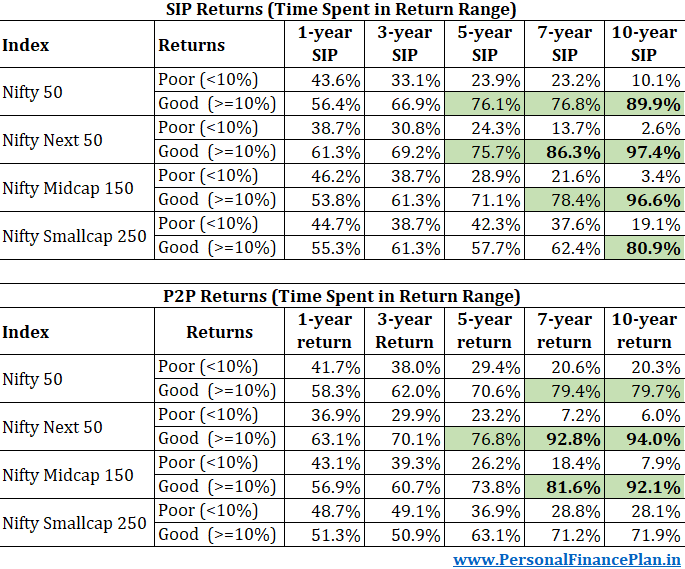

Take into account giving your fairness investments an extended rope. Knowledge suggests 7-year and 10-year funding horizon and SIP tenure improve probabilities of “good” returns. Longer is best. With shorter durations, you’re leaving rather a lot to likelihood. Moreover, the efficiency of the small cap index fails to impress.

Fairness investments do properly over the long run. We learn and listen to this on a regular basis. Don’t we?

Nice. Fairness investments have certainly completed properly in India over the long run.

Nevertheless, there may be nonetheless one query that we should reply.

For fairness investments, how lengthy is long run?

As per tax legal guidelines, a holding interval over 1 12 months is long run.

Then, do you have to anticipate to earn good return inside 12 months? Or you have to give your self an extended rope. Once more, how lengthy? 3-year, 5-year and even 10-years?

What must be your funding horizon in order that “Fairness investments do properly” materializes for you?

If you’re fortunate, even a number of days or a number of months of holding interval can do wonders. However you don’t wish to financial institution simply in your luck. A accountable investor would wish to perceive what has labored prior to now and accordingly determine the funding horizon.

Or let’s consider a extra sensible drawback: You wish to make investments cash for 3 years. If the percentages of incomes good returns in fairness markets usually are not very excessive for a 3-year funding horizon, you’d be cautious of investing that cash into shares.

As an investor, you wish to work with an funding horizon the place your odds of incomes good returns are increased. No assure. Simply higher odds.

Wanting on the previous knowledge additionally helps set your expectations proper. Many buyers wrestle within the fairness markets as a result of they’ve irrational return expectations. If you wish to double your cash in simply 6 months and the percentages of that occuring are 0.5% (simply saying), then you’re getting ready your self for disappointment. To stay to funding self-discipline, this can be very vital to get the expectations proper. And looking out on the previous efficiency will help on this entrance.

On this put up, we’ll attempt to do precisely that. Take a look at the info and work out the funding horizon and SIP tenure the place your probabilities of incomes good returns are increased.

Which Fairness indices ought to we contemplate?

Nifty 50 is the bellwether index. Therefore, if I needed to decide up only one index for this evaluation, I’d have picked up Nifty 50 TRI.

Nevertheless, as buyers, we’ve got preferences for various sorts of shares. Due to this fact, I’ve included Nifty Subsequent 50, midcap and small cap indices too on this evaluation.

On this put up, we take a look at rolling returns for the next indices since inception till July 2022.

- Nifty 50 TRI (since July 1999)

- Nifty Subsequent 50 TRI (since November 2002)

- Nifty Midcap 150 TRI (since April 2005)

- Nifty Smallcap 250 TRI (since April 2005)

To scale back my work, I’ve thought-about solely the month-to-month knowledge for every of the above indices.

Rolling returns are a extra dependable indicator of long-term efficiency since these don’t undergo from start-point bias. And we take a look at the 2 sorts of rolling returns.

- P2P (Level-to-Level) Rolling returns (extra suited to analyzing the efficiency of lumpsum investments)

- SIP Rolling returns (for analyzing the efficiency of SIPs for varied durations)

What are Rolling returns?

Within the P2P rolling returns chart, every level on the 1-year rolling returns chart represents the return from the funding made precisely 1 12 months earlier. Equally, every level on the 3-year rolling chart displays the efficiency of the funding made precisely 3 years earlier.

1-year rolling returns (as on June 30, 2022): Represents the returns from the funding made on July 1, 2021.

3-year rolling returns (as on June 30, 2022): Represents the returns (CAGR) from the funding made on July 1, 2019.

Within the SIP rolling returns chart, every level on the 3-year rolling returns plot characterize the returns for the SIP that began 3 years again.

As an illustration, 3-year SIP rolling returns (as on June 30, 2022): represents the returns from a SIP that began 3 years again. 36 SIP installments. Invested on final day of every month. First installment on June 30, 2019. Final installment on Might 31, 2022. Portfolio worth as on June 30, 2022.

What is an effective return to anticipate from fairness markets?

That is very subjective.

However I’m certain most of us wish to do significantly better than a financial institution fastened deposit.

Why?

What’s the purpose of taking danger if you happen to don’t do higher than a financial institution fastened deposit?

On condition that the financial institution FD charges have principally ranged between 6-8% p.a. during the last couple of many years, I’d wish to earn at the least 10% p.a. from my fairness investments to compensate for the extra danger (in comparison with financial institution FDs). In case your goal “good” return is totally different, you may view the evaluation in that mild.

Right here is how I’ve outlined varied return ranges (and also you don’t should agree).

Clearly, you’d wish to earn “Good”, Very Good” or “Glorious” returns.

Furthermore, from the attitude of deciding funding horizon, there must be 80% likelihood of “good” returns.

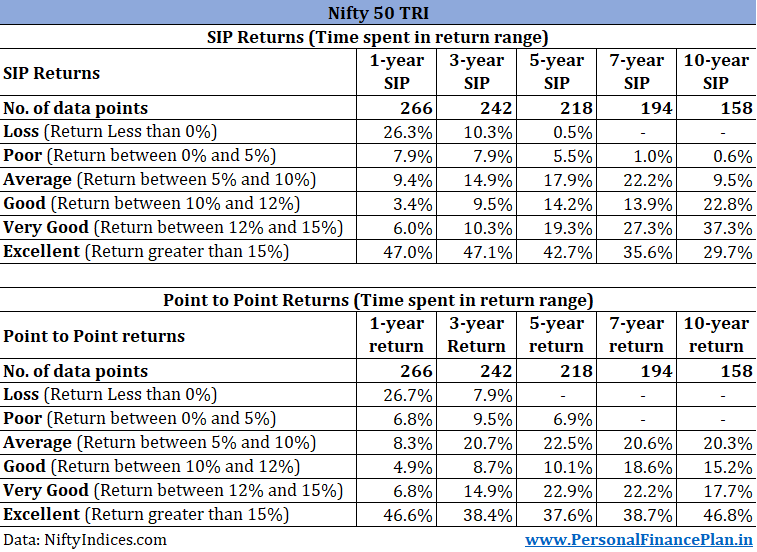

Nifty 50 TRI

As you may see, the 1-year efficiency is like toss of a coin. The patterns emerge once we improve the funding or SIP period.

The probabilities of incomes good (superb returns or glorious) returns improves with the period of funding.

For P2P returns (lumpsum funding), if the funding horizon is 7 or 10 years, the returns have exceeded 10% p.a. roughly 80% of the time. No occasion of loss or poor returns both.

For SIPs, a 10-year SIP has 90% likelihood of delivering greater than 10% p.a. For five-year and 7-year SIP, the likelihood drops to 76% and 77% respectively.

So, in case you are seeking to put money into Nifty 50, have an funding horizon of at the least 7-10 years for higher probabilities of incomes “good” returns. Observe that, regardless of the tenure you select, there isn’t a assure of excellent returns with fairness investments.

I may have checked out an extended tenure (say 12 and 15 years) too however then the variety of knowledge factors would have decreased.

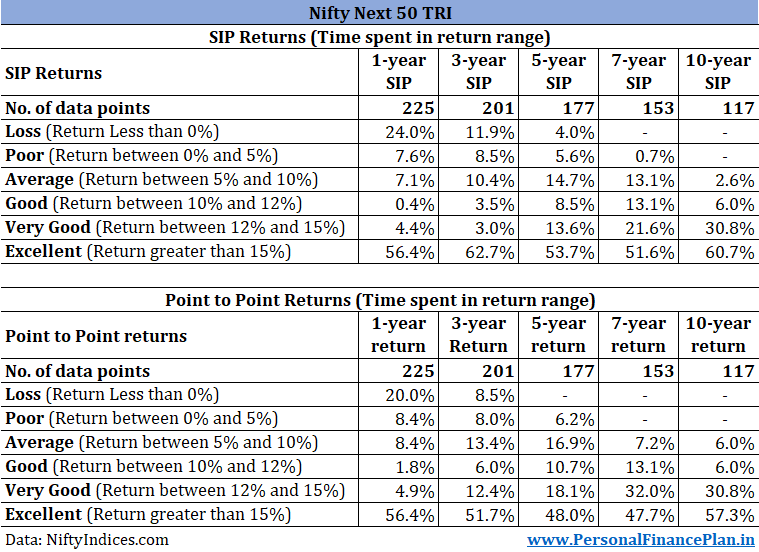

Nifty Subsequent 50 TRI

The efficiency is kind of spectacular right here. Simply taking a look at returns and never volatility.

For a lumpsum funding for 10-year interval, the probabilities of “Good” returns are 94%. Virtually 90% likelihood of incomes over 12% p.a. for a 10-year funding horizon.

For 7-year lumpsum: ~92% likelihood of “good” returns. ~80% likelihood of “Superb” returns.

For 10-year SIP: 97% likelihood of incomes of “Good returns”. ~92% likelihood of incomes “Very Good” returns.

For 7-year SIP: 86% likelihood of excellent returns. 73% likelihood of “superb” returns.

Once more, if investing in Nifty Subsequent 50, it is best to brace for at the least 7-10 years. The longer, the higher.

Nifty Midcap 150 Index

From the returns viewpoint, the efficiency is nearly as good and even higher than the Nifty Subsequent 50 index.

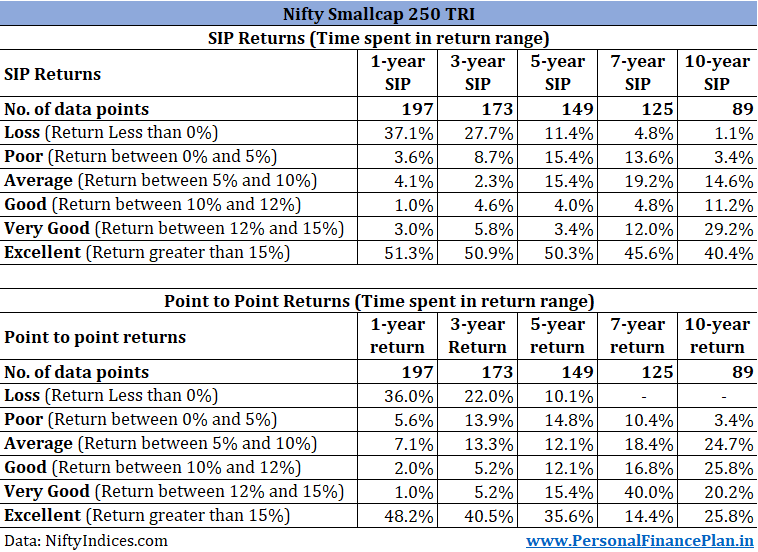

Nifty SmallCap 250 Index

The efficiency of Nifty Smallcap 250 index is a lot worse in comparison with Nifty 50, Nifty Subsequent 50 and the midcap indices.

7-year SIP has ~38% probabilities of leading to loss, poor or common returns. Even for 10-year SIP, the quantity stands at 20%.

For lumpsum investments, there may be 30% likelihood of loss, poor or common returns for funding horizon of seven or 10 years. 35% likelihood of <10% returns if the funding period is 5 years.

The return efficiency of Nifty Smallcap 250 index fund doesn’t encourage a lot confidence. You’re higher off sticking with midcap index.

If you’re eager to put money into small caps, you will have 3 choices.

- You want numerous luck. Occur to enter/exit on the proper time.

- It’s essential to work out a method to enter or exit on the proper time. Are you able to pull this off?

- Take into account an actively managed small cap fund. That has its personal set of dangers.

After I say that investing in a small cap index is just not a good suggestion, I’m referring to solely Nifty Smallcap 250 index. Different small cap indices (or issue based mostly small cap indices) might have a special methodology and the result could also be totally different.

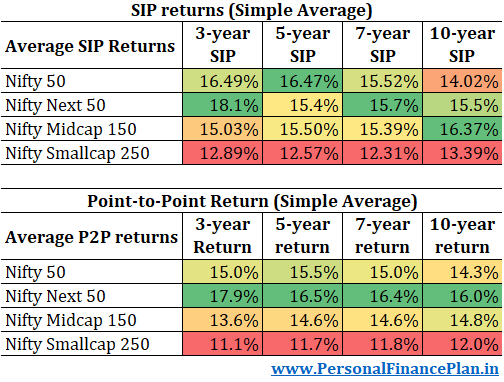

Efficiency Comparability of assorted indices

What does all this imply?

If you’re seeking to put money into equities by means of lumpsum or SIPs, give your self an extended rope. At the very least 7 to 10 years. Longer is best. In case your funding horizon is shorter, you’re leaving rather a lot to likelihood.

The outcomes (probabilities of good returns) enhance secularly with time.

Nifty Subsequent 50 delivers probably the most spectacular efficiency.

The efficiency of the smallcap index is probably the most pathetic. Decrease common returns. Decrease probabilities of good returns. And we all know small cap shares are extra risky too.

The Caveats and the Factors to Observe

- This evaluation is just for a Purchase-and-Maintain investor. If you’re a talented dealer and may time your entry/exits properly, this evaluation is probably not related for you.

- Do keep in mind that timing the market is a double-edged sword. Nobody will get it proper on a regular basis. Nevertheless, if you happen to get it proper extra typically and measurement your trades correctly, you’ll outperform Purchase-and-hold buyers. However, if you happen to don’t, you’ll underperform a easy Purchase-and-hold strategy. The issue is if you suppose you belong within the first class, however your outcomes place you within the second class.

- Moreover, I’ve thought-about broad-based diversified indices on this evaluation. This strategy might once more not be very related if you happen to plan to take concentrated bets and put money into particular shares.

- Previous efficiency doesn’t assure future efficiency. Due to this fact, take any set of again take a look at outcomes with a bucketful of salt. This evaluation is not any totally different.

- We now have a for much longer historical past for Nifty 50 index in comparison with different indices. Nifty 50 TRI knowledge is on the market since June 1999. Nifty Subsequent 50 from November 2022. Nifty Midcap 150 and Nifty Smallcap 250 from April 2005. Therefore, we’ve got totally different variety of knowledge factors for these indices.

- For the Midcap and Smallcap indices, the info received’t present the complete influence of bull run from 2004 to 2007. It’s essential to analyze efficiency in that mild. Nevertheless, each midcap and small cap indices confronted this limitation. And the midcap index has completed significantly better than the small cap index.

- I’ve thought-about the Whole Return indices (TRI) for this evaluation. The index funds monitoring these indices can have monitoring error. And you’ll anticipate monitoring error to be increased as you progress down the market cap. Therefore, small cap index funds will seemingly have a a lot increased monitoring error/distinction than Nifty 50 index funds.

- On this put up, I’ve targeted solely on returns. However the efficiency is not only returns. What about volatility and the risk-adjusted returns? For the reason that put up was concerning the returns, I’ve not thought-about these facets. For such facets, consult with this efficiency comparability of cap-based and issue indices.

I’ve additionally ready a video presentation on this matter the place I talk about all of the above facets in nice element. Do take a look at.

Knowledge Supply: NiftyIndices.com

Featured Picture Credit score: Unsplash