I do not know what the perfect funding of 2023 will likely be, and neither does anybody else. The annual train in futility and fantasy is properly underway within the monetary press and market pundit group, however the truth that their 2022 forecasts have been laughably incorrect, as have been their 2021, 2020, 2019 …

Part 1, The Terrified Investor

Part 2, The Exhausted Investor

Part 3, The Enterprising Investor

The Terrified Investor

In the event you’re obsessed about 2023, our greatest recommendation is (a) reduce your publicity to the inventory market and (b) make investments usually and vigorously in short- and ultra-short bond funds. That gives the perfect prospect of a return of principal, if not astonishing returns on precept.

Finest Brief-Time period and Extremely-short Time period Bond Funds

Nice Owl funds with the smallest drawdowns for the five-year from 1/2018-12/2022

| APR | Most drawdown | Customary deviation | Sharpe ratio | |

| RiverPark Brief Time period Excessive Yield | 2.13% | 1.09% | 1.07 | 0.81 |

| Baird Extremely-Brief Bond | 1.51 | 0.92 | 0.78 | 0.30 |

| BlackRock Extremely Brief-Time period Bond ETF | 1.65 | 0.85 | 0.77 | 0.50 |

| Extremely brief common | 1.19 | 2.34 | 1.37 | -0.10 |

Supply: MFO Premium fund screener

The Exhausted Investor

In the event you’re actually bored with making these requires your self, otherwise you’re unimpressed with the adviser who’s been making them for you, you’ve two choices for simplifying your life.

Choice 1: put money into a best-of-class goal date fund

The target-date funds are easy creatures: they announce upfront what allocation between asset lessons they intend to make and the way these allocations will change over time. All target-date funds have a strategic allocation (“10 years earlier than the goal date, we’ll be 55% US shares, 20% worldwide shares, and 25% bond”), whereas many even have a tactical allocation (a little bit of room for the managers to train judgment: “we’ll be 55% US shares give or take 2.5% with the choice of tilting a bit towards worth or small or …”).

A bit of my retirement portfolio sits within the T. Rowe Value Retirement funds, the extra aggressive of their two target-date collection. Morningstar charges it as a four-star Gold fund. It’s one in all solely two Nice Owl funds within the class, that are outlined as funds with risk-adjusted efficiency within the high 20% of their group for the previous 3-, 5-, 10- and 20-year intervals. The opposite is Mutual of America 2030 which is primarily out there via retirement plans.

Finest Goal-date 2030 Fund

Nice Owl funds for the five-year from 1/2018-12/2022

| APR | Most drawdown | Customary deviation | Sharpe ratio | |

| T Rowe Value Retirement 2030 | 4.4% | 22.1% | 14.2% | 0.22 |

| 203o group common | 3.3 | 21.1 | 12.7 | 0.15 |

Supply: MFO Premium fund screener

Choice 2: put money into a best-of-class versatile allocation fund

Versatile allocation funds give their managers huge latitude to pick out each their allocation to shares, bonds, and money and likewise latitude in deciding on which shares or bonds. The concept is that in case you’re going to pay for lively administration (a prospect that my colleague Devesh finds principally suspect), then pay for actually lively administration. The worst “lively” managers have index-like portfolios however cost exorbitant charges. The perfect have a transparent self-discipline, an extended monitor report, and cheap charges.

They’re few and much between.

For the reason that worth of a versatile fund is that it lets you give up long-term choices, we screened for the funds with the perfect actually long-term efficiency: funds which have weathered all the things from the dot-com bubble to the Covid crash. There aren’t any Nice Owl funds on this group, which highlights the truth that even the perfect long-term methods have fallow intervals. The listing under comprises the versatile funds with the best 25-year Sharpe ratios. We’ve included a pure fairness index, the Vanguard Complete Inventory Market, for comparability. You’ll observe that the highest 5 funds have posted positive aspects similar to, or above, the inventory market with distinctly decrease volatility.

Finest Versatile Portfolio Funds

Highest Sharpe ratio FP funds for the 25 years from 1/2018-12/2022

| APR | Most drawdown | Customary deviation | Sharpe ratio | |

| Bruce | 11.0% | -40.3 | 12.6 | 0.74 |

| First Eagle International | 9.1 | -32.6 | 11.3 | 0.65 |

| FPA Crescent | 7.9 | -28.8 | 11.6 | 0.53 |

| Leuthold Core | 7.4 | -36.5 | 10.7 | 0.52 |

| BlackRock International Allocation | 7.3 | -29.4 | 10.8 | 0.51 |

| Versatile portfolio common | 6.1 | -37.4 | 11.5 | 0.38 |

| Complete inventory market common | 7.6 | -50.9 | 16.2 | 0.36 |

Supply: MFO Premium fund screener

The Enterprising Investor, or portfolio positioning for lively, long-term traders

In the event you’re seeking to reposition your portfolio for the long run – figuring out that the adjustments may or won’t blow up within the brief time period (since nobody has a clue about what 2023 will deliver) and in case you consider that the value of an funding strongly influences your eventual positive aspects, then there are three tilts to think about for the subsequent market. We’ll begin with the important background to the previous and coming markets, then introduce the tilts.

Distortions from the zero-rate atmosphere

The zero-interest-rate markets which have persevered for the reason that Nice Monetary Disaster in 2008 have produced dramatic actions within the inventory market and much more dramatic value dislocations. Free cash favors some investments excess of others: giant corporations with easy accessibility to capital markets may purchase progress utilizing free cash – generally paying lower than zero to borrow as soon as inflation was factored in – and use that progress to generate headlines and momentum. Nevertheless it additionally trusted continued entry to free cash to assist its empire of playing cards.

In a 2019 interview, Rupal Bhansali, supervisor of Ariel International, warned that “a market that’s been on steroids is now on opioids which, I consider, can not finish properly.”

As cash flowed to FAANGs or tech or momentum, it concurrently flowed away from areas that at the moment are tremendously undervalued by historic requirements. Traders may wish to ask whether or not it’s time to tilt of their route.

Projections for a normal-rate atmosphere

Very giant long-term traders have to have a transparent sense of what’s price shopping for and what’s grievously overpriced. These calculations enable them to assemble long-term allocations for his or her main shoppers. Whereas they’re not dependable sources of precise returns (that’s, Constancy’s “it’ll be 3%” truly means one thing like “our pc fashions say we’ve a 65% likelihood of inventory returns between -1.0% and +5.00% with a imply worth of three%”), they’re usually fairly good at signaling relative asset class efficiency. That’s, whether or not home or worldwide is positioned to steer by a bit of or so much, and so forth.

As an summary, listed here are the capital market assumptions utilized by giant US funding corporations for the interval via 2033.

Projected 10-year asset class returns via 2033

| US fairness | Worldwide fairness | Rising fairness | US bonds | Commodities | |

| BlackRock | 8.8% | 11.5 | 11.8 | 4.2 | |

| BNY Mellon | 5.9 | 5.8 | 7.6 | 1.2 | 3.0 |

| Callan | 6.6 | 6.8 | 6.9 | 1.75 | 2.5 |

| Constancy | 3.0 | 3.7 | 5.1 | 1.9 | 2.1 |

| Invesco | 9.3 | 9.2 | 12.4 | 4.5 | 10.9 |

| JPMorgan | 7.8 | 8.9 | |||

| Analysis Associates | 1.8 | 7.7 | 8.6 | 0.9 | 0.7 |

| Schroders | 8.4 | 7.9 | 11.3 | 4.4 | 4.6 |

| Vanguard | 4.4 | 7.1 | – | 3.5 | – |

| Voya | 6.8 | 7.3 | – | 4.0 | – |

| Imply | 5.38 | 7.48 | 9.08 | 2.93 | 3.97 |

It’s not assured that the numbers between corporations are completely comparable as a result of not all corporations specify whether or not their estimates are actual (inflation-adjusted) or nominal. Regardless, asset class variations inside every agency’s row will likely be comparable; that’s, if Schroders tasks shares main bonds by 400 bps, it doesn’t matter whether or not that’s primarily based on actual or nominal estimates.

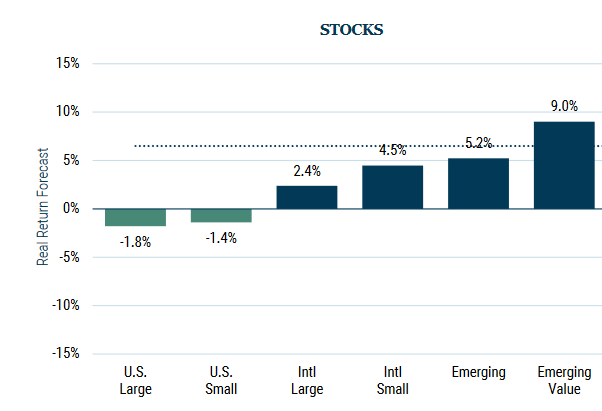

Brief model: Commodities over bonds. Worldwide over the US. Rising over worldwide. And, as we’ll see under, small over giant, rising over developed, worth over progress.

Small cap shares

And, notably, small-cap worth.

Morningstar’s Lauren Solberg famous in December 2022 that “For smaller-company shares, value/earnings ratios—a extensively used measure for figuring out the worth of a inventory relative to its earnings—have reached their lowest ranges in 20 years.” The distinction in P/E ratios between small-cap and large-cap shares – 12.6 versus 20.2 – is the best since 2002. (Small Cap Shares are Actually Low cost, Lauren Solberg, 12/2/2022) The just about completely skeptical GMO permits that “small-cap shares have develop into notably low cost,” and RBC’s Lori Calvasina says that at present ranges, small-cap shares are already priced at valuations that will account for “the worst that you simply’d count on to see in the course of a recession.”

Just about the entire main administration corporations anticipate a decade of small-cap outperformance although the magnitude of the projected variations is large. On the low finish, Callan anticipates US small to outperform US giant by 20 foundation factors (bps); BNY Mellon provides small caps at 100 bps, whereas Invesco and Analysis Associates each put the small cap benefit within the 300 bps space. Financial institution of America estimates the hole at 400 bps.

Provided that small caps are at all times extra unstable than giant caps, we searched out the funds with the perfect long-term risk-adjusted returns.

Finest Small Cap Inventory Funds

Nice Owl funds with the smallest drawdowns for the 20 years from 1/2003-12/2022

| APR | Most drawdown | Customary deviation | Sharpe ratio | |

| FMI Widespread Inventory | 10.5 | -42.6 | 16.1 | 0.58 |

| Meridian Contrarian | 10.1 | -44.01 | 17.0 | 0.52 |

| Kinetics Small Cap Alternatives | 14.3 | -67.1 | 22.9 | 0.57 |

| FPA Queens Highway Small Cap Worth | 9.5 | -43.1 | 15.0 | 0.55 |

Supply: MFO Premium fund screener

There are three different funds that we’ve written extensively about that deserve particular consideration.

The Final True Believers

Palm Valley Capital (PVCMX) is an absolute-value small-cap fund that’s managed by Eric Cinnamond and Jayme Wiggins. Nominally the fund is 4 years previous, which is wildly deceptive. Mr. Cinnamond and, most not too long ago, Mr. Wiggins have efficiently pursued this technique in 4 distinct mutual funds for 1 / 4 century. The core distinction is that this: the managers solely purchase shares which can be buying and selling at a very substantial low cost to their truthful worth. If there aren’t any appropriately priced alternatives, they make investments the portfolio in money and cash-like securities. That makes them extremely irritating to personal when markets are hovering and so they’re steadily unloading overpriced portfolio holdings in favor of money. Certainly, Mr. Cinnamond liquidated one fund as a result of he felt it unfair to cost traders for fairness investments when solely money made sense.

The brand new fund is a five-star Nice Owl that returned 3.2% in 2022, whereas its common peer misplaced 9.8%. That’s particularly putting as a result of the portfolio continues to be solely 19% investing in shares, principally small- to micro-cap worth shares.

Disclosure: I’ve owned PVCMX since launch, and earlier than that, I owned shares of two of the staff’s earlier funds.

The Anti-momentum Index

Index Funds S&P 500 Equal Weight (INDEX) aspires to beat the index with the index. The S&P 500 index weights its holdings by every inventory’s market cap; the fund’s high 5 holdings – Apple, Microsoft, Amazon, Google (two share lessons), and Berkshire Hathaway – devour 19.5% of its portfolio. That provides the index sturdy biases towards dimension, progress, and momentum, that are generally worthwhile and generally not. INDEX takes a distinct method and equally weights the identical 500 shares. That provides it a bias towards smaller, cheaper and steadier. They seize some great benefits of passive investing, have the prospect of outperforming the S&P 500 in the long term (since 2003, the equal weight has a considerable lead on the cap-weighted model), and free themselves from dependence on huge tech.

By way of a considerate buying and selling technique, INDEX tends to modestly outperform its giant competitor (RSP) in the long run.

Beating the index with the INDEX

Efficiency since INDEX inception, 4/30/2005

| APR | Most drawdown | Customary deviation | Sharpe ratio | |

| S&P 500 Equal Weight | 9.24 | -26.5 | 17.4 | 0.47 |

| Multicap core peer group | 7.9 | -25.3 | 16.6 | 042 |

| S&P 500 | 11.3 | 23.9 | 15.9 | 0.65 |

Supply: MFO Premium fund screener

The World At Your Fingertips

Harbor Worldwide Small Cap (HIISX) was reborn a number of years in the past when the staff from Cedar Avenue Asset Administration assumed management. The managers goal high-quality, undervalued small-cap shares … and so they achieve this brilliantly.

As we famous in our August 2022 profile of the fund: “Harbor is the perfect worldwide small-cap fund round. The instantly significant metric right here is the fund’s three-year report for the reason that present staff – which itself has a strong report for longer than three years – assumed duty for the fund … we examined the information of all worldwide small-cap worth and core mutual funds and ETFs. In each absolute and risk-adjusted metrics, Harbor is the top-performing fund.”

36-month report (via August 2022), worldwide small-to-mid worth

| Complete return | Sharpe | Martin | Seize ratio | Alpha | |

| Harbor | 7.9% – #1 | 0.35 – #1 | 0.72 – #1 | 1.2 – #1 | 4.0 – #1 |

| ISCV peer ave. | 3.2 | 0.12 | 0.25 | 1.0 | -0.7 |

The Return of the Previous Methods

We observed one intriguing new fund that was slated to launch on the final day of 2022. Hunter Small Cap Worth Fund is a small cap worth fund run by a bunch of fellows named Perkins. The fund will usually maintain 30-60 small-value shares, a minimum of 90% of which will likely be home. For these with an extended reminiscence, Perkins was a premier small-cap worth investor that was bought by Janus, a agency not famend for its dedication to worth investing. The senior Messrs. Perkins – Tom and Bob – retired from the agency in 2018, which subsequently rebranded the funds twice. Someplace in 2020, the youthful Mr. Perkins departed as properly and based Hunter Perkins Capital Administration. The brand new fund will likely be managed by all three.

Rising markets shares

And, notably, rising markets worth.

After years of being uncared for due to free cash out there within the developed markets and geopolitical instability, basically each main skilled investor has made the identical two observations: EM economies are far stronger than ever (representing 45% of world GDP), and EM inventory valuations are far decrease, setting them up for a interval of prolonged outperformance albeit with greater volatility. GMO’s November 2022 asset class projections for the subsequent 5-7 years are fairly typical:

Basically, worth tends to outperform in rising-rate environments. David Dali, head of portfolio technique at Matthews:

Since 1995, there have been 5 Federal Reserve curiosity rate-hiking cycles and so they have all had a number of issues in frequent . . .the US greenback tends to outperform each developed and rising market currencies, and cyclical, value-oriented shares are likely to outperform growth-skewed firms. (5 causes, 11/28/2022)

Market circumstances as we speak–with rising inflation being pushed partly by greater commodities costs–have added assist to many rising markets, and never simply in Asia, a few of which have smaller benchmark or no benchmark illustration.

Trying again 20 years, there have solely been 5 end-of-quarter cases when the MSCI Rising Markets Fairness Index has registered a price-to-earnings (P/E) a number of of 10 instances or much less. The September quarter-end was one in all them, with a P/E of 9.96 instances. Of the prior 4 cases, the median index whole return for the following one 12 months was 19.03% and for the following two years it was 31.47%. And in all of the prior circumstances, the five-year whole returns have been constructive.

Finest Rising Markets Inventory Funds

Nice Owl funds for the ten years from 1/2013-12/2022

| APR | Most drawdown | Customary deviation | Sharpe ratio | |

| Matthews EM Small Firms | 6.7 | -26.0 | 16.3 | 0.36 |

| Driehaus EM Small Cap Progress | 4.5 | -26.9 | 15.2 | 0.25 |

| First Belief EM Small Cap | 5.2 | -40.7 | 20.4 | 0.22 |

| Constancy EM Discovery | 3.4 | -35.3 | 16.3 | 0.16 |

| EM peer group | 0.5 | -41.6 | 18.4 | 0.02 |

Supply: MFO Premium fund screener

There are three different funds that deserve particular consideration.

Seafarer Abroad Worth (SFVLX) is a $70 million, five-star, Silver-rated Nice Owl fund backed by Seafarer Companions who’ve at all times struck us as probably the most wise gamers within the recreation. In our Elevator Discuss with lead supervisor Paul Espinosa, we acquired a way of his values:

I’m managing this fund for the reader you talked about, the man who manages a diner in Montana and who’s fascinated by his retirement and his household’s safety. That is the core, my private campaign, for why I wish to lead this fund. Authorities and central financial institution insurance policies penalize thrift; they’re making an attempt to encourage value inflation via low rates of interest, however this implies buying energy is declining, and many people are having hassle retiring with dignity. What I’m actually actually making an attempt to do right here is to extend the buying energy of a saver.

The vogue as we speak is for relative return investing. It asks, “how did you do relative to a benchmark,” not “has your supervisor been serving to you meet your objectives?” I consider myself as a type of absolute return investor; we’re benchmark-agnostic, our goal is to provide a minimal fee of return that permits our traders to extend their buying energy.

His efficiency speaks for itself. The fund was by far the best-performing EM fund of 2022, dropping lower than 1% in worth whereas its friends have been trimmed by 21% on common.

Seafarer Worth since inception (5/2016-12/2022)

| APR | Most drawdown | Customary deviation | Sharpe ratio | |

| Seafarer Worth | 6.2 | -27.1 | 14.6 | 0.35 |

| Int’l small worth peer group | 4.0 | -33.9 | 17.0 | 0.13 |

| EM index | 4.4 | -36.7 | 17.3 | 0.19 |

Supply: MFO Premium fund screener

Disclosure: I’ve owned Seafarer Progress & Revenue, Worth’s older sibling, since launch, and earlier than that, I owned shares of Andrew Foster’s earlier fund. Of particular curiosity is the truth that Lydia So, who managed Matthews EM Small Firms to completely peer-tromped efficiency, has now joined the Seafarer Companions.

A lot has been manufactured from the issues posed by the Chinese language regime as President Xi pursues a elementary energy seize that carries huge threat. In consequence, a number of well-respected corporations have simply launched funds designed to put money into rising markets however not in China. These embrace:

Matthews Rising Markets ex China Lively ETF which has the chance to put money into “each nation on the earth besides the US, Australia, Canada, Hong Kong, Israel, Japan, New Zealand, Singapore and many of the international locations in Western Europe” and, after all, China. The fund is managed by John Paul Lech and Alex Zarechnak, who’re additionally liable for Matthews Rising Markets Fairness Fund, which holds a ten% China stake towards its friends’ common of 26%. Since its launch in April 2020, that fund is up 27%, whereas its friends and index are up about 11%. Extra not too long ago, they’ve run the ETF model of the technique.

BlackRock Rising Markets ex-China Fund will fish in the identical waters. It’s led by Chris Colunga, who manages BlackRock’s Rising Europe fund, which is accessible solely to non-US traders.

Worth shares

And, notably, deep worth.

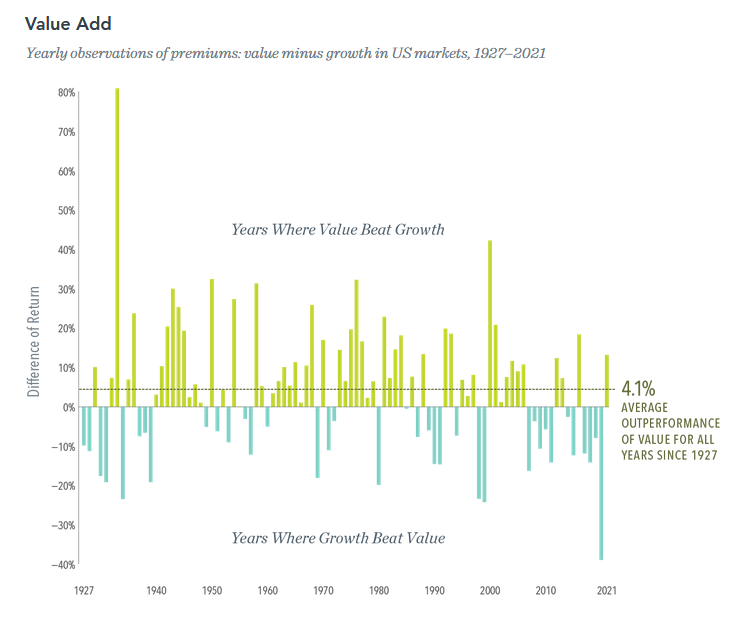

It’s well-known that worth has lagged progress for a decade, pushed by the inevitable penalties of a zero-rate / zero-inflation atmosphere. That market has now expired, leaving worth shares buying and selling at epic reductions to their very own historic averages.

2022 noticed a dramatic reversal. The Vanguard Worth Index (VIVAX) dropped 2.5%, whereas its sibling Vanguard Progress Index (VIGRX) fell 34%. Their Small Cap Worth Index Fund (VISVX) dropped 9.5%, whereas the Small Cap Progress Index Fund (VISGX) fell 29%. Worth and progress are likely to commerce off market management, with one fashion simply able to besting the opposite for 5 years or extra. The chart under, from Dimensional Advisers, reveals worth outperformance each within the mixture (about 400 bps since 1927) and yearly (the yellow bars). Specifically, you may observe the sample of the excessive inflation interval of the Seventies and early Eighties.

The query is whether or not the latest outperformance by worth is a head pretend or the start of a interval of prolonged dominance. GMO is clearly within the latter camp, arguing that progress shares are nonetheless ridiculously costly by historic requirements (after the 2022 massacre, they nonetheless sport valuations greater than they’ve 88% of the time during the last half century) and worth shares are nonetheless ridiculously low cost by those self same requirements (decrease than they’ve been 89% of the time).

The identical sample extends to the European markets (within the backside 4% of their historic vary) and the rising markets (backside 10%).

The issue is that not all components of the “worth” market are equally enticing. GMO breaks the market into “shallow worth” and “deep worth” cohorts. As a result of the entire US market stays costly by historic requirements, shares barely into the most affordable half of an overpriced market aren’t any cut price in any respect. The most cost effective 20% of the market is extremely low cost: the deep worth shares are within the lowest 8% of their historic vary, and the shallow worth shares simply above them are within the 86% of their vary. What does that imply? To ensure that each units to regress to the 50th percentile – that’s, to be priced in a purely atypical method – the deep-value shares would wish to develop by 600%, and the shallow-value shares would wish to say no by 42%. “A price technique within the US,” they counsel, “needs to be avoiding the ‘shallow worth’ shares which can be mildly low cost relative to the market and focusing solely on the ‘deep worth’ quintile.” By their estimation, the deep worth may outperform the shallow worth by 400 bps, and even the shallow worth will outperform progress.

Most shares which can be deeply discounted have earned these reductions. They signify the securities of essentially flawed, mismanaged corporations that persistently lose cash; they’re The Zombies. As a result of deep worth shares have been the worst doable area of interest out there – “Deep worth shares have been each the worst performing cohort from 2007-2020 and the group that didn’t have notably apparent compelling points of interest past their cheapness” (GMO) – each deep worth fund has a depressing trailing report.

Funds with deep-value portfolios

| Portfolio | 2022 returns | |

| Aegis Worth | 64 deep worth small- to micro-cap shares, 2% money, a market cap of $440M | 10.5%, high 1% of small-value funds |

| The Cook dinner & Bynum Fund | 9 worth shares from small to giant cap, 6% money, 70% invested in Latin America | 9.3%, high 1% amongst … rising markets funds? A ardour for South American Coca Cola |

| Pinnacle Worth | 49 deep-value microcap shares, 35% money, a median market cap of $170M | 1.1%, high 2% of its peer group |

| Towle Deep Worth | 27 deep worth small cap shares, 10% money, a median market cap of $2.5B | -2.2%, high 10% of its peer group |

| LSV Worth Fairness | 178 deep-value mid-cap shares, totally invested, market cap of$22.5B. The managers are well-known quants and behavioral researchers; Morningstar gushes about it. | -6%, middling for a large-cap worth fund |

Backside line

Life’s unsure, a actuality that’s maddening for some and exhilarating for others. A elementary selection you face is the way you’ll face the uncertainty out there and the way a lot of your life you wish to spend worrying about it. We don’t faux to have options, simply views. Start by asking, “am I the Terrified One, the Exhausted One, or the Enterprising One?” and start exploring the trail laid out for every.

We want you properly.