I feel the likelihood of a recession occurring within the subsequent 12 to 18 months is far increased than at any level over the previous 12 months. However whether or not I’m proper or unsuitable is irrelevant; the query is, does it actually matter?

I’ll argue that it doesn’t.

I’ll argue that what issues is what occurs to your investments and what, if something, you need to do to prepare in case I’m appropriate.

It might be unwise to proceed this weblog with out restating one in all my damaged document sayings: you need to all the time be prepared for A recession fairly than making an attempt to prepare for THE recession.

One other means of claiming that is that there’s a 100% likelihood that we’ll have a recession sooner or later, however there may be near a 0% probability which you can really guess when it is going to begin and finish.

Which means you’ll be able to’t time your investments primarily based on if you assume a recession will begin and finish. So, you’re all the time higher off being prepared for a recession always because it pertains to your funding technique.

Listed below are some the explanation why I feel there’s a excessive likelihood of a recession over the subsequent 12 months or so:

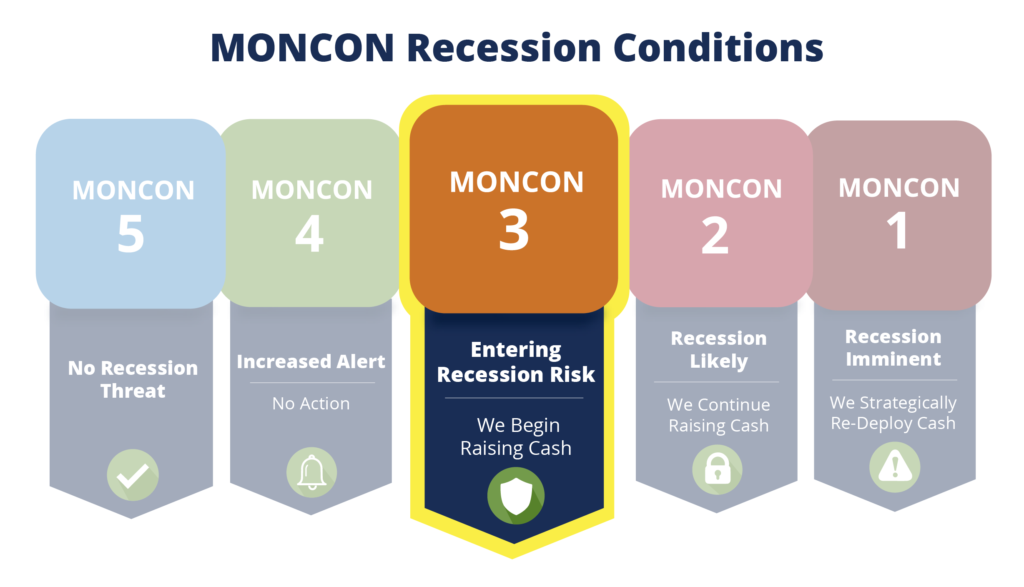

- Our MONCON studying is at THREE, and that’s the primary time it has not been a FIVE since we began formally concerning it in our decision-making course of*. See our weblog right here for an evidence of MONCON and the way we use it.

*The COVID recession change in MONCON from 5 to 1 in a single week doesn’t rely in my e book as a result of that recession was attributable to a single occasion vs. a altering financial system and MONCON tracks the modifications in financial indicators. In different phrases, it’s not an occasion crystal ball.

- Yield Curve Inversions – Whereas there may be quite a lot of speak concerning the inversion of the two/10 yield curve, we’ve began taking a look at all of the completely different mixtures of yields. There are 28 mixtures of yield spreads with sufficient significant information to observe, and 68% of them are inverted.

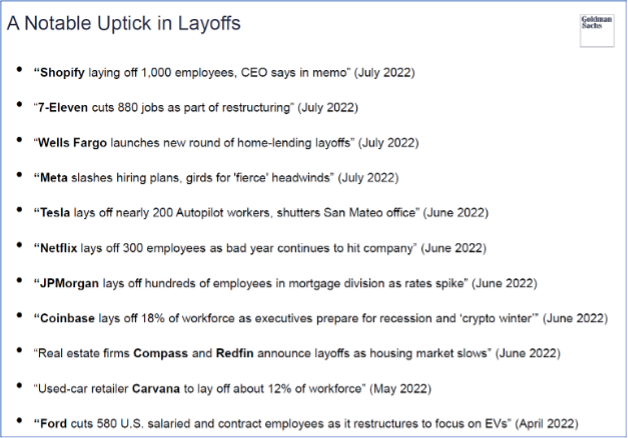

- There have been quite a lot of layoffs – see under:

Listed below are some causes I might be unsuitable:

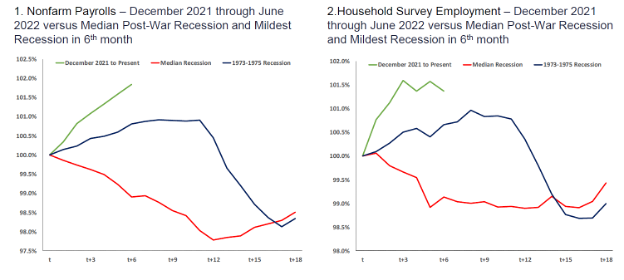

- The current jobs report – Up solidly this 12 months…not regular in a recession

- The current family Survey Employment report – Up solidly this 12 months…not regular in a recession

See the inexperienced traces under within the charts from Goldman Sachs…it’s simply not trying prefer it usually does in a recession.

BUT DOES IT MATTER!!!???

I feel what issues greater than being proper or unsuitable a couple of recession is what occurs within the markets (except you lose your job, however that’s one other story).

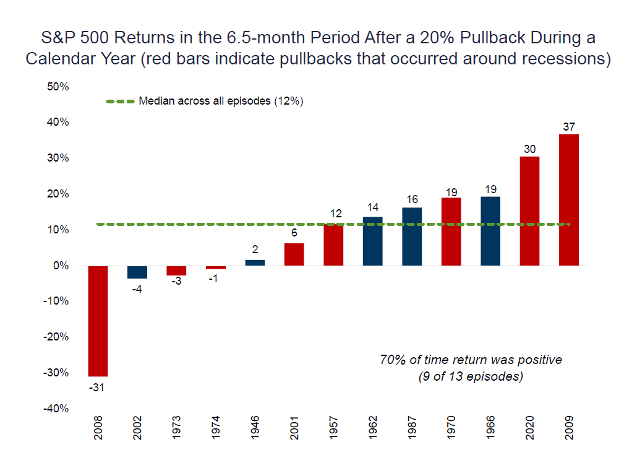

The truth is that 70% of the time, the S&P 500 has optimistic returns inside the subsequent 6.5 months after a 20%+ pullback. Right here’s proof, once more from a Goldman report – take note of the crimson bars, which point out the pullback occurred throughout a recession.

Now, right here’s what I ALSO see…there are 4 occasions when the S&P 500 was adverse after 6.5 months after a 20% pullback. (Sorry, that’s quite a lot of ‘afters’ however I’m not dwelling on it.) Of these 4, three are down single digits, with adverse 4% being the worst of these thrice.

That adverse 31% is OUCH after all, however that was 2008. And I don’t assume we’re in 2008.

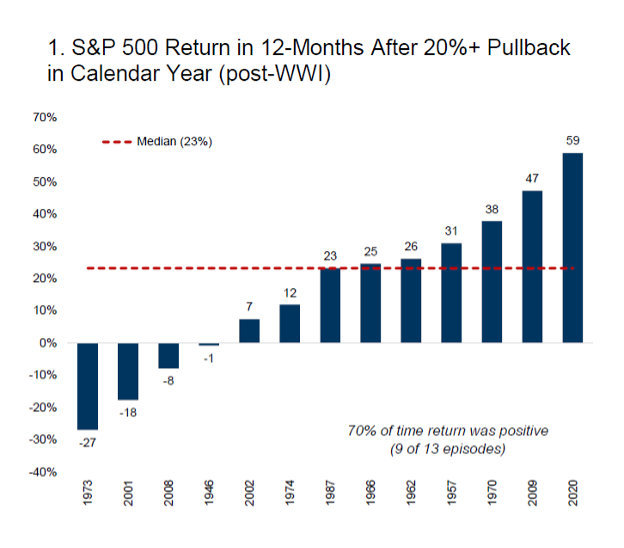

6.5 months – okay, that’s bizarre…why not 6 or 7? Undecided, however listed below are the returns lookin’ out on the 12-month mark. (Once more: Goldman Sachs)

There may be some severe OUCH in right here, however once more, take a look at the percentages and the returns…70% of the time, the market is optimistic and the median return is 23%.

By the best way…for these of you asking, “Okay, what about two years out?” I’ll spare you the graph and simply let you know it’s a +32% median return over the two-year holding interval publish a 20%+ pullback.

One final level about the way it issues extra what the market does than if we’re in a recession…I promise that is it.

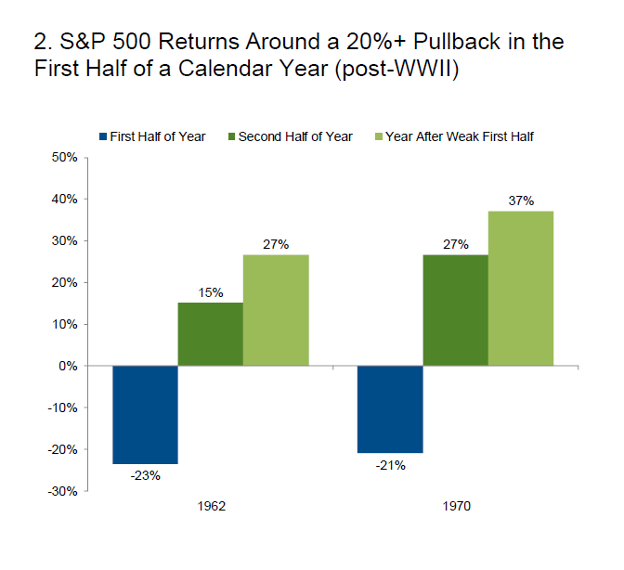

Everybody retains saying this was the worst first half of a calendar 12 months ever. Okay, if we’re going to zero in on a time period…let’s play it out:

I don’t assume I would like to elucidate this any additional.

In different phrases, mic drop on that subject. Hat tip to 1970, the place the returns within the second half utterly worn out the losses from the primary half of that 12 months, and one full 12 months later, there was a 37% optimistic return.

What to do

Look, I simply have quite a lot of conviction within the following recommendation – nobody can guess these items any greater than somebody can guess what two cube will flip up on a craps desk. All I do know is {that a} SEVEN is the quantity the place everybody loses. (In case you are a craps professional, give me some leeway right here so I don’t have to elucidate the “Come Out” roll.) And SEVEN can also be the quantity with essentially the most mixtures of the 2 cube. After that, the almost certainly combo is SIX and EIGHT.

Craps gamers love SIX and EIGHT…as a result of it’s more likely to come up.

However with investing, many individuals wish to assume they know what’s coming subsequent.

So I’m adamant that utilizing the percentages which are in your favor is the very best technique when every part else is solely guessing.

The important thing right here can also be understanding there will likely be occasions that you could be nonetheless lose although the percentages are in your favor. See this weblog I wrote on the result of the Superbowl LIV in 2020. It was when the San Francisco 49’ers had a +90% probability of profitable the sport towards the Kansas Metropolis Chiefs with 7:13 seconds remaining within the recreation.

The 49er’s, with a 10% probability of shedding, F’ING LOST.

Your greatest guess is to take good odds and have a long-term outlook out there and a short-term outlook on liquidity (which means HAVE CASH).

As a result of nobody is aware of what is going to occur, I feel every investor wants to take a look at how a lot of their money they’ve depleted from their financial savings and see if it’s sufficient to make it one other 12 months.

If not, provided that there was a rebound again to a couple of -13.5% loss (relying on if you learn this) vs. the low of -22.55% off the final S&P 500 excessive, you’d be foolish to forgo doing a plus up the money now.

Higher to be unsuitable at -13.5% than if we took one other downturn and want to boost the money then.

We could already be in a recession, or it could nonetheless be on the horizon, however the fairness market doesn’t converse the identical language. I counsel enjoying the percentages whereas additionally enjoying it somewhat secure. I don’t see the financial system as being in an unstable state, which suggests I’ve some respectable confidence within the odds of the market doing higher, even when it’s into the enamel of a recession.

“Create and follow a plan – that’s the very best factor you are able to do.” Billy Beane, the man from the film Moneyball, stated that about investing.

(Okay, I made that up, however I swear he would say that 70% of the time if you happen to requested him about investing, so it’s potential I might be unsuitable.)

Oh, and tune out the noise and the controversy over whether or not we’re in a recession or not…it’s all political get together bullshit. I can guarantee you that if it was 2017, when the R’s held the bulk in each homes and the White Home, R’s can be saying there was no recession, and the D’s can be screaming that two back-to-back adverse GDP prints is the classical definition a recession.

Insert face palm emoji.

AND WHO CARES – none of them know a rattling factor anyway. So do your self a favor and activate the brand new season of Beneath Deck Mediterranean Season 7 and watch some actual drama if you happen to want a break. Or the Outdated Man with Jeff Bridges on Hulu…actually good after you make it by way of the primary 45 minutes of the primary episode.

Name us with any questions or considerations and remember to take a look at among the current episodes of the Off The Wall Podcast, they’ve been very talked-about this 12 months.

Preserve trying ahead.