Since retiring two months in the past, I bought the actively managed Constancy New Millennium ETF (FMIL) for diversification. It’s one in all 4 actively managed fairness ETFs provided by Constancy that has greater than $50M in property. My introduction to FMIL got here from an article by Tezcan Gecgil, “3 Constancy ETFs To Diversify Your Portfolio In August,” at Investing.com, during which she highlighted that FMIL has achieved comparatively nicely year-to-date. I then learn “ETF of the Week: Constancy New Millennium ETF (FMIL)” by Aaron Neuwirth from VettaFi, previously referred to as ETF Database, which summarizes a podcast by ETF Tendencies CEO Tom Lydon in “ETF of the Week” with Chuck Jaffe on the MoneyLife Present.

- The Wrapper: A non-transparent ETF clone of a mutual fund

- The Supervisor and Technique: Multi-cap development with worth

- Rubber hits the street: Fund efficiency

The Wrapper: A non-transparent ETF clone of a mutual fund

Whereas FMIL is a brand new (two-year-old) fund, FMILX is the mutual fund counterpart which is sort of thirty years outdated and has been managed by John Roth since 2006. Mr. Roth joined Constancy in 1999 and in addition manages FMIL. The Constancy web site describes FMIL as:

The fund seeks long-term development of capital. Usually investing primarily in fairness securities. Figuring out early indicators of long-term modifications within the market and specializing in these firms which will profit from alternatives created by these modifications by analyzing technological advances, product innovation, financial plans, demographics, social attitudes, and different components, which might result in investments in small and medium-sized firms. (Constancy New Millennium ETF)

I favor actively managed funds the place the supervisor has flexibility. Actively managed ETFs are comparatively new, however the pattern is rising as a result of they provide the advantages of ETFs together with an energetic administration strategy. Actively managed ETFs are outlined in Investopedia as:

An actively managed ETF can have a benchmark index, however managers might change sector allocations, market-time trades, or deviate from the index as they see match. This produces funding returns that don’t completely mirror the underlying index. (James Chen and Charlene Rhinehart “Actively Managed ETF”, Investopedia, June 2022)

The actual twist right here is that FMIL is a non-transparent ETF. That’s, it doesn’t disclose its holdings each day. That’s a safety provided to the supervisor who would possibly want every week to both construct or unwind a portfolio place; if their exercise was disclosed too quickly, hedge funds and others would front-run the fund’s commerce, driving up prices and driving down returns. Constancy actually warns traders concerning the worth that comes with non-transparency:

Conventional ETFs inform the general public what property they maintain every day. This ETF won’t. This may increasingly create further dangers to your funding. For instance: You’ll have to pay more cash to commerce the ETF’s shares. This ETF will present much less info to merchants, who are inclined to cost extra for trades once they have much less info. The worth you pay to purchase ETF shares on an alternate might not match the worth of the ETF’s portfolio. The identical is true if you promote shares. These worth variations could also be higher for this ETF in comparison with different ETFs as a result of it gives much less info to merchants. These further dangers could also be even higher in dangerous or unsure market circumstances.

VettaFi gives a useful listing of energetic ETFs (“Actively Managed ETFs”). The most important actively managed fairness ETF is JPMorgan Fairness Premium Revenue ETF (JEPI) with $12B in property. Constancy is comparatively new to energetic managed fairness ETFs and has Constancy Blue Chip Development ETF (FBCG), Constancy Blue Chip Worth ETF (FBCV), together with Constancy New Millennium ETF (FMIL). VettaFi classifies FMIL as a “Giant Cap Mix Fairness” developed markets fund whereas Factset classifies it as a “International Broad Thematic” sector fund. Morningstar classifies FMIL as a Giant Cap Worth Fund and Lipper classifies it as a Multi-Cap Worth Fund. The composition will change with the funding setting. FMILX is at present about 85% invested in home equities and 11% invested in worldwide equities.

The Supervisor and Technique: Multi-cap development with worth

Constancy Actively Managed New Millennium ETF (FMIL) is a clone of the four-star Constancy New Millennium Fund, so the form of that fund and its supervisor may also help us anticipate the ETF’s prospects.

We are able to see in Determine #1 that the mutual fund (FMILX) and ETF (FMIL) variations have carried out very intently for the reason that inception date of FMIL. We are able to learn the way FMIL would possibly carry out over the longer-term by trying on the mutual fund model, New Millennium Fund (FMILX).

Determine #1: Comparability of Constancy New Millennium Mutual Fund and ETF

John Roth joined Constancy in 1999 and has managed Constancy New Millennium Fund (FMILX) since 2006. He has been a part of the administration workforce on a big selection of funds together with balanced, mid-cap inventory, sector, client discretionary, multimedia, chemical substances, and utility funds. Constancy describes the fund’s strategy this manner; it takes:

- … an opportunistic strategy, investing throughout all sectors, market capitalizations and types.

- Philosophically, we consider an organization’s inventory worth displays the market’s collective view of its future earnings energy, however the collective view is commonly mistaken.

- We consider bottom-up, elementary evaluation can determine these alternatives the place our earnings forecasts deviate from consensus, and the place the potential reward for being proper is excessive.

- We search for funding alternatives in rising development shares, the place we’ve a differentiated view on the magnitude of the expansion fee; compounders, the place we’ve a differentiated view on the sustainability of the expansion fee; and mean-reversion shares, the place we’ve a differentiated view on the timing, period or magnitude of the cycle.

- In setting up the portfolio, we dimension positions by assessing our conviction within the differentiated view on future earnings energy versus its potential payoff.

Morningstar agrees that the technique is distinctive and evolving, however frets that the method has been utilized inconsistently,

- Supervisor John Roth pursues a mix of development, economically delicate, and cyclical firms.

- The title depend has step by step come down throughout Roth’s tenure. The variety of shares within the portfolio peaked at almost 300 in mid-2007, however since mid-2014 it has stayed largely within the 150-170 vary. Roth tends to commerce occasionally. Annual portfolio turnover up to now 5 years has ranged from 22% to 44%.

- This technique’s contrarian, valuation-conscious strategy is distinctive however lacks consistency over time and warrants an Common Course of score…

Morningstar praises Mr. Roth’s “lengthy tenure, total expertise, and entry to Constancy’s huge analyst pool [which] earn this technique an Above Common Folks score…Roth has greater than $1 million invested in each this fund and Constancy Mid-Cap Inventory. He attracts on Constancy’s well-resourced fairness workforce, which incorporates round 60 domestic-focused analysts.”

Shortly after Mr. Roth assumed administration of FMILX, it had a most drawdown much like the S&P 500 through the 2008 International Monetary Disaster of simply over fifty p.c; nevertheless, this was higher than most multi-cap worth funds. The administration type of FMILX has modified considerably since then and the evaluation on this article focuses extra on the previous three to eight years.

The ETF has $56M in property below administration, holds 125 firms, and the highest ten firms comprise 26% of the investments. Mr. Roth is chargeable for the funding technique and Andy Browder is chargeable for buying and selling and execution. The type field from Morningstar reveals that FMIL is a diversified multi-cap fund with a “tilt” in the direction of giant cap worth. Lipper concurs. Over 35% of the fund is in small-cap and mid-cap firms which tends to extend volatility. The supervisor having the pliability to pick out funds throughout type and dimension was a consider my collection of FMIL.

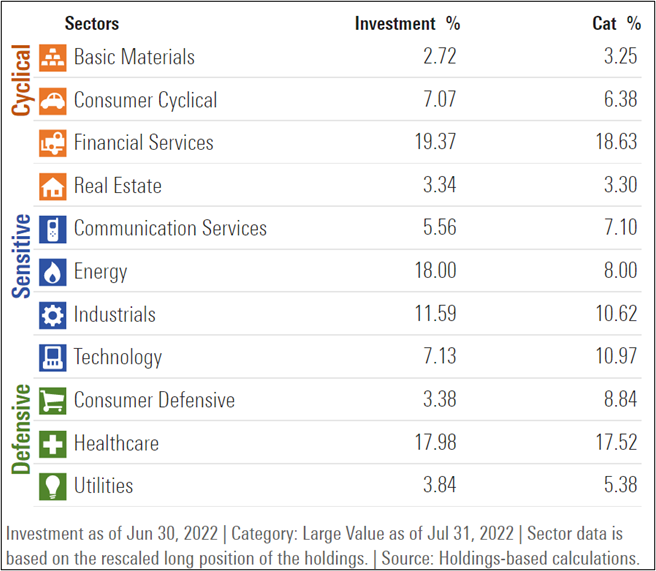

Desk #1 reveals the sector allocation for FMILX. My Defensive Portfolio is heavy in Shopper Staples, Healthcare and Utilities. I needed a fund that’s tilted towards different sectors however “mild” on Know-how and Shopper Cyclical. There may be an overlap on Healthcare.

Desk #1: Sector Allocation of Constancy New Millennium Fund (FMILX)

Supply: Morningstar

The Rubber Hits the Street: Fund efficiency

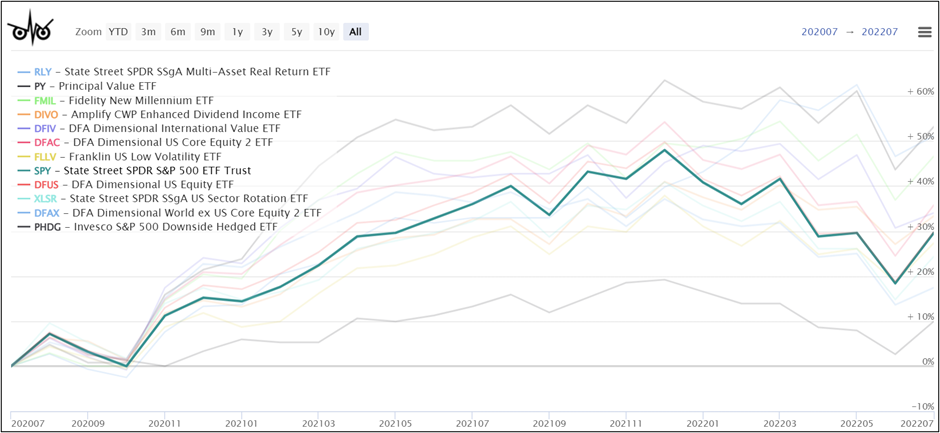

I used my Bullish ETF Display screen at Constancy, which I modified to incorporate solely Actively Managed ETFs, to determine the actively managed ETFs in Determine #2 since July 2020. I added the State Road SPDR S&P 500 ETF (SPY) as a baseline, and FMIL which solely has $56M in property below administration whereas one in all my regular standards is a minimal of $100M. The eleven actively managed ETFs have achieved comparatively nicely in comparison with the S&P 500. The fund with the bottom whole returns over the previous two years is the Invesco S&P 500 Draw back Hedged ETF (PHDG) and the most effective performing fund is the State Road SPDR SSgA Multi-Asset Actual Return ETF (RLY) which has benefited from increased inflation. Each of those funds carry out nicely below particular conditions.

Determine #2: Chosen Actively Managed ETFs Since July 2020

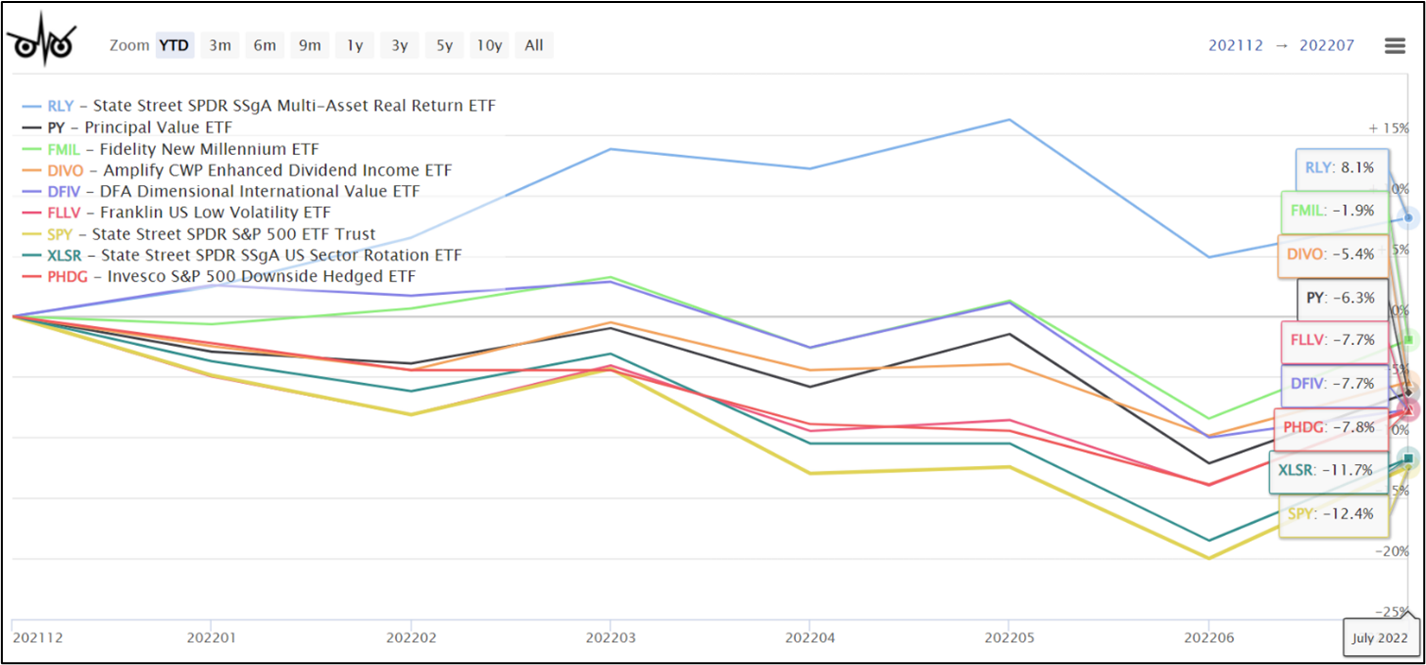

Let’s check out the higher performing funds year-to-date as of the top of July. The S&P 500 (SPY) is the worst performing of the remaining 9 funds adopted by State Road SPDR SSgA US Sector Rotation ETF (XLSR). Not stunning with excessive inflation, State Road SPDR SSgA Multi-Asset Actual Return ETF (RLY) is the most effective performing fund. Constancy New Millennium ETF (FMIL) is the second-best performing fund almost breaking even.

Determine #3: Prime Performing Actively Managed ETFs Yr-To-Date

Danger vs Reward

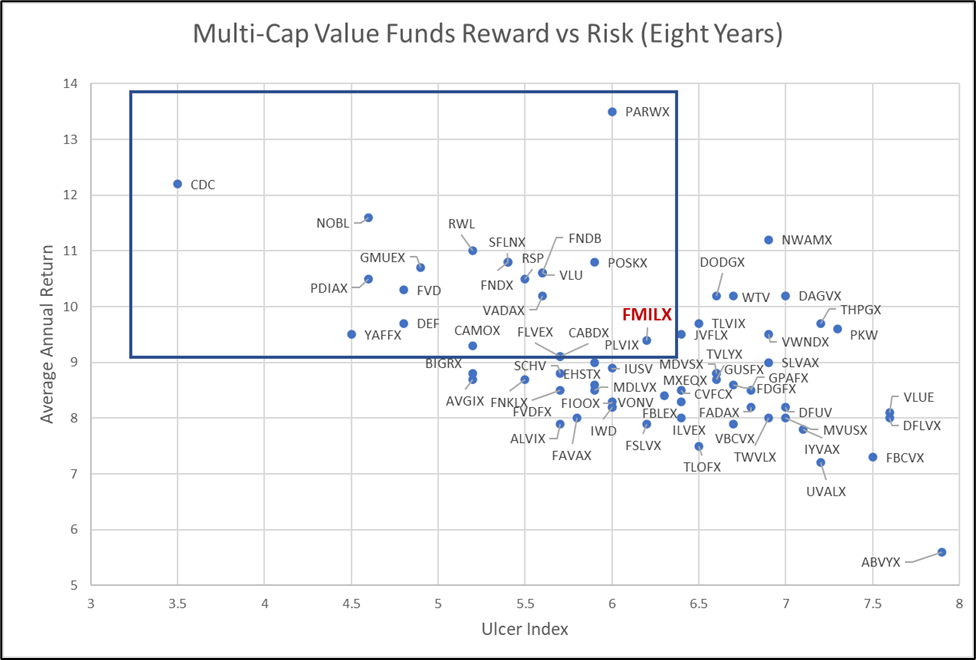

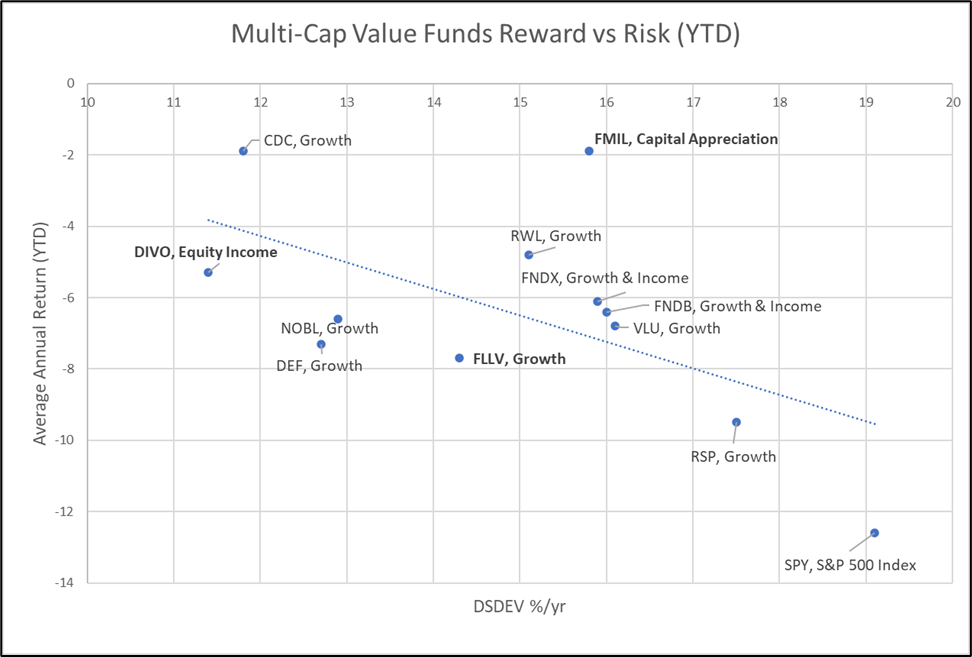

I used eight years to investigate the efficiency of multi-asset worth funds accessible to particular person traders, to see how FMILX compares since Mr. Roth turned established because the supervisor. The blue rectangle in Determine #4 highlights these with increased returns and decrease threat as measured by the Ulcer Index which relies on the depth and period of drawdown. Discover the excessive threat adjusted efficiency of VictoryShares US EQ Revenue Enhanced Volatility Wtd ETF (CDC) which I’ve owned up to now. I had bought CDC final 12 months when simplifying portfolios. Each are nice funds, however just lately I made a decision to purchase FMIL primarily based on its efficiency this 12 months. I’ll contemplate including CDC once more at a later date.

Determine #4: Multi-Cap Worth Funds Reward vs Danger (Eight Years)

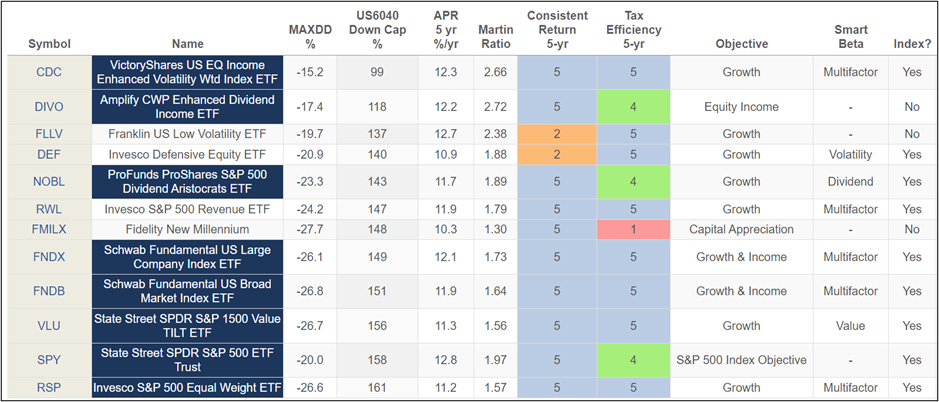

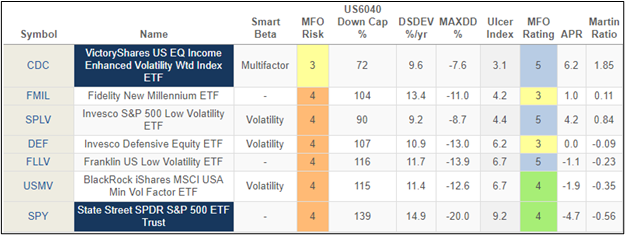

Desk #2 compares a few of the finest multi-cap worth ETFs over the previous 5 years. The names in blue point out funds which might be labeled as “Nice Owls” by Mutual Fund Observer. These Nice Owl Funds “delivered prime quintile risk-adjusted returns, primarily based on Martin Ratio, in its class.” Excluding SPY, used as a baseline, Lipper classifies every of those funds as “Energetic”, however solely FMIL, DIVO, and FLLV should not thought of Index funds. The 5-Yr Tax Effectivity Score is low for FMILX as a result of the turnover can typically be excessive so tax-advantaged accounts could also be ideally suited places for the Constancy New Millennium fund.

Desk #2: Prime Multi-Cap Worth ETFs In comparison with FMILX (5 Years)

I then in contrast how these funds carried out year-to-date in opposition to their draw back deviation as a measure of threat. VictoryShares US EQ Revenue Enhanced Volatility-Wtd Index ETF (CDC) has been the most effective performing multi-cap worth fund with decrease volatility. New Millennium ETF (FMIL) has had the same return, however has been extra unstable.

Determine #5: Prime Multi-Cap Worth ETFs Reward vs Danger YTD With Goal

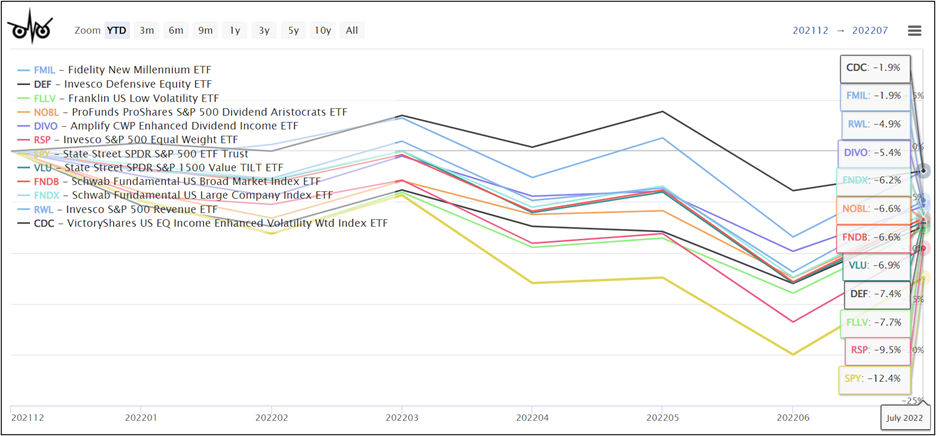

A graphical illustration of the funds year-to-date is proven in Determine #6. The S&P 500 (SPY) is included as a baseline fund.

Determine #6: Prime Multi-Cap Worth ETFs (YTD)

Comparability to Low Volatility Funds

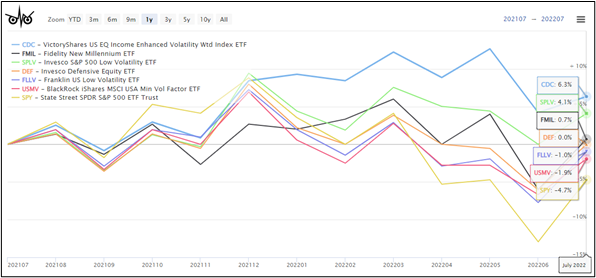

After Jerome Powell gave his speech on Friday following the Jackson Gap Convention, the S&P 500 fell 3.37% and FMIL fell 2.31%. After I noticed the composition of the iShares MSCI USA Min Vol Issue ETF (USMV) contained 18.6% in Know-how, I did a comparability to see how FMIL faired in opposition to some low volatility funds on Friday: CDC (-2.08%), SPLV (-2.17%), DEF (-2.82%), FLLV (-2.41%), and USMV (-2.63%). Desk #5 reveals the comparability for one 12 months. For threat, I confirmed Draw back Seize in comparison with a 60/40 fund, Draw back Deviation, Most Drawdown, and Ulcer Index. For return, I present Complete Return (APR) and Danger Adjusted Return (Martin Ratio). The Martin Ratio is the whole return divided by the Ulcer Index. CDC, FMIL, and SPLV had the most effective efficiency for the previous 12 months by most measures.

Desk #3: Comparability of Low Volatility Funds to FMIL (One Yr)

FMIL doesn’t have an goal of decreasing volatility, however has carried out higher than many low volatility funds for the previous 12 months. The funds are proven graphically for the previous 12 months in Determine #7. FMIL is extra unstable on a month-to-month foundation reflecting the excessive allocation to power, amongst different causes.

Determine #7: Comparability of Low Volatility Funds to FMIL (One Yr)

Why did I purchase FMIL if I consider {that a} recession is approaching? I’ve adopted the Bucket Strategy by having pensions and Social Safety to cowl most dwelling bills:

- Security Bucket for dwelling bills and emergencies for a number of years,

- Defensive Bucket for Conventional IRAs the place taxes have but to be paid and which is chubby in client staples, well being care, and utilities,

- a Tax Managed Account, and

- Development Bucket for Roth IRAs the place taxes have already been paid. I take advantage of Constancy Wealth Providers to handle the longer-term portfolios.

Mr. Powell’s hawkish speech and response by the markets doesn’t impression my long-term technique. A bear market will probably be a chance to do a Roth Conversion and improve allocations to shares at decrease valuations. I purchased FMIL as a possible long-term funding during which I improve allocations as we transfer by means of the contraction section of the enterprise cycle.

I proceed to purchase CD ladders as rates of interest rise, and can scale back allocations to shares barely in favor of bonds as rates of interest rise. I diminished allocations to the Columbia Thermostat Fund (COTZX/CTFAX) as rates of interest rose, and am now growing allocations step by step as I anticipate rates of interest to plateau subsequent 12 months and the likelihood of a recession continues to rise. For these of you not acquainted with Columbia Thermostat, the Prospectus reveals that it will increase its allocation to shares because the market falls.

Closing

Shopping for the Constancy New Millennium ETF (FMIL) is a small journey for me in my Defensive Portfolio which is ready as much as stability the dangers of inflation and recession whereas being the least unstable of my portfolios. My Defensive Portfolio incorporates Actual Return, Multi-Asset, Multi-Various, Multi-Technique, Managed Futures, and defensive sector funds. FMIL provides diversification in sectors and types that I’ve low publicity to. I selected FMIL due to the energetic administration type which was rewarded this 12 months with decrease volatility. The shortage of transparency is a matter for traders used to conventional passive ETFs. Quick-term traders might need to keep away from the fund due to the low property below administration and low quantity.

FMILX and FMIL have carried out comparatively nicely in opposition to multi-cap funds on a risk-adjusted foundation over numerous timeframes. I just like the adaptive funding type that adjusts to market circumstances, regardless that it has been described as “inconsistent”. When market circumstances change, I anticipate allocations in my investments to replicate these modifications. I anticipate FMIL to be a longer-term fairness holding.

For readers who could also be serious about a broader collection of actively managed ETF Classes, I extracted the next actively managed funds with excessive MFO scores for risk-adjusted efficiency for the previous three years. FMILX is included for comparability functions.

Determine #8: Greatest Danger Adjusted Actively Managed Fairness Funds (Three Years)