In creating and advertising and marketing a product, it may be extraordinarily useful to create purchaser personas. Most of us have had some expertise in growing or reviewing purchaser personas. There’s one space of insurance coverage, nonetheless, the place purchaser personas turn into barely extra complicated as a result of they’re layered. If I’m an insurer making an attempt to promote a selected voluntary advantages product, for instance, I’ve to considerthe worker as a purchaser and buyer, the SMB proprietor as a facilitator and buyer, and a advantages dealer as each a distribution channel and communicator. How does the insurer or voluntary advantages supplier attain the SMB employer with the suitable merchandise in the suitable channels in a approach that can be useful and can attraction to the workers?

The reply is expertise.

The SMB insurance coverage market is a big, helpful market. It’s all the time rising and value reaching. It pays glorious dividends for many who are ready to fulfill their wants. However there are some keys to unlocking the market. We are able to discover these keys by wanting on the views of the essential stakeholders — the SMB homeowners and their staff. Majesco analysis can lend proof to your purchaser personas by supplying you with particulars surrounding SMB proprietor and worker sentiment. Start your information gathering utilizing SMB survey statistics from Majesco’s 2022 SMB report, A Quickly Altering SMB Panorama: Development Alternatives Grounded in Grit and Resilience. In at present’s weblog, we’ll take a look at 5 classes that insurers can use to maximise alternatives within the SMB house.

Gen Z/Millennial SMB Homeowners Will Contemplate Procuring By way of Any Channel

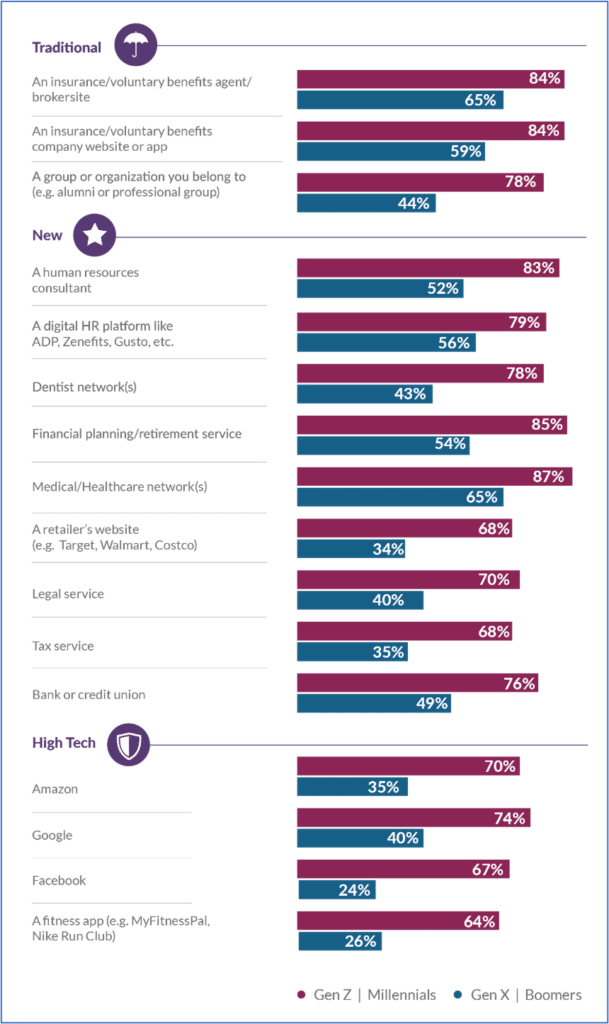

Channels are altering and SMB homeowners are open to the adjustments. In line with Majesco’s survey, when securing voluntary advantages for his or her staff, Gen Z/Millennial SMB homeowners proceed their sample of contemplating all channel choices. They outpace Gen X/Boomers throughout conventional, new, and high-tech choices from 19% to 35%, as mirrored in Determine 1.

Whereas Gen X/Boomers’ strongest curiosity is with conventional agent/dealer (65%), medical/healthcare networks (65%) , and insurance coverage firm channels (59%), their curiosity pales compared to the youthful technology SMBs with 84% to 87% curiosity for these similar channels. Different channels over 50% for the older technology embrace digital HR platform (56%), monetary planning/retirement service (54%), and a human sources advisor (52%), however as soon as once more, these pale compared to the youthful technology with 79% to 85% curiosity for a similar channels.

Determine 1: Curiosity in voluntary advantages buy channels

These giant variations throughout a broad array of channel choices spotlight the dramatic shifts underway for the youthful technology of SMBs which are looking for insurance coverage options by different trusted relationships that assist them handle their companies extra successfully. In lots of instances, the acquisition of those advantages aligns with the enterprise relationships they belief and worth. Because of this insurers must develop new partnership choices to supply their merchandise to fulfill this new technology of SMBs on their phrases of the place they need to purchase…not primarily based on the way it has all the time been finished.

Lesson 1: Put together your online business and expertise for channel growth or lose alternatives.

What do these statistics imply to insurers? Flexibility in channel choices can solely be assured by new, platform-based enterprise fashions, associate ecosystems and real-time information administration. These are essential to turn into a valued provide associate for everybody — brokers, SMB homeowners, aggregators, and any method of group distribution companions.

Group and Voluntary Advantages insurers as soon as lived in a semi-blissful state as brokers working with SMBs supplied a typical set of profit plans to their staff. As the worker market shifts and demand for various voluntary advantages panorama broadens, SMB homeowners should department out to customise their full package deal providing for various generational worker teams.

“Clients are prepared to throw away prior profit plans for one thing that’s a lot less complicated and digitized.” — Insurance coverage govt/round-table participant

The survey outcomes reinforce the necessity for insurers to rethink their enterprise to align with a altering worker workforce.

Gen Z/Millennial SMB Proprietor Curiosity in Voluntary Advantages is Rising in All Classes

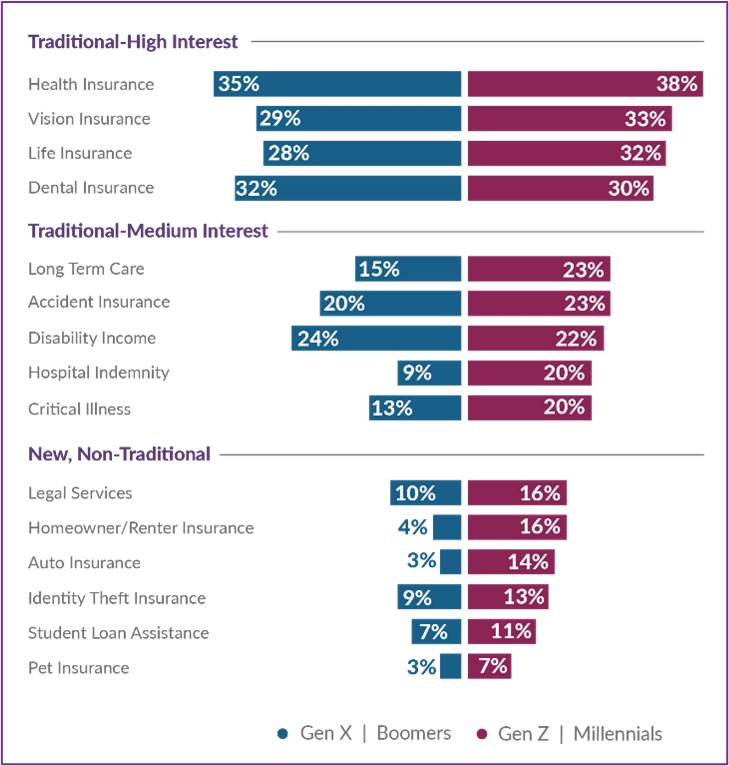

Each Gen Z/Millennial and Gen X/ Boomer SMB segments constantly align in curiosity for conventional advantages, having the next curiosity in some than others, as mirrored in Determine 2. These within the high-interest class are what many contemplate the baseline advantages wanted to draw and retain staff – well being, imaginative and prescient, dental, and life insurance coverage. Surprisingly, incapacity insurance coverage was not within the high-interest group, notably given the regulatory and legislative push and the 2 years of the pandemic.

The medium curiosity class consists of different health-related merchandise together with long-term care, accident, incapacity, hospital indemnity, and demanding sickness which have garnered extra curiosity because of the pandemic, notably for the youthful SMB section with long-term care, hospital indemnity, and demanding sickness standing out.

For the newer advantages rising available in the market, Gen Z/Millennial SMBs’ curiosity outpaces the older technology, reflecting their shifting wants and way of life. Whereas small percentages general, the variations are 1.5 – 4 occasions greater than the older technology, reflecting a robust shift in wants and expectations which are anticipated to speed up because the youthful technology continues to upend office expectations.

Lesson 2: As younger SMB homeowners mature into their roles, non-traditional advantages and providers, and medium-interest advantages and providers can be more and more sought. Insurers should put together now.

That is an insurer’s window of alternative to create new choices, launch greenfield merchandise on recent expertise and reimagine how SMBs and their staff will greatest be served. Nice new product and repair concepts must be fueled by digital service, channel flexibility, and proactive partnering.

Determine 2: Kinds of voluntary advantages SMBs supply staff

SMB Homeowners and Their Workers are Not Aligned on Which Advantages are Desired

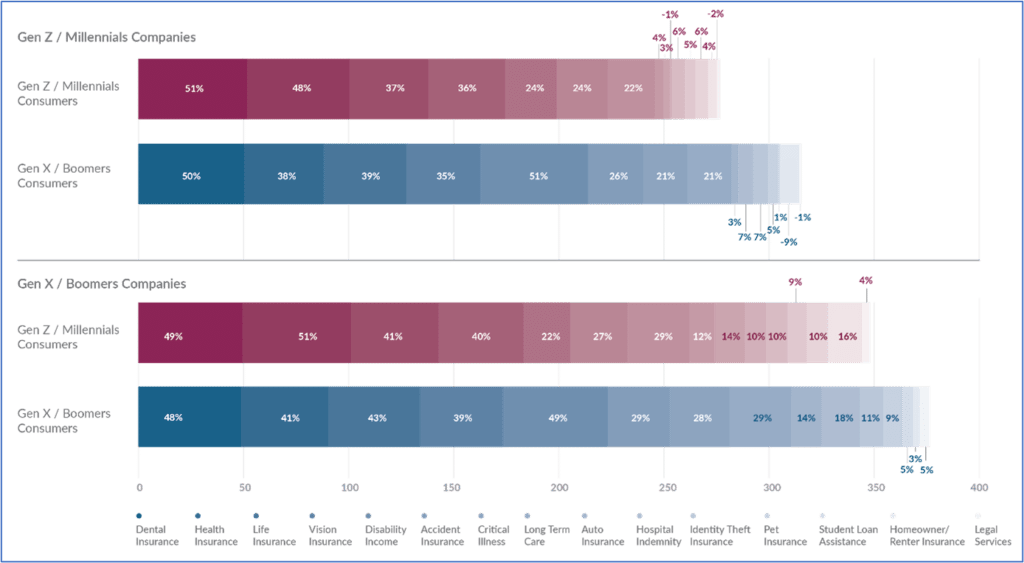

Majesco in contrast the SMB and Shopper (particular person) analysis outcomes and located that homeowners are clearly not aligned with their staff wants and expectations. Determine 3 reveals the cumulative gaps between staff’ pursuits and SMBs’ choices. Even the standard advantages of well being, dental, imaginative and prescient, and life have important gaps, the place the curiosity in dental insurance coverage is sort of 50% greater than the extent at which SMBs supply it. The most important cumulative gaps are created by Gen X/Boomer SMB homeowners, particularly for his or her like-generation staff.

Determine 3: Gaps between staff’ curiosity in voluntary advantages and SMBs’ choices

Lesson 3: Insurers will help SMBs enhance worker retention and acquisition.

Insurers have a chance to place the worth of a greater variety of profit plan choices, notably given a lot of them are worker paid. Much more importantly, it will possibly assist drive the variety of merchandise per worker and create a chance to develop longer-term buyer relationships ought to the worker go away.

On this case, insurers must proceed to create merchandise which are sought-after and simple to make use of. Then, they should talk with each SMBs and SMB brokers in phrases that make it very clear — “THIS profit can be straightforward to usher in and it’ll pay its approach.”

SMB Curiosity in Utilizing Telematics to Management Premiums Grows

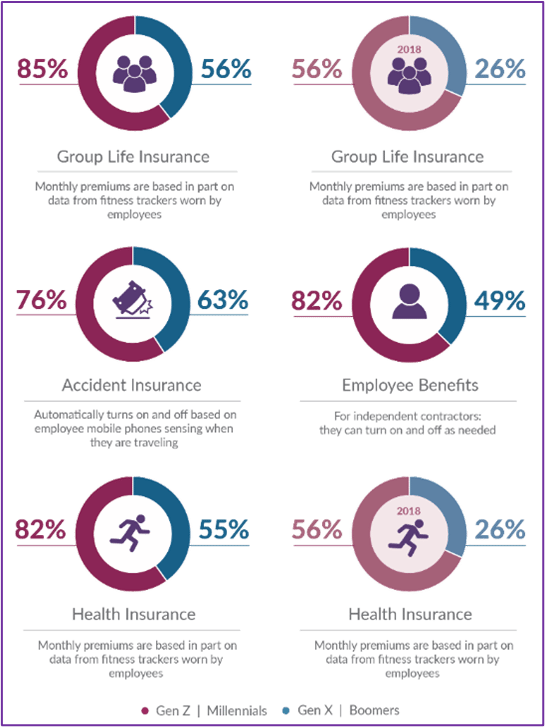

A couple of years in the past, fostering well being and wellness within the office was most likely the very last thing on most SMB homeowners’ minds. With climbing well being prices, rising deal with wholesome dwelling and a tough labor surroundings, curiosity is rising. In line with Majesco’s survey, utilizing health tracker information as an enter to group life and medical health insurance premiums has proven robust will increase within the curiosity of 26% to 30% in comparison with our 2018 SMB survey for each SMB segments (See Determine 4). The youthful generational group nonetheless has a a lot greater curiosity with practically a 29% distinction in comparison with the older technology, reflecting their robust curiosity in way of life wellness and the usage of health trackers. There’s a substantial improve in curiosity by the older technology, nonetheless, doubtless because of the elevated use of health trackers and an growing need for a wholesome way of life as they age, emphasised in the course of the pandemic.

Determine 4: Curiosity in methods to make use of/activate and decide the price of worker group/voluntary advantages

Lesson 4: SMB homeowners are prepared to associate with insurers to assist them lower prices and enhance worker well being.

Each generational segments are open to the usage of telematic information for well being premiums, however they’re additionally occupied with activating accident insurance coverage by way of a cell phone sensor. This marks a definitive shift within the SMB proprietor mindset. If each teams are prepared, are insurers making it straightforward to share telematic information and stories with SMB executives? Are they prepared to construct out the suitable applied sciences to be able to domesticate loyalty within the relationship?

An offshoot of the voluntary advantages dialog is entry to advantages for impartial contractors or Gig employees. The youthful technology of impartial contractors or Gig employees would really like advantages that may activate or off primarily based on after they work for a corporation. Within the quickly altering workforce market, modern advantages that tackle part-time, Gig, or impartial contractors for various intervals have gotten key differentiators within the combat for expertise. Insurers can be anticipated to adapt their merchandise to assist this altering office expectation.

Perks and Worth-Added Providers Often is the Wave of the Advantages Future

Perks are in all places. Within the retail sector and within the journey, eating, and leisure sectors, the businesses with factors, perks, and loyalty advertising and marketing proceed to realize marketshare.

SMB homeowners, who’re massive customers of bank card rewards, airline miles, and free lodge nights, can simply grasp the thought of linked information and value-added providers.

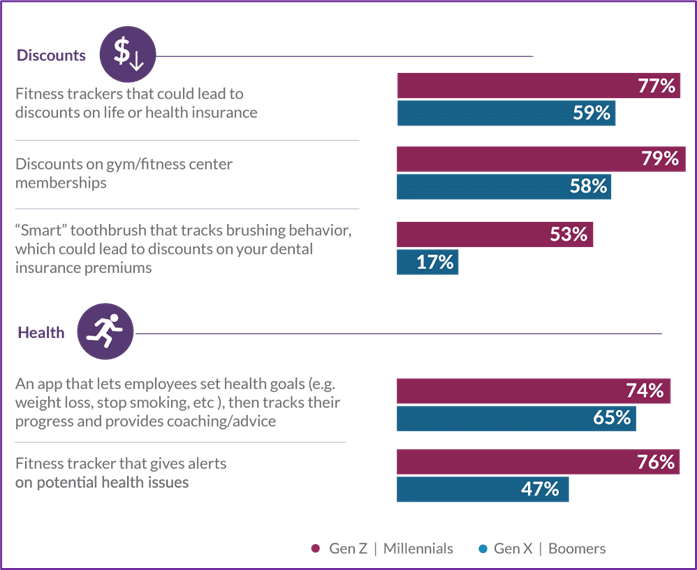

Majesco discovered that curiosity continues for each SMB proprietor segments in gaining access to value-added providers together with reductions on fitness center memberships. Extra importantly, the usage of information from health trackers, apps, or sensible toothbrushes that may drive decrease premiums, and supply well being alerts or well being/wellness objectives and proposals, is of overwhelmingly greater curiosity to the youthful technology, as much as 29% greater than the older technology. (See Determine 5).

Determine 5: Curiosity in value-added providers for voluntary advantages

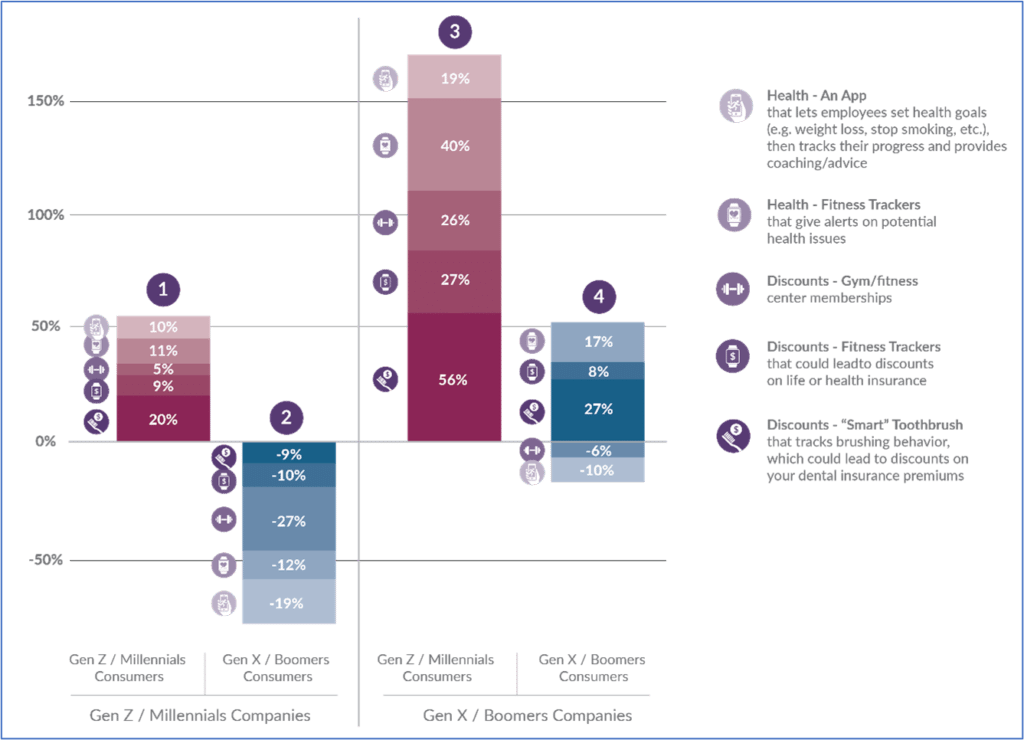

Offering further context utilizing our client analysis information, Gen Z/Millennial shoppers’/staff’ curiosity in value-added providers exceeds each SMB generational segments’ curiosity in providing them, as seen within the first and third column stacks in Determine 6. The older technology of shoppers/staff can be extra occupied with these providers than Gen X/Boomer-led SMBs are in providing them, as seen within the fourth column stack. However as seen within the second column stack, they’ve much less curiosity than Gen Z/Millennial-led SMBs do in providing them.

Determine 6: Gaps between staff’ curiosity in voluntary advantages value-added providers and SMBs’ choices

This disconnect between SMB’s and their staff is one that may doubtless improve because the office surroundings continues to shift to elevated calls for by the dominant youthful technology. Insurers might want to assist SMBs tackle this by the advantages and value-added providers they’ll supply, creating a chance for premium development and elevated loyalty.

Lesson 5: A price-added providers technique is enabled by expertise.

Worth-added advantages are strategic recreation items that enable organizations to associate, shift and even transfer a few of their earnings out of risk-bearing utilities and into ancillary revenue facilities. Most steps into value-added providers additionally open the doorways of further insurance coverage advertising and marketing. For instance, an insurer providing value-added apps that hyperlink to conventional advantages might give them an entry into promoting that profit.

Likewise, an insurer with a knowledge safety app or a well being teaching app could possibly hold the connection going after the worker has left the SMB employer. Worth-added advantages are versatile if they’re approached in the suitable approach.

SMBs want insurer assist. Their HR and advantages applications are strapped for time and they’re cost-conscious. Gravity pulls them towards advantages which are straightforward to manage and those who add worth to their backside line. It helps if these advantages additionally enhance recruitment or retention. Insurers must concurrently enhance their choices, enhance digital service and enhance their ties to brokers and different companions. The applied sciences that may place them in the suitable place usually are not onerous to return by. Every single day Majesco helps insurers meet the wants of group and voluntary markets with the applied sciences that may promote by each brokers and different channel companions. We give insurers with initiative a aggressive enhance.

Are you prepared to fulfill the calls for of a brand new worker market? Are you able to capitalize on the brand new wants of the SMB market? Contact Majesco at present. To dig deeper into Majesco’s SMB analysis, make sure to learn, A Quickly Altering SMB Panorama: Development Alternatives Grounded in Grit and Resilience.