Put up Views:

819

It’s widespread information now that benchmark Indian & US (S&P 500) indices are

down by 16% & 21% respectively with some shares down by greater than 50%. The sharp uptick in yields prompted the mark to market losses in long-term debt

devices. There’s a number of chaos lately after Russia’s assault on Ukraine

and the market appears directionless & confused on the best way ahead.

On this

piece, we try to know what the long run holds and the way we are able to put together our

funding portfolio to take care of future outcomes.

However first a

fast recap.

After the

subprime disaster in 2008, many developed nations’ Central Banks began

printing cash and flooding the worldwide economies with low-cost liquidity. The

quantum of cash printing jumped massively after Corona-led financial shutdowns.

US Fed elevated its steadiness sheet dimension from ~$4-4.5 trillion to ~$8-8.5

trillion in a span of simply 2 years.

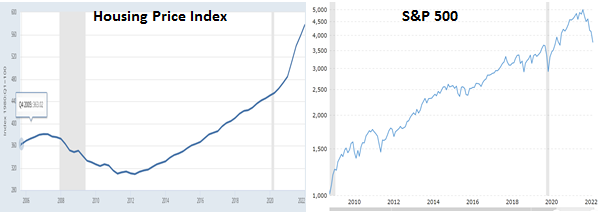

The liquidity assist since 2008 and large stimulus submit March 2020 has inflated all of the asset costs be it fairness, debt, or actual property.

Stimulus

cheques and wealth impact strongly boosted demand for items

and providers whereas provide facet points that cropped up throughout lockdowns weren’t

addressed fully and quite received aggravated after Russia’s assault on

Ukraine.

There’s an

eerie similarity between what’s taking place now and what occurred in 1972-73 – free

financial coverage adopted by crude shock. To raised perceive the nice

inflation and resultant final result within the Nineteen Seventies, chances are you’ll learn it right here.

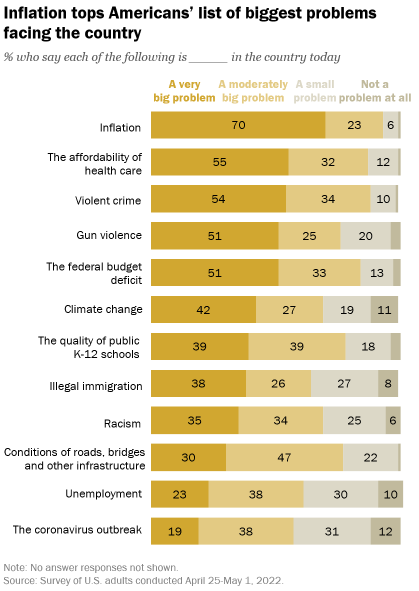

Imbalances in provide and demand resulted in rising in lots of generally used commodities. This resulted in inflation to the degrees final seen 40 years in the past in lots of developed economies.

Inflation has now grow to be a significant political subject. To make sure the steadiness of the Authorities and maintain its recognition maintained, the policymakers are pressured to work out options to curb inflation and inflationary expectations.

The answer is straightforward – reverse the components that prompted inflation within the first place i.e., suck out the surplus liquidity and improve the rates of interest, the train which often resulted in recession a number of instances up to now. However this resolution is troublesome to implement. Why? As a result of the large degree of debt issuance at low-interest charges will begin getting defaulted in a good liquidity situation which may deepen the recession resulting in excessive job losses and public backlash.

Subsequently, we’re at a crossroads, and it’s very troublesome to determine the best way ahead. Nonetheless, we are able to consider three potential eventualities forward:

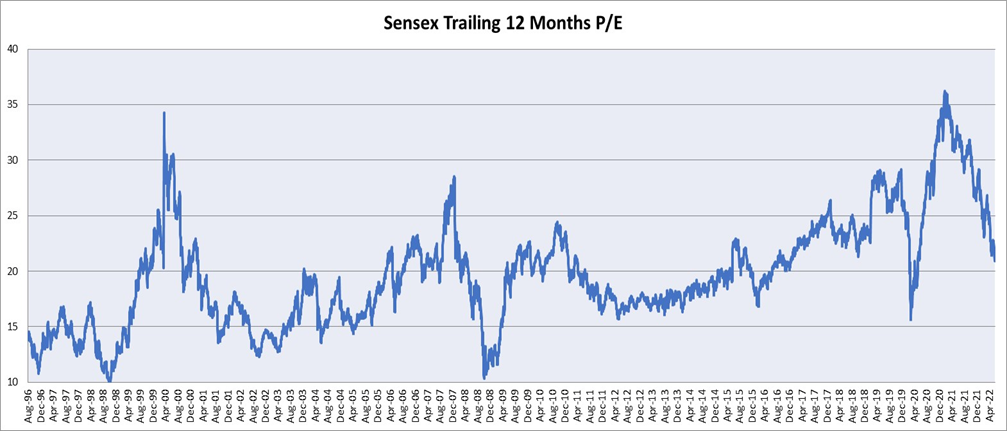

No matter what state of affairs will pan out, fairness valuations inevitably have to regulate based on the precept of imply reversion. This means one thing that has gone a lot above the long-term median ranges will go down a lot under the median ranges to make sure long-term median ranges are maintained.

Within the graph under of TTM (trailing twelve months) Sensex PE ratio during the last 22 years, Sensex PE has at all times reverted to the imply of 20x. After the peak circumstances have materialized, the backside has finally shaped after a correction of greater than 50%.

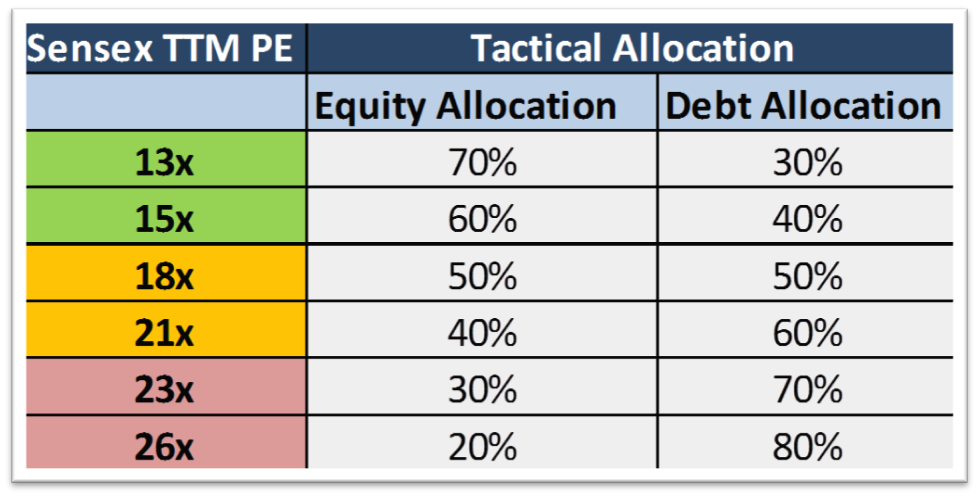

With a lot uncertainty round future outcomes, it’s at all times vital to place the portfolios primarily based on potentialities quite than certainties. The end result of the potential eventualities would work higher in our favor if we align the portfolio primarily based on the danger profile (the issue we are able to considerably management) and market valuation ranges, that decide the utmost draw back threat to our investments. This technique primarily based on potentialities is known as tactical asset allocation which at all times results in larger portfolio returns at a given degree of threat.

Beneath is the pattern asset allocation plan for a reasonable threat profile investor for reference:

For extra detailed studying concerning the dynamic asset allocation technique, click on the hyperlink right here.

Moreover, one ought to at all times keep in mind – to make long-term excessive returns from an funding portfolio with fairness publicity, one must embrace damaging returns through the funding journey.

Sticking to the asset allocation with utmost self-discipline when everyone seems to be dropping their thoughts is the stuff of a robust character. Embracing damaging returns and benefiting from them is a part of the method of profitable investing. The discovered ones know that the trail to nirvana goes by means of troublesome terrain.

PS: You may also watch the recording of the web session on this matter by clicking right here.