Expensive associates,

Welcome to February. It’s a month we affiliate with love, St. Valentine’s Day. As holidays go, it’s one other triumph for the entrepreneurs. The vacation started life as a Roman fertility pageant, Lupercalia, and its attendant events. Ultimately, the Christian church made the identical transfer right here as they did with the pagan year-end pageant; they repurposed the December solstice pageant into Christmas and the February fertility pageant into St. Valentine’s Day. The strikes gave them yet one more instrument for changing party-loving pagans into … properly, party-loving nominal Christians.

February itself was the month of purification, “februa” means “to cleanse,” forward of the Roman New Yr, which started with the planting of crops in March. And so that you’d take one final alternative to resolve outdated grudges, clear the air with aggrieved associates, assessment your portfolio, repent your errors, and start your new 12 months with a clear slate.

Okay, I may need slipped the “assessment your portfolio” bit in, however the remainder was completely Roman.

Serious about the brand new 12 months

For many buyers, 2022 was an execrable 12 months stuffed with dangerous outcomes and worst prophecies. 2023 has began off with a ferocious rally amongst a few of the lowest-quality shares; Morningstar’s screener exhibits 300 of the lowest-quality shares (home corporations with no financial moat and “excessive” worth uncertainty rankings) rose by 100 – 10,000% in January 2023. On the flip aspect, no large moat / low uncertainty inventory returned greater than 24%.

Morningstar, and others, imagine that the markets are broadly undervalued and that “the perfect days for buyers lie forward” (“Are We in a Low Return World? We Doubt It,” 1/27/2023). Their oddly cheerful conclusion is that bonds are priced to ship 1.5-2.0% actual returns over the approaching decade, with a 60/40 portfolio set to reel in 3.6% actual returns.

They is perhaps proper, however my colleagues and I recommend considerate warning.

Devesh’s essay this month, “In Protection of Taking Threat,” walks readers by means of the method of understanding and calibrating the dangers they’re exposing themselves to. One instrument he presents is a situation evaluation that begins to reply the questions, “how dangerous may it get?” and “what’s going to I do if it does?” A simplified model: (1) lay out your present portfolio by asset class, then (2) low cost your shares by 25%, your bonds by 10%, and your cryptocurrencies by 100%. The odds symbolize typical bear market outcomes. Verify the ensuing values and ask, “what ought to I do if this involves cross?”

| January 23 | December 23 | |

| Shares | $30,000 | $22,500 |

| Bonds | $15,000 | $13,500 |

| Crypto | $5,000 | $o |

| $50,000 | $36,000 |

Why assign zero worth to crypto? Easy. As a result of crypto is totally disconnected from something apart from pure hypothesis, there isn’t any manner of predicting its worth. Since you’ll be able to’t depend on it to be there (over 900 cryptocurrencies a 12 months fail, and their accounts go to zero), prudent budgets assume it received’t be there.

In live performance with Devesh’s work, I’ve shared the form and outcomes of Snowball’s indolent portfolio once more this 12 months. Utilizing the instruments at MFO Premium, I calculated my 12 months’s efficiency and the way it in comparison with what would have occurred if I had held the common fund in every area of interest moderately than those I picked.

The end result: the portfolio was down however by lower than anticipated. We discovered the identical factor after we checked out its efficiency through the Covid Bear in 2020. It seems that danger is stickier than returns (John Rekenthaler, beneath, discovered the very same factor in his seek for bear-resistant winners); there’s a predictive validity in deciding on managers who carry out properly within the long-term and have a file of thriving throughout downturns. That essay suggests a couple of classes from my occasional wins and plenty of errors.

Lynn Bolin departs from his regular behavior of setting up and testing portfolios to supply an prolonged evaluation of a single fund, American Century Avantis All Fairness Markets ETF, a low-cost, actively managed fund-of-funds that goals to outperform a passive benchmark. The truth that it’s led by DFA’s former chief funding officer, Eduardo Repetto, offers you a way of the dedication to harvesting the benefits of each energetic (flexibility, adaptability) and passive (low cost, clear) approaches. Collectively the administration staff has over 80 years of expertise at a half-dozen top-tier corporations.

On the theme of single funds, I additionally share an replace on The Prepare dinner & Bynum Fund, which immediately finds itself atop Morningstar’s rising markets (??) heap, and the newly launched Matthews Rising Markets ex-China Lively ETF. The potential resurgence of rising markets investing will information a bunch of our protection within the months forward.

Lastly, The Shadow gathers “all of the information you want to know,” not less than in regards to the funding trade, into his brief and sharp Briefly Famous.

On politicians and sustainable investing choices: Please shut up.

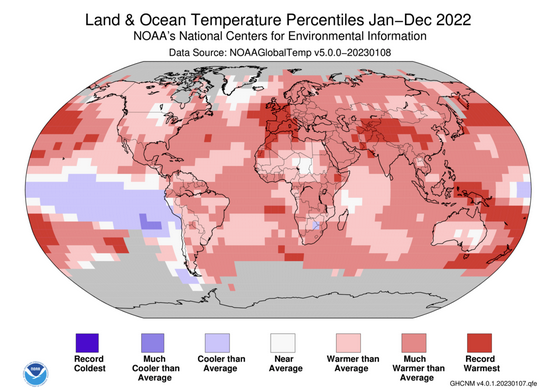

Our planet is in hassle.

Buyers’ choices about the place to commit trillions of {dollars} in property may make not less than a bit distinction within the battle to maintain the world liveable for us all.

That, in a nutshell, is the case for sustainable investing. There are, nonetheless, three issues with sustainable investing:

- It’s extremely sophisticated – what counts as “good”? What do you do with a agency that’s 50.1% good and 49.9% dangerous? What do you do with the perfect agency within the worst trade? How do you weigh publicity to carbon manufacturing as one danger issue relative to, say, mediocre administration or excessive debt hundreds, as others?

- Its associates. Throughout The Nice Inexperienced Orgy of 2020-21, funding entrepreneurs rebranded each slow-moving fund of their secure as an ESG automobile in addition to rolling out all the pieces from the Vegan ETF to limitless Carbon-Free, Carbon-Lite, Carbon-Impartial, and Inverse Double-Carbon Whammy funds and ETFs with nice fanfare however with none profound evaluation of their influence. The time period of the 12 months was “greenwashing.”

- Its enemies. Conservative politicians, working with even much less reflection than trade entrepreneurs, have latched onto ESG funds with the identical ardour {that a} bulldog latches onto a piece of brisket. Apparently, the scent of crimson meat triggers each. State-level bans on “woke investing” adopted.

Utah officers demanded that S&P withdraw its ESG scores for state bonds, and Missouri’s legal professional normal is main a multi-state investigation. Eighteen states are investigating Morningstar and its Sustainalytics arm. Nineteen states despatched a nastygram to BlackRock CEO, charging that BlackRock’s ESG sensitivity would “drive the phase-out of fossil fuels, improve vitality costs, drive inflation, and weaken the nationwide safety of the USA.” Texas bans cities from utilizing monetary corporations which can be woke. Florida barred the state’s pension fund from contemplating ESG components in any respect; it was shortly adopted by eight to 10 different states.

In idea, that is all being achieved to guard buyers’ returns. In observe, it’s one other tirade designed to advance a set of political ambitions within the title of defeating one other set of them. The New York Occasions highlighted the statements of Louisiana’s treasurer as an illustration: he denounced ESG investing due to “Louisiana regulation on fiduciary duties, which requires a sole concentrate on monetary returns for the beneficiaries of state funds” however then contradicted himself by declaring his actions have been “vital to guard Louisiana from actions and insurance policies that will actively search to hamstring our fossil gas sector. Merely put, we can’t be celebration to the crippling of our personal financial system” (“Politicians Need to Preserve Cash Out of E.S.G. Funds. Might It Backfire?” 1/30/2023). In case your “sole focus” is on monetary returns, then defending one politically highly effective trade needs to be off the desk.

However, for politicians, politics isn’t off the desk.

To which we reply, please shut up.

The reality is that investing is all about managing dangers and maximizing returns. Merchandise which fail one or each of these assessments are useless. Interval. Buyers is not going to constantly commit their assets to excessive danger / low return automobiles. That explains why funds and ETFs have been liquidated by the lots of and why underperforming managers are routinely fired by funding committees. Telling professionals that they’re forbidden from contemplating sure kinds of dangers doesn’t enhance our prospects. The sleek operation of that system requires transparency. It doesn’t require the intervention of politicians.

By all means, police greenwashing. Standardize disclosures and reporting. Publicize benchmarks and metrics. Encourage alternate options. However in any other case, hold out of individuals’s portfolios.

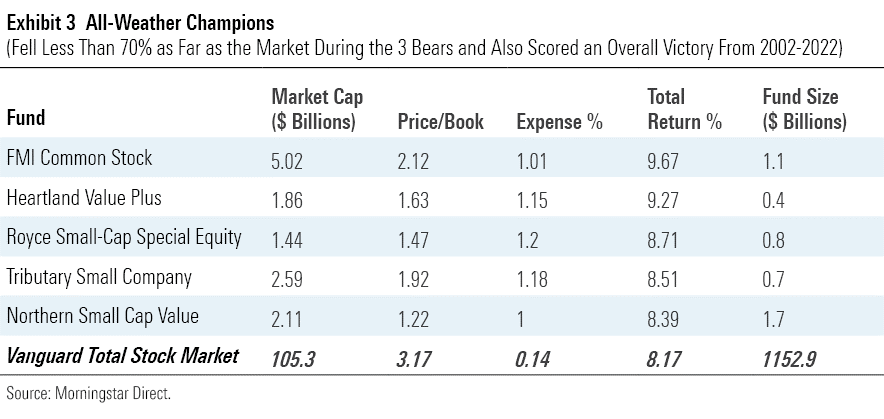

John Rekenthaler discovers the unhappy truths about all-weather funds

Fact #1: there are some, and so they have predictable traits.

Fact #2: nobody invests in them.

Mr. Rekenthaler, Morningstar’s curmudgeon-in-chief and longest-tenured fund savant, not too long ago went on the seek for funds that you simply may plausibly purchase and maintain endlessly. In step with our dialogue of danger and return administration above, he seemed for folk who outperformed the inventory market in the long run and guarded you throughout market turmoil. His standards have been:

all-weather U.S. fairness funds as these funds which have outgained the general inventory market over the lengthy haul whereas additionally experiencing lower than 70% of the inventory market’s decline in 2002, 2008, and 2022.

His completely satisfied discovering was that the funds that protected you in 2002 additionally seemingly protected you from the very completely different turmoil in 2008 and the still-different turmoil in 2022. That’s, danger administration was one thing that could possibly be maintained throughout completely different markets and completely different threats.

In the long run, Mr. Rekenthaler recognized 5 funds which have been successful in your behalf over the course of this century.

As he research the widespread traits of his winners, he notes,

the all-weather winners stand out from the mainstream. Every of the 5 all-weather funds is sponsored by a distinct segment group. The funds have comparatively few shareholders, and their performances are pushed by small to midsized corporations that promote at low value multiples. Predictably, their expense ratios additionally sharply exceed that of the index fund.

. . . essentially the most profitable all-weather funds stroll the place others have feared to tread. Their rivals’ reluctance is comprehensible. Small-value funds can languish for lengthy bull-market stretches, as through the late Nineties after which once more twenty years later. These occasions are intensely irritating. (Even perhaps worse for buyers than struggling outright losses is watching whereas others rating fats earnings.) Such lulls, together with unfavorable publicity, have restricted the quantity of property in small-value funds—particularly, as we’ve seen, among the many all-weather winners. (All-Climate Inventory Funds Do Exist, 1/12/2023).

By Morningstar’s calculation, 4 of the 5 funds have “energetic share” rankings of above 95; Northern Small Cap Worth, a quant fund whose program stops it from deviating from its benchmark by an excessive amount of, is the one exception. 4 of the 5 have MFO’s highest efficiency score over the previous 20 years, with Northern coming in only a notch beneath. We’d commend any of them to buyers who suspect that the subsequent market is perhaps extra delicate to valuations and fewer enamored with mega-cap progress than the frenzy simply handed.

Teresa Kong: Dwelling my values.

One small change coming to my portfolio can be discovering a alternative for Matthews Asia Complete Return Bond (MAINX) fund, a tiny “curiosity place” in my retirement portfolio. Supervisor Teresa Kong quietly left the agency in July 2022, and Matthews introduced their determination to liquidate their two fixed-income funds, each initially managed by her, in December 2022.

We’ve spoken with Ms. Kong on a number of events through the years. The truth that she’s sensible, devoted, and considerate is past query. Her arguments on the long-term prospects of Asian fastened earnings markets led me to way back set up positions in her flagship fund, a curiosity place in my retirement portfolio – that’s, simply sufficient cash to remind me to concentrate – and in my non-retirement one.

We caught up with Teresa in January 2023 to pursue two questions: (1) the place are you? And (2) what ought to I do with my portfolio? She had an enchanting reply to a kind of two.

Teresa grew up in Minnesota however has lived in Hong Kong, China, and Germany, the place she met her husband, a Czech citizen. She’s studied at a few of the world’s greatest colleges and has labored for a few of its greatest monetary corporations. And she or he determined, after 25 years within the enterprise, it was time for a change.

“Curiosity has all the time been certainly one of my core values. Dwelling in Hong Kong then China, I couldn’t assist however surprise about why some locations prosper, different wither. Why some have lives stuffed with which means, and others don’t. And so I’ve determined to middle this chapter of my life round my values.”

Specifically, she’s working with two small corporations on tasks that may find yourself being actually consequential. The “moon shot” challenge is working with a start-up that’s attempting to assist folks reassert “information sovereignty.” The brief model is that Google, Meta, and others make billions of {dollars} a 12 months by vacuuming up your private info – what apps you employ, what websites you go to, what searches you conduct, what folks you contact, what companies you’re linked with – and promoting it to different companies. They get billions. You get bupkus. (Technically, you get your privateness invaded, along with bupkus.) The startup is taking a look at expertise that may can help you obtain negotiating leverage with the Googles of the world: “you get (a) the information I select to launch as long as (b) I get honest compensation for it.”

The second challenge is the pursuit of “meals sovereignty” by means of the creation of a vertical farm in Bloomington, Delaware. Along with being Joe Biden’s residence district, Bloomington is a meals desert, a spot the place the vast majority of residents don’t have routine entry to recent, wholesome, reasonably priced meals. Teresa’s challenge – which features a group house, studying house, and kitchen along with the farm itself – goals to vary that. They’ve an architect engaged on securing a website and are working by means of the IRS paperwork to develop into a 501(c)3 non-profit group.

The second challenge is the pursuit of “meals sovereignty” by means of the creation of a vertical farm in Bloomington, Delaware. Along with being Joe Biden’s residence district, Bloomington is a meals desert, a spot the place the vast majority of residents don’t have routine entry to recent, wholesome, reasonably priced meals. Teresa’s challenge – which features a group house, studying house, and kitchen along with the farm itself – goals to vary that. They’ve an architect engaged on securing a website and are working by means of the IRS paperwork to develop into a 501(c)3 non-profit group.

The one query she couldn’t reply is what to do with my portfolio. There’s, she agrees, nothing fairly just like the Matthews Asia fastened earnings funds. She has promised to mull over the probabilities and share her conclusions within the months to return.

We want her properly.

Jeff DeMaso: Dwelling my publication!

We famous in January that Daniel Wiener’s iconic Vanguard investor publication was present process two epochal modifications. First, following a call by their long-time writer, they have been ceasing manufacturing of their bodily publication and transferring completely on-line. Second, Dan’s long-time affiliate Jeff DeMaso was succeeding Dan because the face of the franchise.

Tania Mitra, writing for CityWire, studies that “Adviser Investments’ director of analysis Jeff DeMaso has left the agency after 12 years to concentrate on his publication, The Impartial Vanguard Advisor” (“Adviser Investments gatekeeper exits to concentrate on Vanguard funds publication,” 2/1/2023). Mitra quotes Jeff as saying

What’s subsequent for me is actually going all in on this text, that in some methods, I’ve been engaged on for the higher a part of a decade. The brand new wrinkle and the why now could be that I bought a chance to self-publish and personal the publication and getting the prospect to go all in [and] concentrate on the entrepreneurial angle of beginning a brand new publication appealed to me and [it] wasn’t one thing I may flip down.

The Impartial Vanguard Adviser web site presents some new free content material weekly, in addition to peeks at its premium content material. The newest weekly publication highlights a brand new fund launch, supervisor modifications, and Jeff’s outlook for the 12 months (umm … optimistic).

We want him and his venerable senior accomplice nice success as they attempt to assist buyers make the very best use of the more and more troubled $2 trillion beast.

Yet another certainty misplaced: “A pint’s a pound the world round!”

Charles Adiel Lewis Totten (1851 –1908), a Nineteenth-century British eccentric (the time period is nearly a tautology), wrote the theme track for the Worldwide Institute for Preserving and Perfecting (Anglo-Saxon) Weights and Measures. He entitled his pub favourite hit, “A Pint’s a Pound the World Round,” in 1883, which included these strains:

Then swell the refrain heartily.

Let each Saxon sing:

“A pint’s a pound the world round.”

Until all of the earth shall ring.

“A pint’s a pound the world round”

For wealthy and poor the identical;

Simply measure and an ideal weight

Known as by their historical title!

I’ve found this month that shrinkflation has gutted this final courageous outpost of (Anglo-Saxon) Weights and Measures. Hefting my 15 ounce pint container of yogurt subsequent to my 10.5 ounce pound of espresso (down from final 12 months’s 12 ounce pound), I noticed the final remnant of cosmic certainty drift away just like the fog.

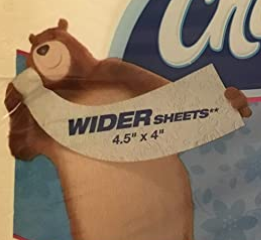

At the least I can console myself with Charmin’s wider sheets**.

About these **. Toilet tissue, to be well mannered, was as soon as standardized at 4.5 x 4.5”. To masks value will increase, the sheets have been trimmed to 4.2 x 4.2”. And now producers give you a motive to cease complaining about value gouging: you’re getting Wider Sheets! But in addition shorter ones (4,” down from 4.2 and 4.5), which we needn’t point out.

Thanks, as ever …

Lupercalian blessings to our reliable regulars, the nice of us at S&F Funding Advisors, Wilson, Gregory, William, the other William, Brian, David, and Doug.

On January 2nd we acquired a word and a contribution from an outdated buddy, Crash, who’s having fun with retirement and nonetheless including to his assortment of 8300 feedback on the MFO Dialogue board. Cheers, huge man!

Lastly, Gardey Monetary Advisors, Benjamin from Ann Arbor (the everlasting squabble is whether or not I win and we go to Zingerman’s first or she wins and we go to Discovered … TBH, she wins), Joseph, Andrew from Akron, and John. We thanks all.

As ever,