Disclaimer: This isn’t funding recommendation. PLEASE DO YOUR ON RESEARCH !!

As this submit has turn out to be fairly lengthy, right here is the Elevator pitch:

DCC Ltd, a 4,3 bn market cap UK listed, Eire based mostly firm at a primary appear to be a really boring, unremarkable assortment of very boring distribution companies. A second (or third) look nevertheless, reveals a really steady , nicely managed distribution firm that has been compounding EPS at double digit progress charges for the final 28 years and might be purchased for a really modest valuation of ~10x earnings. The corporate clearly faces some challenges however this is likely to be greater than outweighed by superb capital allocation, firm tradition and progress alternatives.

- Historical past

DCC has a really fascinating historical past. It was based really as some type of Enterprise Capital firm in 1976 in Eire and was led for 32 ears by founder Jim Flavin. After turning into an working firm, DCC went public in 1994. Through the years they acquired lots of companies, a lot of these the place distribution companies from oil majors but in addition in different areas reminiscent of well being care and expertise elements.

What I discover extraordinarily spectacular is their monitor report since they listed in 1994 and is obtainable in every annual report:

So not less than for the final 28 years since itemizing, they’ve compounded at a really first rate fee.

2. Enterprise mannequin

DCC’s essential companies are distribution companies. In my portfolio I’ve a few distribution corporations amongst them are Thermador, Photo voltaic and Meier Tobler. Listed here are just a few factors with regard to distribution which might be possibly value mentioning:

- Distribution is including probably the most worth if there are lots of suppliers and lots of prospects

- Pace and availability are not less than as vital as value

- outsourcing of Working capital necessities: If a buyer is aware of that he can get the required gadgets rapidly, there’s much less want to carry massive volumes of stock

- to a sure extent it’s also an “infrastructure” play, as it’s worthwhile to construct bodily infrastructure reminiscent of warehouses and so forth.

- Returns on capital Employed are often good however not tremendous nice as “exhausting property” reminiscent of warehouses and stock must be financed

- Gross margins are usually fairly low, however steady

- Buyer relationships are fairly steady if the distributor provides worth for the client. Typical Distributors don’t spend that a lot on advertising and marketing

Enterprise traces:

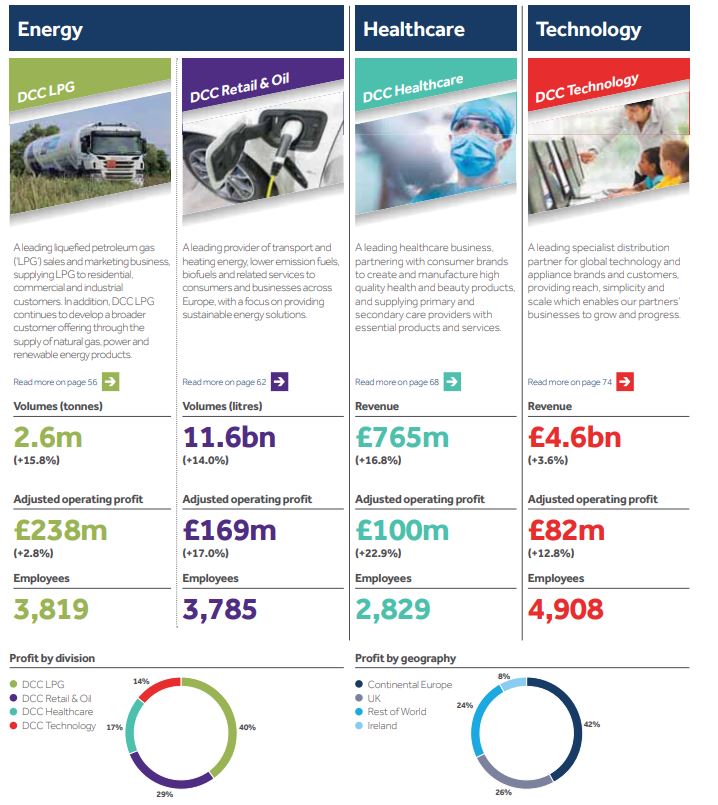

Of their annual report, DCC has an ideal overview over their enterprise traces:

Power enterprise

The vitality distribution enterprise consists of two enterprise traces:

- Mobility

That is the smaller phase is right here they’re mainly operating a sequence of filling stations and ship heating oil to customers. The mobility enterprise is definitely fairly comparable with Alimentation Couche-Tard with the addition of offering heating oil to households. Normally they receives a commission per liter in that enterprise and don’t bear and oil value danger - Power options

On this phase, they’re providing LPG largely to industrial prospects. LPG is definitely a fairly fascinating enterprise, particularly now with the dearth of Pure gasoline. Once more, to my understanding they solely have quantity danger however no value danger.

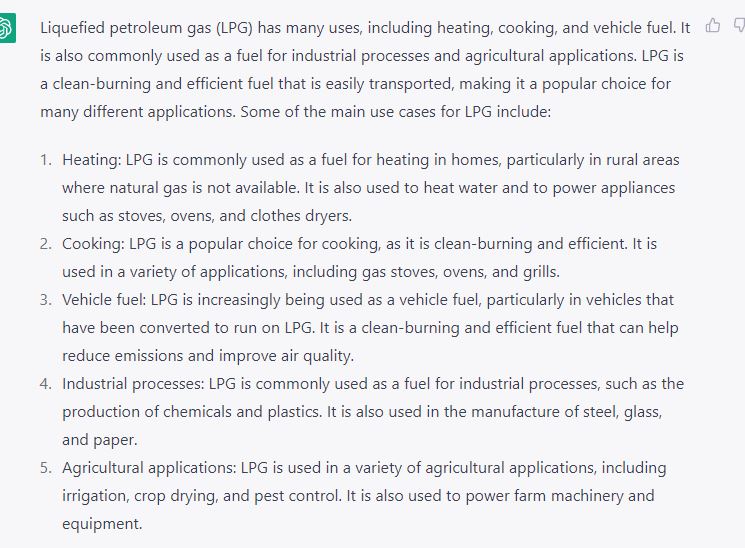

The LPG enterprise is a really fascinating enterprise in my view. In a primary try to make use of ChatGPT, that is was the AI offered on the makes use of of LPG gasoline:

LPG is often a really steady enterprise and proper now a reasonably “scorching commodity” and distributing it needs to be a superb enterprise. For example I discovered this instance of huge German industrial Glass producer Schott constructing massive Propane (LPG) tanks as a fallback for Pure Gasoline shortages. As much as a sure extent, LPG can be utilized to switch Pure gasoline particularly to generate warmth.

Healthcare:

Healthcare contains just a few main companies. DCC Very important is a basic distributor, distributing medical merchandise to hospitals, medical doctors and different main care suppliers. DCC Well being and Magnificence is somewhat an outsourced manufacturing enterprise that produces tablets, capsules, gels and so forth. within the areas of vitamin (well being dietary supplements) and sweetness merchandise for Model corporations. Just a few months in the past they made an fascinating acquisition within the Healthcare Sector with MediGlobe that appears to suit nicely with DCC Very important. Total DCC Healthcare grows properly and has above common margins and ROCE’s.

Expertise

DCC Expertise contains a number of companies that distribute “technological” merchandise primarily in North Amercia. The newest acquisition was a enterprise known as Almo which as actually vital with an EV of 610 mn and EBIT of 70 mn. Almo appears to distribute kitchen home equipment, shopper electronics. audio gear from producers reminiscent of Samsung, Jabra, Electrolux or Liebherr through a variety of distribution facilities within the US. Up to now, margins and ROCE in that phase was under common however the Almo acquisition might change this. And the CEO of Almo has an fascinating first identify: Warren. Of the three phase, that is the one the place I possibly perceive the least what are the principle drivers.

One fascinating side: I’d have thought that they’ve a a lot larger UK share however it’s “solely” 24% of earnings.

Why is the inventory low cost ?

Trying on the share value, we are able to see that the inventory virtually “exploded” between 2013 and 2017 and since then has been roughly buying and selling sideways after which downwards. On the time of writing, the inventory really trades at 7 12 months lows:

As we are able to see under, that is largely pushed by a really extreme contraction in multiples as we are able to see on this chart:

In 2016 and 2017, traders thought {that a} honest ahead P/E was thought-about to be 25x, for the time being, the consensus is barely 9-10x. Regardless of Covid and so forth. GAAP EPS will improve from 2,69 in 2016/2017 to an anticipated 3,73 GBP for the present 12 months. Possibly 25x was too wealthy, however 10x appears to be like low cost for a corporation that is ready to develop earnings so constantly.

Curiously, the height in a number of and share value correlates with the final change within the CEO position in 2017. A part of the meteoric rise of the valuation a number of might possibly defined by the relisting of DCC from the thinly traded Irish inventory Trade to London in 2014 and becoming a member of the FTSE 100 in 2015.

The oil and gasoline enterprise is the outdated core enterprise of DCC and could possibly be additionally half of the present drawback: With the advance of Electrical autos and the Power transition, one can clearly argue that this enterprise can solely shrink over the following 10-20 years. As well as, “ESG” oriented traders may not wish to put DCC into their portfolio.

Nevertheless what I discover actually fascinating is that DCC has already reacted and formulated a brand new technique for the vitality division in Might 2022. In a nutshell, what DDC tries to attain is that they wish to assist their prospects to transition to an vitality combine with a a lot decrease Carbon impression.

How do the wish to do that ? Just by providing their prospects decrease carbon options reminiscent of biofuels, warmth pumps and so forth. Already in November final 12 months, they confirmed in an fascinating Presentation how this works in observe: Providing photo voltaic rooftop set up in France, Sustainable Aviation Gas in Denmark and EV charging posts for his or her gasoline station community. In addition they acquired just a few corporations with a purpose to develop their choices to prospects:

My evaluation is that there’s clearly a danger but in addition a big alternative within the vitality enterprise of DCC. In an effort to mirror the danger, a barely larger return needs to be required.

Yet one more side to say is that at the moment money conversion of DCC’s enterprise is considerably under the historic imply of near 100%, primarily attributable to inflationary strain. As a distributor, DCC is, prefer it’s peer hit by inflation immediately as costlier merchandise imply larger working capital wants. If it’s worthwhile to have 100 gadgets of merchandise x out there and the value will increase 30%, this interprets in a short time right into a 30% larger working capital requirement.

Then again, their worth proposition of outsourcing working capital will get much more enticing, so pricing energy is definitely there which ought to permit higher money conversion going ahead.

Total, I do suppose that there are clearly some elements that may clarify the present low valuation, however I believe that this doesn’t justify it, which for me is the everyday definition of an funding alternative.

Administration Incentives

As DCC is an organization that’s not Founder/household owned/run, a more in-depth have a look at the incentives is vital with a purpose to perceive potential conflicts in alignment.

The CEO Donal Murphy has been with DCC since 1998 and is CEO since 2017. He earns a “first rate” wage of round 3,5 mn GBP, but in addition owns shares in a worth of ~12x his wage. Kevin Lucey, the CFO solely owns 2x his wage in shares however has been appointed solely in 2020. There are necessities for the highest degree administration to carry shares as a a number of of their wage. As well as there’s a efficiency associated bonus plan in addition to a long run incentive plan:

Bonuses

The chief Administrators will proceed to take part within the bonus plan for the 12 months ending 31 March 2023, in step with the Remuneration Coverage, with bonuses based mostly 70% on progress in Group adjusted EPS and 30% on strategic goals; the utmost award alternative for the 12 months might be 200% of wage for the CEO (the utmost alternative

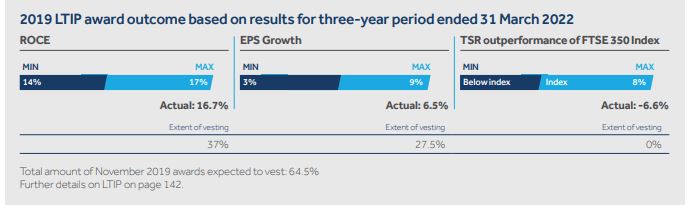

LTIP

The chief Administrators might be granted LTIP awards within the 12 months ending 31 March 2023 in step with the Remuneration Coverage. The efficiency situations will proceed to be based mostly on ROCE, EPS and TSR efficiency over three years. The grant worth might be in step with that within the 12 months ended 31 March 2022 at as much as 200% of wage for the CEO and CFO.

Total I believe the motivation scheme is above common with very cheap KPIs (EPS, progress, ROCE, share efficiency) that ought to align shareholders and administration moderately nicely. What I additionally like that they’re very clear of their reporting. a quite simple overview like this chart from the earlier annual report needs to be in any report however sadly isn’t.

The one unfavorable side that I discovered is that for the 2019 LTIP, the retroactively adjusted one of many standards resulting in the next award, each, for the CEO and CFO. Initially, UK inflation was the benchmark for EPS progress and they might have missed this with the skyrocketing 2022 inflation numbers. So that they retroactively modified it to the more moderen LTIP schemes which defines a hall of 3-9% EPS progress. Not nice however Okay in the event that they don’t repeat this.

Capital allocation & Company tradition

In a various enterprise like DCC’s capital allocation is essential. From what I’ve seen to date, what they do appears to be very disciplined. They allocate based mostly on their value of capital throughout their 3 platforms. They’ve performed just a few bigger acquisitions during the last 12 months and it must be seen how they develop, however as an example they’re at all times releasing first rate details about every acquisition together with buy value and EBIT on prime of the strategic rational. The massive US acquisition as an example appears to be like very enticing at an EV/EBIT of seven and administration staying on board. Up to now additionally they did’t need to make massive write-offs on any acquisition.

In the mean time, “Serial acquirers” aren’t that widespread anymore however I believe that they’re a really first rate “serial acquirer”.

With regard to tradition, from what one can see from the skin, the group appears to be like like an entrepreneurial, decentralized mannequin which is possibly the one method to run such a enterprise. Glassdoor opinions are surprisingly good for such an unsexy enterprise.

Total I’d fee each, capital allocation and company tradition as very excessive.

Valuation:

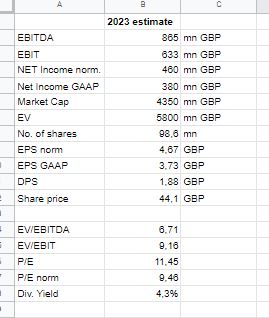

For the present enterprise 12 months, estimates are as follows (Supply: TIKR):

One side value mentioning right here is that DCC reveals each, GAAP earnings and “normalized” earnings. They do that fairly clear:

The “exceptionals” largely contains M&A associated bills, reminiscent of earn outs and m&A prices. Right here I’d hesitate to normalize as M&A is aprt of DCC’s enterprise fashions.

Nevertheless the amortization of Intangibles is one thing that I’d certainly neutralize as that is on the finish of the day a pure accounting entry. So for me the “Appropriate” degree of earnings can be 385 pence for 2021/2022 however not the 429 pence.

For the primary 6 months of the 12 months, EPS progress has been round +9%, so assuming “my adjusted” EPS for the present years of 400-420 Pence can be reasonable which in flip provides us a really modest P/E of round 10.

In an effort to worth the share, we have to make an assumption of the longer term progress fee. Traditionally, DCC managed to develop by ~12% for the final 28 years. Going ahead, Administration targets double digit charges as might be seen on this graph with 3-4% coming from natural progress and the remainder from M&A:

Curiously, as talked about earlier than, the bonus plans of DCC’s administration goal a EPS progress fee of 3-9%, that means that the utmost bonus is reached at 9% EPS progress which might be on the decrease finish of the acknowledged targets above. Subsequently I believe {that a} progress fee of one thing between 7-9% is possibly extra reasonable within the mid- to long term.

On the present estimated dividend yield of ~4,5%, this might imply an anticipated return of of between 11,5% to 13,5% in the long run, assuming no change in valuation a number of which I’d discover extraordinarily enticing.

My value goal for a 3-5 12 months holding interval can be between ~58 GBP (3 years 7% progress, fixed exit a number of, together with dividends) and 95 GBP per share (5 years, 9% progress, 13x Exit P/E).

Different traders

The investor base is nearly completely made up of huge institutional traders (Blackrock, Invesco, Vanguard and so forth.) which is without doubt one of the essential weaknesses. Up to now Governance appears to be OK, however having not less than some “robust fingers” can be preferable. Then again, this might even be an invite for a Non-public Fairness take over bid. Which to a sure extent is a danger as a result of this might cap the upside for traders if they’d are available on the present value degree with the same old premium of 30-40%.

Professional’s and Con’s

As at all times, earlier than coming to a conclusion, lets have a look at a listing of Professional’s and COn’s for DCC as a possible funding:

Execs

+ nice 28 monitor report

+ Helpful metrics (ROCE) for administration incentives

+ superb reporting

+ fascinating firm tradition with decentralized determination making

+ very cheap valuation

+ first rate progress alternatives

+ low beta, traditionally steady enterprise mannequin

Impartial

+/- progress pushed by m&A

+/- OK returns on capital/ low “headline” margins

+/- not an apparent “ESG pleasant” enterprise mannequin

+/- very numerous companies

Cons

- barely elevated leverage at first of a possible recession

- Working capital improve attributable to inflation

- Comparatively great amount of goodwill/Intangibles attributable to acquisitions

- Retail Power enterprise wants to remodel

- no household/Founder/massive shareholder

- ugly share value improvement over the previous 7 years

Abstract:

I’ve been DCC a number of occasions throughout the previous few years. I’ve been launched to the corporate by my pal Mathias just a few years in the past, he has a pleasant abstract in his 6M 2020 report (German).

DCC ticks most of the packing containers that I’m searching for: An unsexy enterprise mannequin that could be very nicely executed, an organization with an ideal tradition and at a really first rate valuation with first rate progress outlook and an ideal monitor report. There are clearly challenges and naturally I would favor the next possession from Administration, however total I discover the danger/return profile extraordinarily enticing.

Timing clever, it is likely to be somewhat bit too early because the inventory chart doesn’t look good (7 12 months low as talked about) however as a rule I are inclined to ignore this. What I discover very enticing right here is that DCC just isn’t a Contrarian inventory however somewhat a uncared for one.

Therefor I allotted ~5% of the portfolio to DCC at a value of round 43 GBP per share. I financed this largely by promoting the remaining 3U place and promoting somewhat TFF.

Disclaimer: This isn’t funding recommendation. PLEASE DO YOUR ON RESEARCH !!