My mid-week morning practice reads:

• Fed Is Dropping Billions, Wiping Out Income That Funded Spending: Central banks world wide paying extra in curiosity Governments could must make up holes at central banks The Marriner S. Eccles Federal Reserve constructing in Washington, DC. (Bloomberg)

• There’s a rosy projection for the US economic system. People could not have felt it: 2.9% GDP? Why so rosy regardless of all the grim information? For one, a giant chunk of GDP is comprised of shopper spending — and although we’re all complaining about inflation, rising costs haven’t truly stopped shoppers from splurging simply but. Retail gross sales had been up 8.2% in September from a 12 months in the past. (CNN) however see additionally NABE Survey: US Already in Recession or Will Be Quickly: Nearly two-thirds of respondents in a survey of enterprise economists say the US is both already in a recession or has better-than-even odds it will likely be throughout the subsequent 12 months. (Bloomberg)

• Shares Backside First: Overweighting at the moment’s information, for higher and for worse, will get buyers in hassle as a result of at the moment is already priced in. Stanley Druckenmiller lately relayed this message to an viewers, saying: “Don’t spend money on the current. The current will not be what strikes inventory costs.” (Irrelevant Investor)

• Builders Say They’re Prepared for This Housing Slowdown. ‘I’ve Discovered My Lesson.’ Meltdown of 2007-09 fostered much less dangerous techniques; not as a lot debt. (Wall Avenue Journal)

• The Federal Reserve Owes the World a Mea Culpa: The US central financial institution can’t ease the worldwide repercussions of its fast financial tightening, however it could possibly and will come clean with its errors. (Bloomberg)

• Financial Outlook: Rubber Bands on a Watermelon: With sufficient stress, the watermelon *will* explode. (Kyla Scanlon)

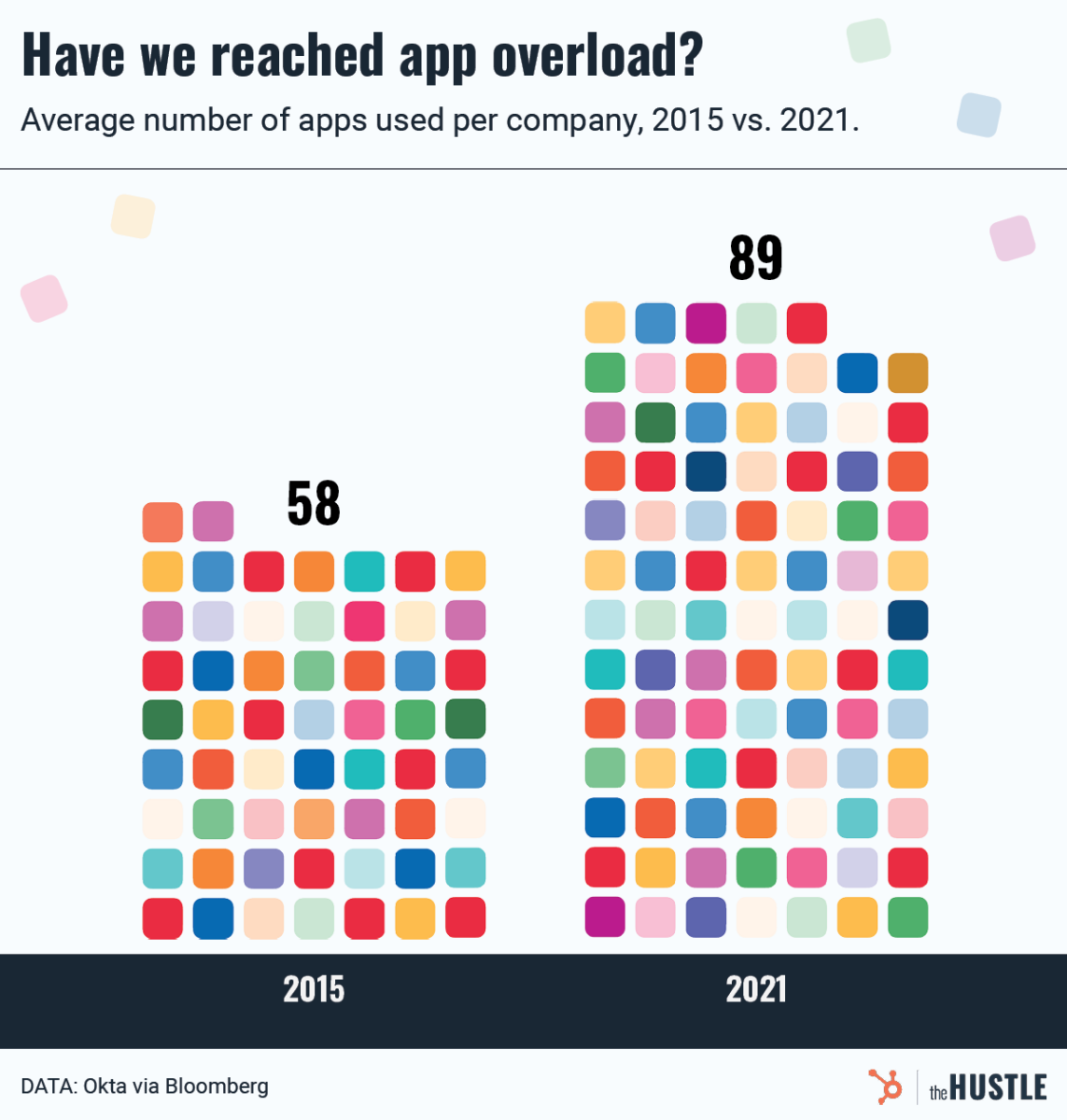

• Zoom, Groups, Slack Are Wreaking Havoc on Worker Productiveness: Shifting between a number of apps to get stuff achieved drains employees’ time, effectivity and engagement. Can something be achieved? (Bloomberg)

• Rising Transport Prices Immediate Companies to Get Inventive With Deliveries: FedEx, UPS and U.S. Postal Service have elevated transport charges as their prices rise. (Wall Avenue Journal) see additionally Why the Worth of Gasoline Has Such Energy Over Us: “When costs go up, we’ve this sense of oppression that we will’t do every part we wish.” (Upshot)

• What broke Britain? The UK has gave the impression to be in fixed disaster for a couple of years now. There’s one massive motive why. There may be one clear root explanation for Britain’s woes: Brexit. The choice to go away unleashed critical financial aftershocks, which had been unimaginable to disregard or paper over indefinitely. The consequence has been a chaotic, unsteady Britain, battling social malaise and political upheaval within the aftermath of the pandemic amid an inflation disaster sweeping the worldwide economic system. (Vox)

• Taylor Swift Has So A lot New Music. How Will She Ever Carry out It All? Along with her new album ‘Midnights,’ the pop celebrity has 4 entire information she has by no means carried out stay, creating an uncommon live performance problem. ‘She’s in a whole logistical nightmare.’ (Wall Avenue Journal)

You’ll want to try our Masters in Enterprise interview this weekend with Marta Norton, Chief Funding Officer of Morningstar Funding Administration. The agency manages straight or advises on $249.4B in consumer funds. She started her profession as BLS economist, and earlier than her present function, she was Head of U.S. Final result-Primarily based Methods for Morningstar.

Apps are purported to make life simpler, however they’re stressing workers out

Supply: The Hustle

Join our reads-only mailing listing right here.