Within the yr 2000, there have been 10,000 banks in the USA. On the finish of 2020, there have been roughly 5,000. In 2021, not less than 3 banks per week had been closing or merging.[i] Insurers that want to keep aggressive ought to have a look at what is occurring within the monetary companies sector.

Banks are being outmaneuvered. In some methods, they’re shedding their relevance. In different methods, they’re merely shedding enterprise. Consolidation is on the rise for individuals who want to stay aggressive.

What has modified for financial institution prospects? Financial savings accounts and CDs used to supply actual curiosity. We used extra checks drawn from our checking accounts. We used additional cash. If we had a bank card, there was a excessive chance that it was affiliated with our financial institution. If we had a debit card, it was bank-issued. Expertise, nonetheless, has revolutionized funds. We not want banks for financial savings or funds.

New cost channels are on the rise, pushed by startups and Fintechs. They’re disintermediating banks. The cost platform, Sq., for instance, gives a debit card to small enterprise homeowners, permitting them to attract on funds collected by Sq. on the retail counter.[ii] The enterprise proprietor’s major channel of revenue has simply change into its quickest path to liquid capital. The financial institution? It’s not a necessity.

After we have a look at the opposite Fintechs, we see a lot of the identical. You may maintain funds in PayPal for on-line purchases. You may maintain funds in Venmo for pleasant transactions. You may ship your paycheck to Robinhood, then spend and make investments from inside Robinhood. You should utilize Sofi (as soon as a Fintech, now a financial institution) to handle your entire funds from faculty loans by fractional share investing and into retirement accounts.

Fintechs have reconstructed monetary companies outdoors of the normal realm of economic companies. They constructed ecosystems, related APIs to digital companions, and rapidly utilized know-how to govern information.

There’s a flip aspect. The most important banks nonetheless have wholesome development. They’re including the applied sciences and companions which might be catapulting them into the buyer stratosphere. This aggressive catapulting is on the market to insurers as nicely. The truth is, Majesco’s personal analysis (revealed in our current report, A Seven-12 months Itch: Modifications in Insurers’ Strategic Priorities Outlined by Three Digital Eras Over Seven Years) is proving {that a} large hole is rising between Leaders, Followers, and Laggards within the two areas the place insurers MUST compete — partnerships and information use.

Immediately’s tech is the ticket to aggressive channels

Associate ecosystems are a aggressive catapult. They are going to separate the leaders from the pack by sending them approach out forward, however they require know-how as a strategic precedence. A partnership is simply pretty much as good as a accomplice’s capabilities. Insurers are those interviewing for positions as channel companions. To achieve entry to new markets, they have to enhance their tech and information resume and show that they’ll meet new client developments.

Market boundaries are not related. Clients need to purchase when and the place and from whom they need. Expertise is fueling buyer expectations, altering, and increasing the normal markets and channels by which insurance coverage is bought, together with automotive, transportation companies, huge tech, and extra. This creates better worth for insurers and brokers as a result of new income streams and entry to a broader market by the multiplier impact.

But, Majesco’s analysis is exhibiting that within the final yr, there are comparatively few adjustments within the diploma of exercise for partnerships and ecosystems, remaining just under the “desk stakes” stage of planning/piloting. This continued “treading water” place more and more creates misplaced alternatives to succeed in new or underserved markets, not to mention set up key partnerships earlier than others to place for market management.

Failure to acknowledge the criticality of aggressively establishing partnerships and an ecosystem now is a main blind spot.

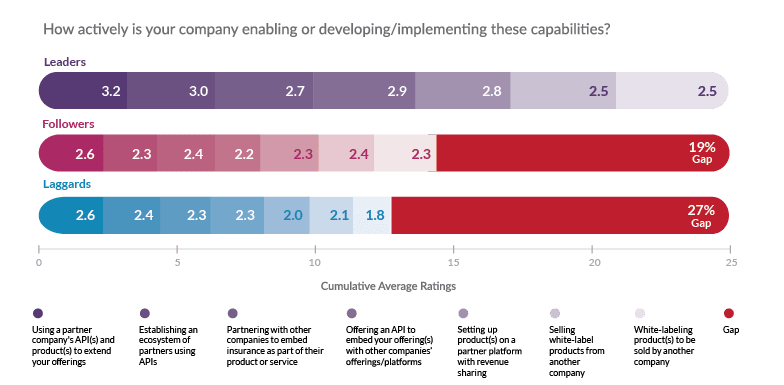

Nevertheless, what is evident from our multi-year analysis is that the growth of accomplice ecosystems is starting to separate the leaders from the pack. The gaps between Leaders, Followers, and Laggards in embracing these actions are appreciable at 19% and 27%, respectively (See Determine 1).

The three largest and most consequential gaps for Followers and Laggards are using APIs to increase choices (24%), establishing an ecosystem of companions utilizing APIs (28%, 31%), and embedding/promoting choices with different firms (25%, 32%). Laggards place themselves at an extra drawback with vital gaps for the white-labeling product(s) to be bought by one other firm (39%) and organising product(s) on a accomplice platform with income sharing (36%).

These gaps put Followers and Laggards at an rising drawback with prospects who’re searching for to purchase insurance coverage from a wider array of entities as proven in our client and SMB analysis, with Millennials and Gen Z practically all open to those channels, at 50% or extra. The influence is lack of prospects and income, resulting in declining market relevance.

Giant insurers are stronger in utilizing APIs (common hole of 20%) and in partnering with different firms to embed their insurance coverage merchandise (8% hole). Entry and use of APIs is foundational to efficient partnerships and ecosystems, typically restricted by legacy applied sciences.

Determine 1: Ranges of exercise in establishing partnerships and ecosystems by Leaders, Followers and Laggards segments

Information & analytics might someday eclipse all priorities

Information and analytics capabilities are poised to be a game-changer for insurance coverage. Coupled withnew and real-time information, superior analytics and AI and machine studying, insurers can have a major influence throughout the complete insurance coverage worth chain. From optimizing enterprise processes to enhanced resolution making, pricing, advertising, buyer experiences, automated underwriting, claims administration, and extra, information and analytics are poised to assist reimagine the insurance coverage enterprise mannequin, merchandise, and full worth chain.

The usage of real-time information and analytics will assist insurers keep on high of quickly altering circumstances. They supply perception for launching new companies and so they allow fixed product refinement to satisfy altering wants and keep aggressive out there.

With the ever-increasing volumes of latest, non-traditional information from IoT gadgets, geospatial, climate, unstructured sources, and extra, main insurers are realizing the significance of leveraging this information to remain forward of rivals within the race to satisfy quickly altering buyer wants and expectations.

With regards to partnering and plugging into accomplice ecosystems, most firms will want greater than a purposeful API basis. They will need to have efficient information administration that permits expanded analytics.

Information and analytics — prioritizing capabilities

Majesco’s report discovered that gaps between Leaders, Followers and Laggards and enormous vs. mid-small segments mirror a brand new breed of market leaders rising.

Total, throughout all segments, the primary stage of knowledge maturity, consisting of operational reporting, enterprise intelligence (BI) reporting, and the transfer to superior analytics with predictive analytics, are firmly established capabilities. This isn’t shocking given this has been the main target during the last decade or extra. Nevertheless, the maturity shift to rising analytics with machine studying and pure language processing is at or close to desk stakes standing, reflecting the continued information maturity of the trade.

Nevertheless, Leaders’ information maturity lead is emphasised with the sizable gaps in comparison with Followers and Laggards. Surprisingly, the gaps in baseline maturity capabilities of BI reporting (24%, 33%) are fairly vital. Predictive analytics (21%, 24%) additionally reveals giant gaps. For each maturity ranges, these gaps recommend the shortage of continued funding in these capabilities and the challenges of legacy programs to successfully use the info. Given the gaps for the primary two phases of maturity, it’s not shocking that the most important gaps are in machine studying (36% every).

When trying on the variations between giant and mid-small insurers, sizable gaps emerge. Giant insurers stay nicely forward of the mid-small insurers in superior analytics, with predictive analytics (19%), and in rising analytics, with machine studying (24%) and pure language processing (20%). This units giant insurers aside as information redefines a brand new technology of market leaders.

Determine 2: Ranges of exercise in constructing information and analytics capabilities by Leaders, Followers and Laggards segments

Information and analytics — purposeful priorities

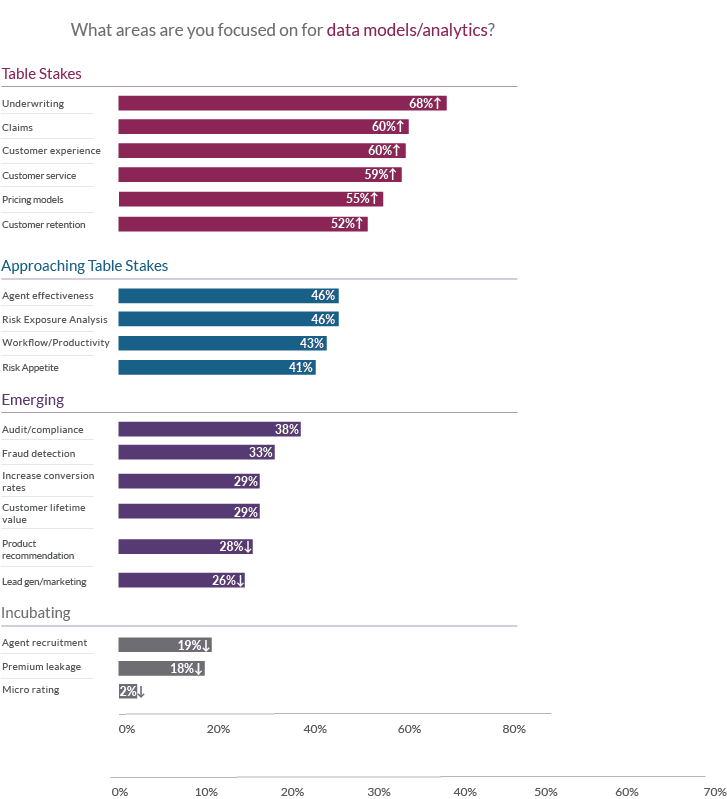

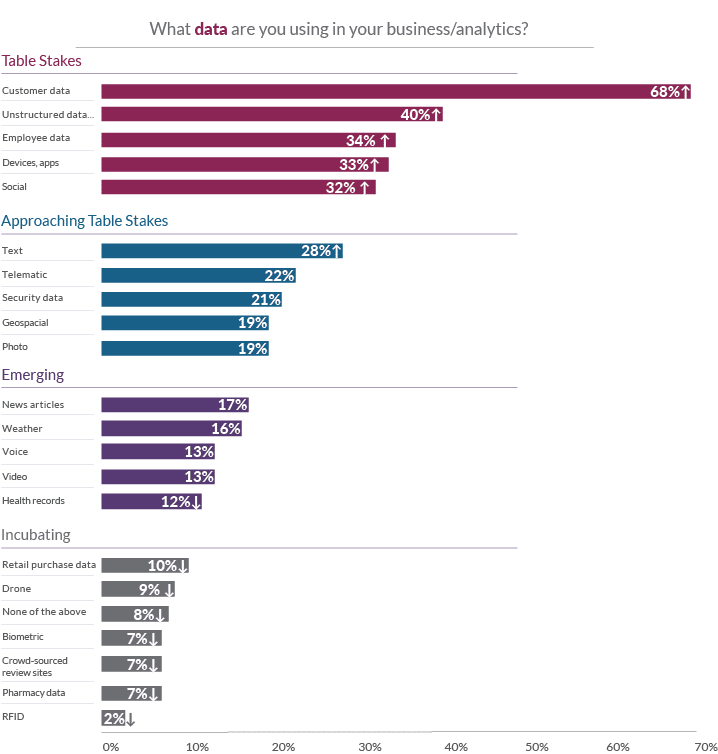

When taking a look at using information and analytics throughout the worth chain, 4 totally different phases of use are mirrored: desk stakes, approaching desk stakes, rising, and incubating, based mostly on their ranges of utilization, as highlighted in Determine 3 beneath.

Established desk stakes areas mirror people who have historically leveraged information and analytics together with underwriting, pricing, and claims in addition to buyer expertise, service, and retention. Practical areas approaching desk stakes embody danger publicity evaluation, danger urge for food, agent effectiveness and workflow/productiveness.

Determine 3: Information and analytics purposeful priorities

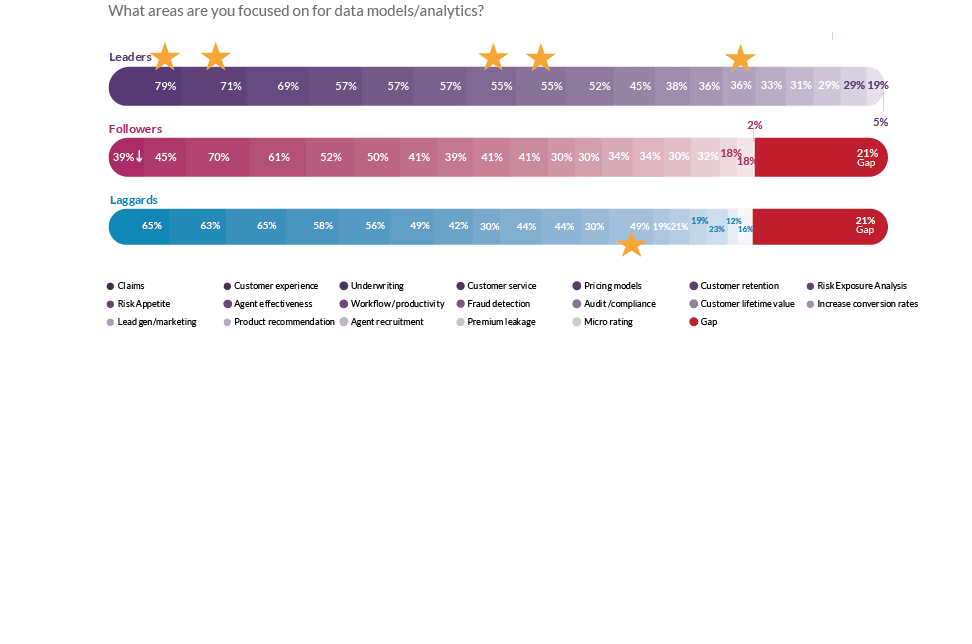

When trying on the distinction between Leaders versus Followers and Laggards, the gaps are related at 21%, however are pushed by totally different relative weaknesses and strengths (See Determine 4). Laggards’ best gaps are danger urge for food (25%), buyer lifetime worth (17%), and agent recruitment (17%), however they lead Leaders and Followers for Audit/compliance (13%, 19%). Apparently, Followers are the weakest in claims (40%), buyer expertise (26%), and danger urge for food (16%), all essential areas to drive total profitability.

Giant firms led by double-digits in 15 of the 19 areas over the mid-small firms. Buyer lifetime worth (17%), buyer retention (16%), agent recruitment (16%), underwriting (12%), product suggestion (11%), and premium leakage (10%) all present robust gaps that closely affect product and total profitability for insurers.

The previous adage of “management what you may management” is now entrance and heart for insurers as they have a look at new danger administration methods as an important element of their underwriting and customer support technique. They’re more and more focusing their time and sources on how they’ll higher assess danger and forestall losses to enhance underwriting profitability and buyer experiences.

Determine 4: Information and analytics purposeful priorities by Leaders, Followers and Laggards segments

Information — prioritizing sources

Much like the purposeful areas the place insurers are focusing their information and analytics efforts, the sources of knowledge used are categorized into desk stakes, approaching desk stakes, rising, and incubating, based mostly on utilization ranges (See Determine 5). Total outcomes spotlight that insurers are increasing the info sources from buyer information to unstructured information akin to loss runs and loss management studies to new digital information sources from gadgets, video, geospatial and extra.

Determine 5: Information sources priorities

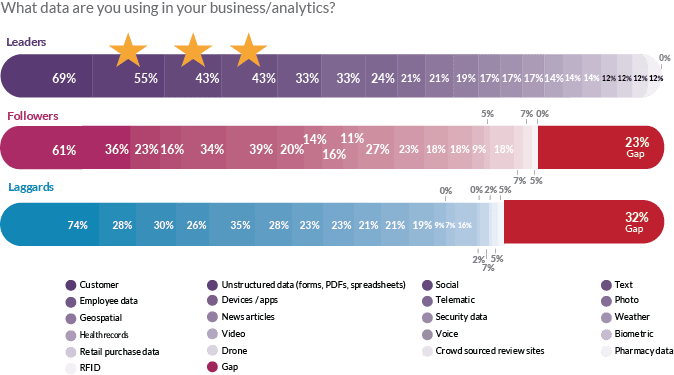

When evaluating Leaders to Followers and Laggards in using these information sources, vital gaps of 23% and 32%, respectively, emerge (See Determine 6). Followers’ and Laggards’ most noteworthy gaps are in three areas: unstructured information (27%, 18%), social (13%, 20%), and textual content (17%, 27%). All besides one in all these information sources was utilized by not less than 12% of insurers within the Leaders phase, which is a testomony to their willingness to experiment with totally different information of their quest to optimize operations and keep forward of the competitors.

An elevated give attention to loss management has resulted in elevated quantity, selection, and velocity of structured and unstructured information sources. Loss management has moved from surveys with questions, checklists, and images, to leveraging real-time information from good gadgets, video, pictures of labels, and extra, by danger engineering companies, buyer self-surveys, and video-guided surveys. Insurers can use the richer information captured with superior AI/ML for improved danger evaluation, urge for food evaluation, underwriting, and pricing.

On this one space of Majesco’s analysis, mid-small insurers indicated related ranges of utilization for 15 of the 22 information sources. Nevertheless, they reported larger utilization of textual content (32% vs 23%) and information articles (22% vs 11%) whereas giant insurers indicated larger utilization of gadgets/apps (38% vs 30%), climate (23% vs 11%), well being information (18% vs 7%), drones (14% vs 4%), and biometric (13% vs 3%).

Determine 6: Information sources priorities by Leaders, Followers and Laggards segments

Superior AI/ML permits insurers to investigate information in real-time to drive clever decision-making. By figuring out hazards and offering suggestions as information is collected, insurers and distributors can now create extra worth by proactively addressing points and offering suggestions in real-time.

That is the sort of aggressive edge that insurers will want as prospects search their very own worth within the companies that insurers present. Insurers who’re clear with prospects about their skills to forestall and shield — not simply cowl losses — will likely be those that catapult themselves ahead with actual worth to people and companies.

In at this time’s new insurance coverage age, information is the gas for innovation. New applied sciences, demographics, and behaviors are driving the explosion of knowledge and can energy the expansion of latest companies and industries over the subsequent 10 years. Many of those companies will develop inside fully new trade sorts, setting the stage for brand new insurance coverage market growth, merchandise, and companies.

How can insurance coverage be totally different and higher than different monetary companies? Insurers can, proper now, have a look at their enterprise fashions and the way their know-how both feeds or drains sources. Are developments aligned to aggressive plans? Do insurers know what new choices can be found to provide them velocity, flexibility, and the correct basis for partnerships and information administration?

Each insurer is totally different and distinctive. Does your group have the initiative to compete, however you marvel how one can transfer from the place you might be to the place it is advisable to be? Evaluate your individual strategic priorities to the priorities of the Leaders in insurance coverage by studying A Seven-12 months Itch: Modifications in Insurers’ Strategic Priorities Outlined by Three Digital Eras Over Seven Years, then contact Majesco to debate how one can change into an insurance coverage know-how chief of the longer term.

[i] Gran, Ben and Mitch Strohm, Can PayPal Function Your Financial institution Account?, Forbes, July 23, 2021

[ii] Bary, Emily, How debit playing cards have gotten a democratizing power, Marketwatch, October 4. 2021