Good bye Denmark, hiya Norway !!

As with earlier sequence (Germany, Switzerland & Denmark) I’ll deal with the Norwegian shares in random order. The principle purpose for that is that I discover this funnier in comparison with working down the listing in Alphabetic order. The primary batch of 15 shares has resulted in two watch listing candidates. Let’s go !

- Kahoot!

Kahoot! is 1,1 bn EUR market cap former “progress darling” that was a part of many “naive Tech investor” portfolios. Kahoot! is an internet studying platform that addresses each, personal clients in addition to the company studying market. As many different Tech corporations the monetary report is a gibberish of Non-GAAP adjusted numbers. On a GAAP stage, the corporate is loss making and money appears to be shrinking. At 7x P/S this nonetheless seems a lot to costly. “Cross”.

2. AF Gruppen

AF Gruppen is a 1,5 bn EUR market cap building and engineering firm energetic in Norway and Sweden. They appear to be energetic in varied areas, from residence constructing, civil building to demolition and off-shore. In 2022 they’ve seen already a decline in profitability. in Sweden they’re really already making losses. The rising and worthwhile offshore division is sadly comparatively small.

Over the long run, the share worth has carried out very nicely till 2016 however since then went largely sideways:

With a P/E of 15x, the inventory can be not low-cost. “Cross”.

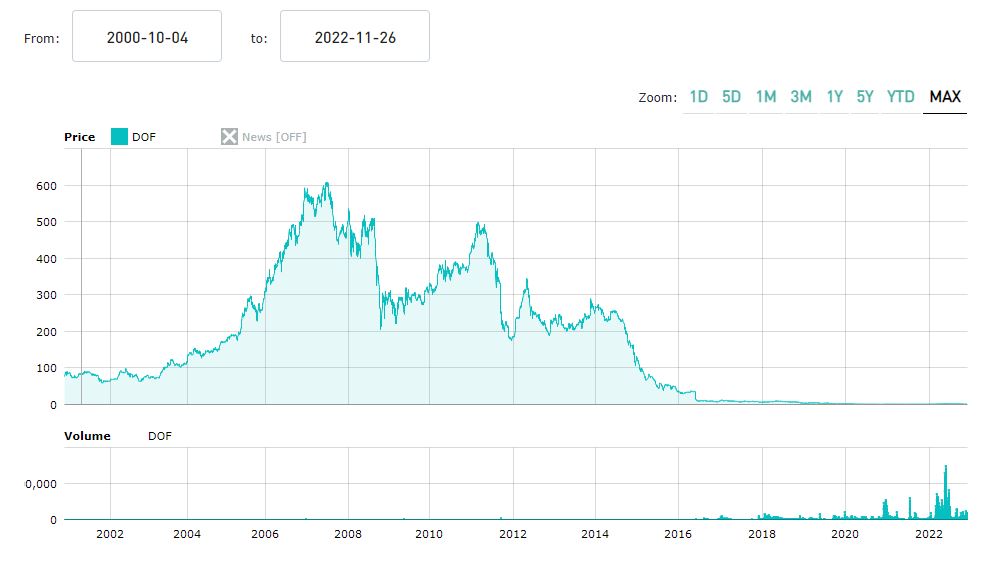

3. DOF

DOF is a 30 mn EUR market cap firm working a fleet of vessels for offshore and subsea companies around the globe.

Taking a look at the long run share worth chart, one can see that there appear to be some points right here:

In keeping with TIKR, the corporate carries 2 bn EUR of debt and the money stream goes into debt repayments. With rising rates of interest, this doesn’t look promising. “Cross”.

4. Holand OG Setskog Sparebank

This can be a native financial savings financial institution with a market cap in accordance with TIKR of solely 10 mn EUR. I’m not positive nonetheless if there or different share lessons that weren’t counted for this. I couldn’t even discover the Investor Relations part on their web site. Perhaps it’s a hidden treasure however I’ll “go”.

5. Cambi ASA

Cambi is a ~80 mn EUR market cap firm that “offers thermal hydrolysis, superior anaerobic digestion, and biogas options for sewage sludge and natural waste administration in Europe, america, Asia, Africa, and Oceania. “

The corporate went public within the loopy days of 2021 and its share worth tanked quickly afterwards:

The therapy of waste is a fairly fascinating enterprise and Cambi’s know-how appears to have some benefit. Nevertheless I discover the financials extraordinarily onerous to learn. There’s plenty of POC accounting and mixing the 2 enterprise fashions of producing gear in addition to proudly owning and operating installations isn’t simple to know. However, I’ll put them on “watch”.

6. BEWI

BEWI is a 1,2 bn EUR market cap firm that’s manufacturing packaging and insulation based mostly on Styrofoam, however most lately additionally based mostly on organic inputs.

BEWI IPOed in August 2020 and is apparently nonetheless above the IPO worth. The chart exhibits that there was fairly some actions over the past 2 years:

Basically, the corporate has developed nicely for the reason that IPO, though I’m not 100% positive what occurred earlier than as TIKR exhibits some very unusual numbers. Valuation smart, it doesn’t look low-cost (P/E ~15) and the corporate has some debt, however the insulation side alone warrants a spot on the “watch” listing.

7. Huddly

Huddly is a 85 mn EUR market cap know-how firm that appears to supply digicam methods for assembly rooms. The corporate has grown from nothing in 2016 to ~40 mn revenues for 2022. Nevertheless, in accordance with TIKR, they’ve made income solely in 2019 and 2020 which was good timing for his or her 2021 IPO. 2021 and 2022 nonetheless will once more see a loss. In keeping with their newest quarterly report. They’re nonetheless rising at a 30% fee, nonetheless gross margins are contracting and GAAP outcomes go much more unfavourable.

They nonetheless have new money however on the present burn fee, the money is spent in 4 quarters. In addition they appear to capitalize R&D.

So possibly not the worst of all 2021 classic IPOs however nonetheless a “go”.

8. Atlantic Sapphire

Atlantic Sapphire is a 110 mn EUR market cap fish farming firm that appears to farm Salmon in Denmark and the US, and regardless of it’s identify not within the Ocean however with land based mostly installations. Over the previous 18 months, the inventory misplaced ~-90% of its worth, so not all the pieces appears to go in accordance with plan:

The corporate is loss making, which isn’t unusual for a fish farm that’s within the technique of ramping up, as fish takes a while to develop and in between one has to feed and have a tendency them.

Land based mostly aquaculture appeared to have been a hype sector for a while. Nevertheless it appears to be very capital intensive and in Atlantic’s case, there appear to be points with the precise high quality of the product. Usually, i I discover fish farming fascinating and would wish to be taught extra, however Atlantic Sapphire doesn’t appear to be a very good place to begin. “Cross”.

9. Norse Atlantic

Norse Atlantic is a 800 mn EUR market cap airline “Begin-up” that was IPOes in 2021. It appears to be in some way associated to bankrupt Norwegian Airways and specializes on lengthy haul flights. As many different 2021 IPOs, the inventory is struggling and misplaced ~-90% from the IPO. Airways will not be my form of factor, subsequently I’ll “go”.

10. Andfjord Salmon

Andfjord is a 160 mn Salmon farm situated in Polar Waters that was IPOed in 2020. In addition they appear to make use of land based mostly swimming pools however with Seawater. On their web site they speak lots about sustainability and low power depth. Nevertheless they appear to be in a construct up face with the primary harvest anticipated for 2023. I’m not positive if they’re hit by the additional tax on fish farming revealed by the Norwegian Authorities some months in the past. The inventory has been doing higher than Atlantic Sapphire, however remains to be down ~-1/3. Total, this additionally won’t be the perfect place to know extra about fish farming, subsequently I’ll “go”.

11. Play Magnus

Play Magnus is a 75 mn EUR market cap firm that’s energetic in on-line chess, has Magnus Carlsen as a principal investor and is well-known to my readers as I owned the inventory twice and made some cash in whole. Nevertheless, as talked about on the weblog, competitor Chess.com made a proposal of 13 NOK per share lately and evidently that is the tip of Play magnus as a stand-alone firm. Nothing to see right here anymore, “go”.

12. Sikri Holding

Sikri Holding is a 107 mn EUR market cap firm that was IPOed in 2020 and appears to offer software program for the property sector and public authorities. The excellent news is that the corporate is worthwhile, the unhealthy information is that they don#t appear to have the ability to develop organically of their principal enterprise line. The inventory has performed comparatively nicely for a 2020 IPO, solely shedding round -1/3% which for a software program firm isn’t so unhealthy:

The corporate has fairly some debt (near 100 mn EUR), so the valuation of round 20x EV/EBITDA is sort of formidable. Doesn’t look so fascinating to me, “go”.

13. Noram Drilling

Noram is a 230 mn EUR market cap firm that simply went public in October 2022. It appears to function a fleet of 11 on shore drilling rigs energetic within the Permian basin within the US. Issues presently look fairly good, TIKR estimates a P/E of 9 for 2022. Nevertheless I assume that it is a very cyclical enterprise and I perceive subsequent to nothing about drilling, so I’ll “go”.

14. Crayon Group

Crayon is a 920 mn EUR market cap B2B software program/ companies firm that appears to largely resell software program and repair. At first sight, the corporate grows properly by round 30% p.a., however margins are razor skinny, with EBITDA margins being between 1-2%. At 11,5x EV/EBITDA and 22x P/E, the corporate appears to be adequately valued. “Cross”.

15. Ultimovacs

Ultimovacs is a 355 mn EUR market cap Biotech that appears to develop a “common most cancers vaccine” and has one product at stage II growth stage. There are not any revenues however rising losses. Nevertheless they appear to have the ability to increase capital. “Cross”.

16. Melhus Sparebank