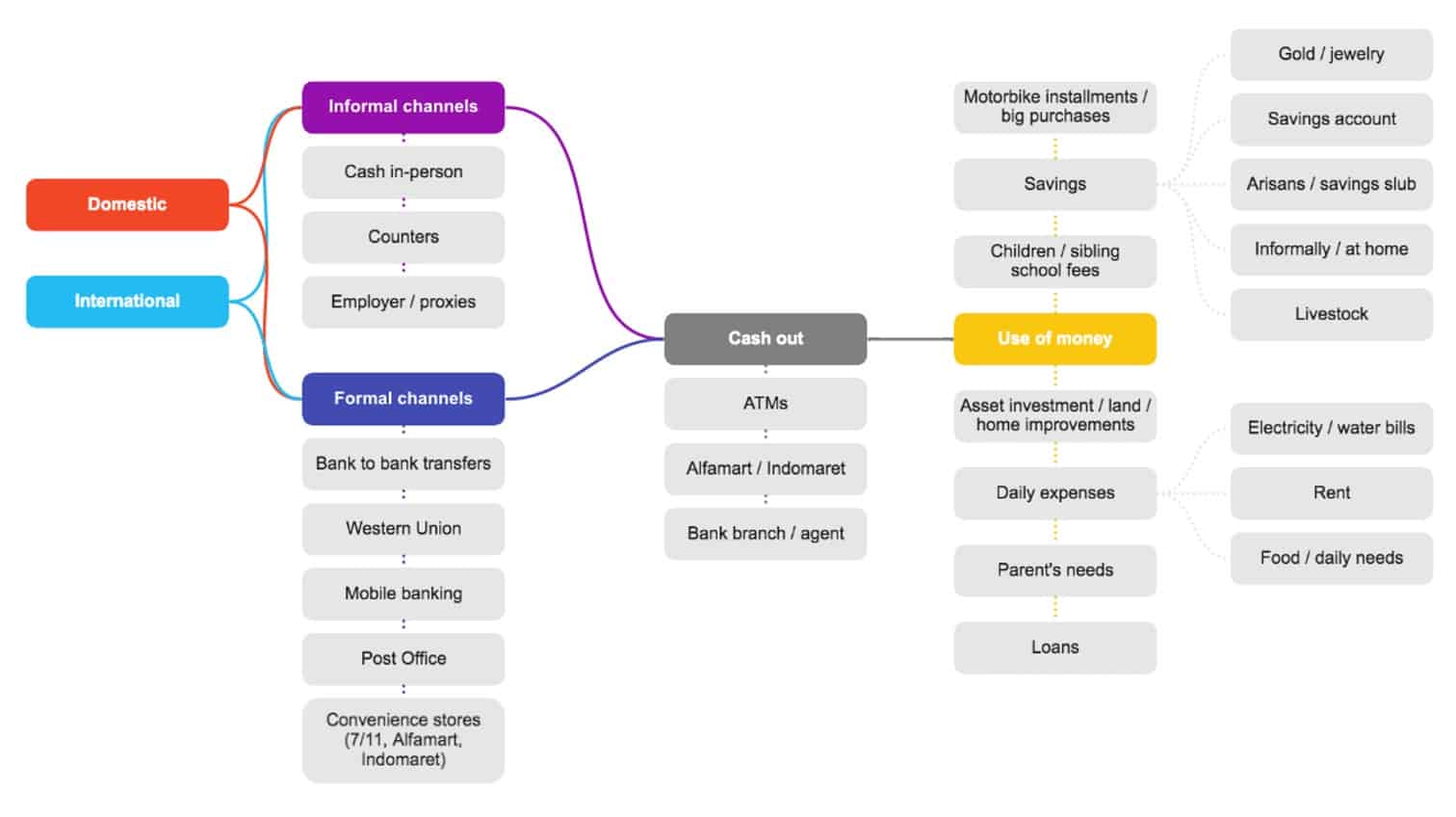

Sadly, entry doesn’t all the time translate into utilization. Whereas many worldwide migrant staff have entry to financial institution accounts, they don’t essentially use the account to ship a refund residence. Moderately, they may nonetheless withdraw all their funds and ship money by a proper outlet like Western Union or retailers (e.g., Indonesian outlets), which act as casual cash switch brokers between communities and nations. Sending remittances can also be solely half the story; the opposite half is ensuring that cash despatched is accessible by recipients. Many recipient households would not have financial institution accounts, and due to this fact, migrant staff will ship cash to a relative’s or neighbor’s account, which could be simply cashed out at close by brokers, financial institution branches, and ATMs.

Case Examine A: Nani, The Worldwide Migrant Employee

Nani is a 36-year-old migrant employee in Hong Kong, working as live-in home assist who cooks, cleans, and takes care of her employer’s household. She comes from a small village in rural Indonesia, the place her dad and mom are caring for her three youngsters. She discovered her job by the assistance of a proper placement company, which helped practice her by offering fundamental language courses, housekeeping coaching, and cooking worldwide dishes. Though it was a tough choice at first, she moved overseas for larger and higher alternatives to earn more cash to help her household.

Nani will not be very technologically literate, however she understands learn how to use social media to remain linked together with her household and talk together with her employer, colleagues, and associates. Attributable to her restricted technological consciousness and information, she depends on her employer’s recommendation on what to make use of. Because of this, her employer has opened a checking account for her, the place she receives her month-to-month wage.

Every time she receives her wage, Nani goes out throughout her restricted free time to ship cash to her household. For comfort, Nani prefers to do all of her errands in a central location and chooses a close-by remittance service that ensures supply of her funds however requires the next transaction price.

The Home Migrant Employee

Equally, home migrant staff rely on their small migrant neighborhood within the metropolis they reside or work to know what monetary services to make use of. In contrast to their counterparts, home migrant staff are much less more likely to have entry to a proper checking account and are paid virtually solely in money by employers. In a cash-driven economic system and atmosphere, home migrant staff lack invaluable expertise in utilizing a checking account and thus have considerations about making errors when utilizing unfamiliar services.

The dearth of entry, publicity, and expertise with formal monetary services contributes on to why many home migrant staff select casual strategies for remittances. From their perspective, it’s a lot simpler and easier to have their employers ship cash residence for them and to make use of another person’s account than to undergo the difficulty of building and sustaining considered one of their very own. An identical logic could be seen when home migrant staff truly choose the place and to whom they ship cash; sometimes, cash (50-70% of their total wage) is distributed to whoever has or owns an account again residence, whether or not a mum or dad, neighbor, or buddy, as long as funds could be transformed to money and obtained by the supposed recipient.

Case Examine B: Sri, The Home Migrant Employee

Sri is a 2

Sri has a smartphone and makes use of it primarily to remain linked together with her household and associates again residence, however she has restricted information and web connectivity. With very low reminiscence on her cellphone, Sri fastidiously chooses which cell apps she retains and makes use of and which she deletes. Though she has low e-money consciousness, she has heard about some apps, corresponding to OVO and GoPay.

Since Sri doesn’t have a checking account, she depends on her employer to ship 50-70% of her wage residence or makes use of her household or buddy’s checking account when sending cash residence. No matter is left of her wage, she spends on her each day bills and saves in her room or on her individual.

What can we do to supply an inexpensive and secure remittance service for ladies migrant staff?

Primarily based on this analysis, remittances for each worldwide and home migrants burn up most of their salaries, leaving solely sufficient for his or her each day wants and bills. Migrants usually communicate with recipients on learn how to use the cash, which usually covers quite a lot of bills and the wants of households again residence. In any case main bills have been paid for, the remaining funds are used for financial savings, as an funding for the household’s future. Within the occasion of bigger purchases, corresponding to a motorcycle, the cash is used to cowl substantial fee installments. Different funds could go in the direction of residence enhancements and land purchases as investments for the long run.

As a result of migrants’ salaries are the primary approach of supporting their households’ livelihoods, migrant staff extremely worth the safe and assured supply of their funds. When selecting a particular remittance service, not solely will migrants go for one that’s expensive however ensures the secure and well timed supply of funds, they will even select one that’s simply accessible for the recipients again residence. Subsequently, when choosing a remittance service, migrant staff usually have to think about a number of elements that would affect them as financial suppliers (the senders), along with their beneficiaries (the recipients).

Clearly, there’s a want for a remittance service that resonates with ladies migrant staff—one that’s designed to be quick and straightforward, guarantee secure supply of funds, and be simply accessible for recipients. By understanding the migrant’s wants, behaviors, and considerations, and what they worth most in remittance providers, Ladies’s World Banking will probably be higher positioned to efficiently assist migrant staff in Indonesia undertake and readily use digital remittance providers that work of their particular context.

In Half 2, we’ll share our specifically designed answer that targets migrant staff and promotes the usage of digital formal monetary providers to meet their remittance wants.

Ladies’s World Banking’s work with DANA Indonesia is supported by The Invoice & Melinda Gates Basis.