Scotiabank reaffirmed the energy of its variable-rate mortgage portfolio, regardless of the upper prices confronted by debtors on account of rising rates of interest.

The feedback had been made in the course of the financial institution’s fourth-quarter earnings name on Tuesday, through which Scotia reported a 20% year-over-year drop in web revenue, but in addition an 11% enhance in mortgage volumes.

Of Scotia’s $302 billion mortgage portfolio, $112 billion value, or 37%, has a variable charge. The financial institution can also be the most important mortgage lender to supply adjustable-rate mortgages, that are variable-rate mortgages with funds that fluctuate as prime charge rises or falls.

Due to this, the financial institution’s variable-rate shoppers don’t have to fret about hitting their “set off charge,” since their funds are usually adjusting to cowl the upper curiosity prices.

“We imagine strongly {that a} variable charge mortgage ought to have a fee that varies,” stated Dan Rees, Group Head of Canadian Banking. “We’re not seeing credit score stress in that class throughout This autumn, full cease.”

He added that the financial institution is “having a lot of conversations about money move administration” with its shoppers, however that, general, the creditworthiness of its variable-rate prospects is larger in comparison with their fixed-rate counterparts. Variable mortgage prospects keep roughly 36% larger balances of their deposit accounts in comparison with fixed-rate prospects, the financial institution famous.

“As we have a look at the liquidity place of checking and financial savings accounts mixed within the variable buyer balances which can be with us, we see properly over a yr value of extra liquidity to soak up fee will increase of $200, $300, $400 per thirty days,” Rees stated. “So, we’re not involved concerning the credit score facet of the mortgage place…[and] from a client behaviour standpoint, the variable buyer is in good condition.”

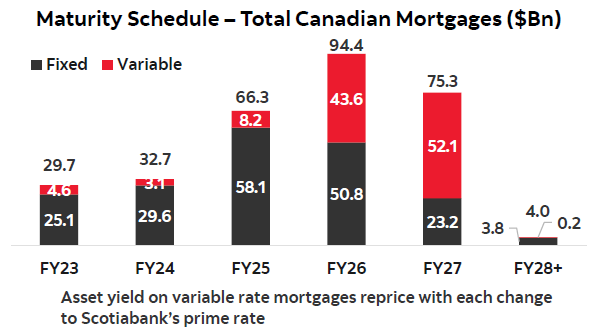

Scotiabank additionally offered perception into the maturity schedule for its mortgage portfolio, exhibiting that the majority of loans ($94.4 billion) might be up for renewal in 2026.

“Regardless of larger rates of interest and inflation, our prospects’ monetary well being stays resilient,” stated Chief Danger Officer Phil Thomas. “Canadian retail deposits, on common, are 13% larger than they had been in February 2020. And delinquency of 90-plus days for Canadian retail has been steady at 15 foundation factors for the final three quarters and roughly half of the pre-pandemic ratio.”

Scotiabank earnings spotlights

This autumn web revenue: $2.09 billion (-20% Y/Y)

Earnings per share: $1.63

- The whole portfolio of residential retail mortgages rose to $302 billion in This autumn, up from $280 billion a yr in the past.

- 28% of the financial institution’s residential mortgage portfolio is insured. Of the uninsured balances, the typical loan-to-value of this portfolio is 49%.

- Residential mortgage quantity was up 11% year-over-year.

- Web curiosity margin in This autumn was 2.26%, down from 2.29% in Q3 however up from 2.20% a yr in the past.

- Mortgage loans that had been 90+ days overdue held regular at 0.09%, unchanged from the earlier quarter however down from 0.12% in This autumn 2021.

- Scotia raised its provisions for credit score losses to $529 million within the quarter, up from $412 million in Q3 and $168 million a yr in the past.

Supply: Scotiabank This autumn Investor Presentation

Convention Name

- “Strategically, we’ve been targeted within the mortgage enterprise at cross-selling into the deposits,” stated Dan Rees, head of Canadian Banking. “We’ve been doing that year-on-year now for the final three years. 50% of our mortgage holders have a deposit account with us. And inside the first six months of opening a variable-rate mortgage, [our] prospects now have three or extra merchandise.”

- “I believe our emphasis on deposits could properly have been overshadowed within the entrance half of the yr the place we noticed sturdy mortgage progress,” stated Rees. “Clearly, within the final two quarters, you’ve seen deposit progress charges in Canadian Banking equal or beat mortgage progress charges; and in This autumn in balances, deposits grew sooner than loans. So, that emphasis on a balanced stability sheet will proceed in ’23, and that ought to assist NIM.”

- “The financial institution’s earnings in 2023 are anticipated to learn from larger curiosity revenue and non-interest income, however be impacted by larger funding prices, larger bills, normalizing provisions for credit score losses…and a better tax charge in each Canada and sure worldwide nations,” stated Raj Viswanathan, Chief Monetary Officer.

Featured picture by Pavlo Gonchar/SOPA Photographs/LightRocket by way of Getty Photographs